[ISC] Q. 26 solution of Dissolution of Partnership Firm Chapter TS Grewal Book Class 12 (2022-23)

Solution to Question number 26 of the Dissolution of Partnership Firm Chapter of TS Grewal Book 2022-23 Edition for the ISC Board?

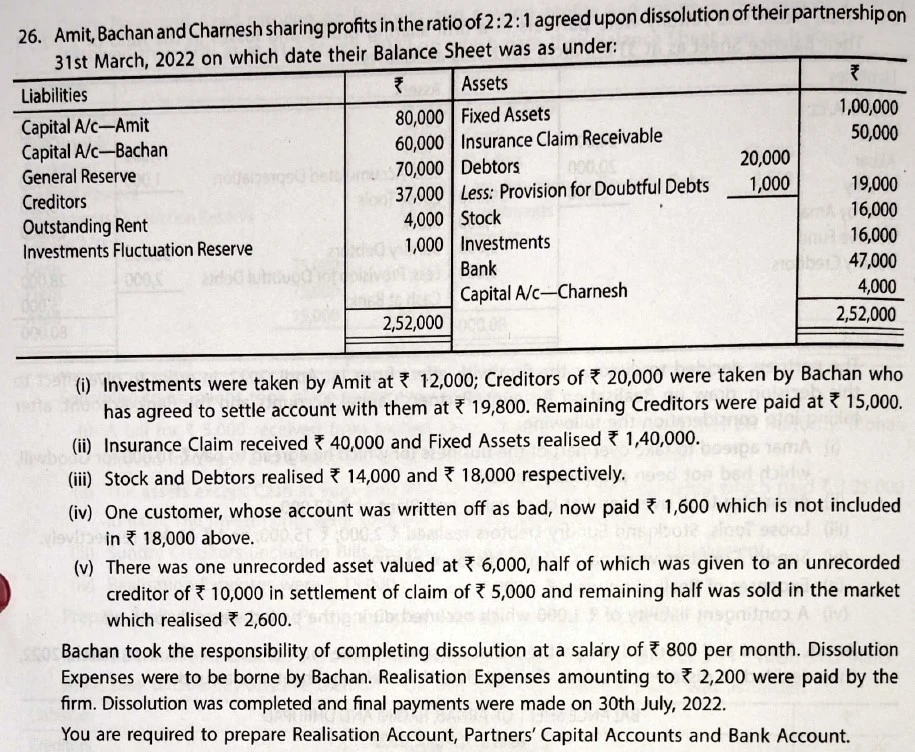

Amit, Bachan and Charnesh sharing profits in the ratio of 2 : 2 : 1 agreed upon dissolution of their partnership on 31st March, 2022 on which date their Balance Sheet was as under:

| Liabilities | ₹ | Assets | ₹ | |

| Capital A/c – Amit Capital A/c – Bachan General Reserve Creditors Outstanding Rent Investments Fluctuation Reserve | 80,000 60,000 70,000 37,000 4,000 1,000 | Fixed Assets Insurance Claim Receivable Debtors Less: PDD Stock Investments Bank Capital A/c – Charnesh | 20,000 1,000 | 1,00,000 50,000 19,000 16,000 16,000 47,000 4,000 |

| 2,52,000 | 2,52,000 |

(i) Investments were taken by Amit at ₹ 12,000; Creditors of ₹ 20,000 were taken by Bachan who has agreed to settle account with them at ₹ 19,800. Remaining Creditors were paid at ₹ 15,000.

(ii) Insurance Claim received ₹ 40,000 and Fixed Assets realised ₹ 1,40,000.

(iii) Stock and Debtors realised ₹ 14,000 and ₹ 18,000 respectively.

(iv) One customer, whose account was written off as bad, now paid ₹ 1,600 which is not included in ₹ 18,000 above.

(v) There was one unrecorded asset valued at ₹ 6,000, half of which was given to an unrecorded creditor of ₹ 10,000 in settlement of claim of ₹ 5,000 and remaining half was sold in the market which realised ₹ 2,600.

Bachan took the responsibility of completing dissolution at a salary of ₹ 800 per month. Dissolution Expenses were to be borne by Bachan. Realisation Expneses amounting to ₹ 2,200 were paid by the firm. Dissolution was completed and final payments were made on 30th July, 2022.

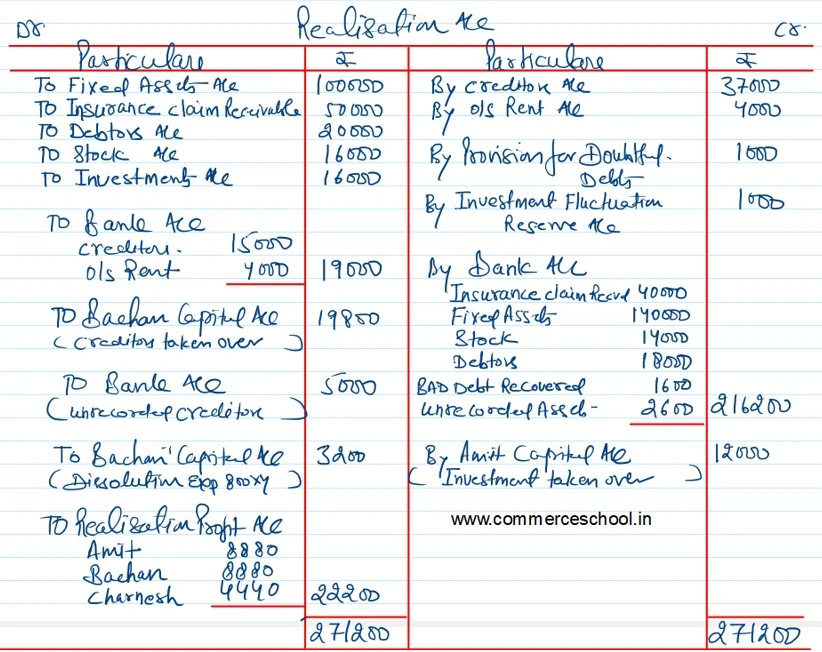

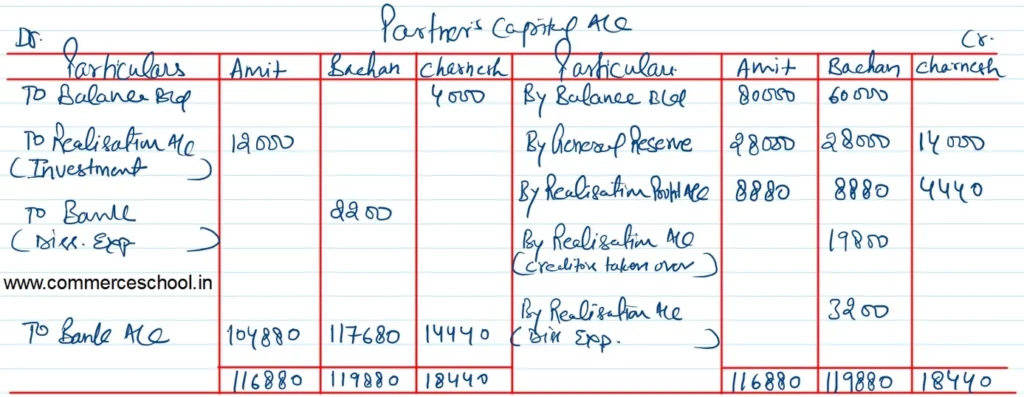

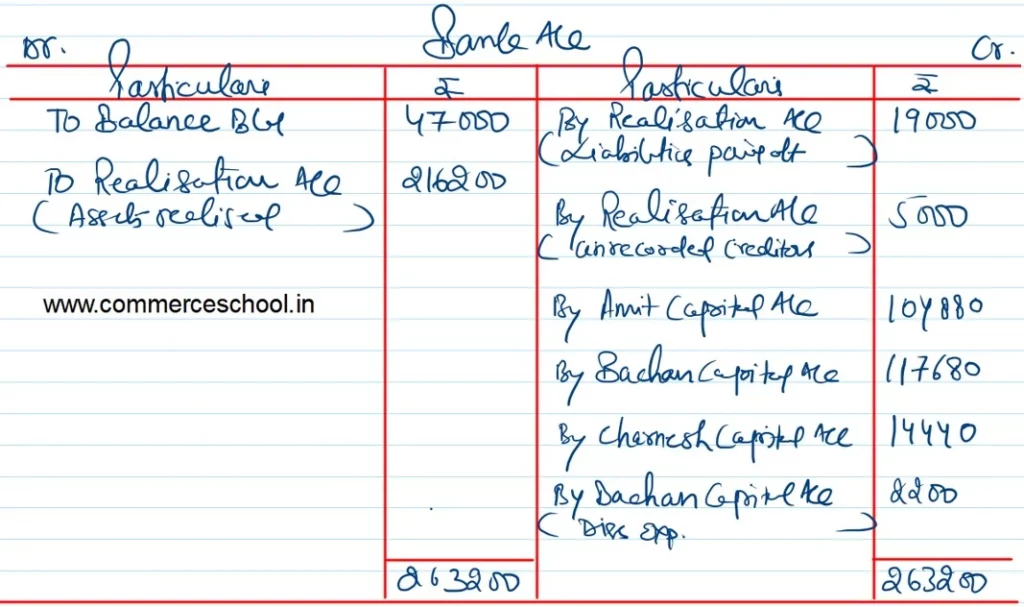

You are required to prepare Realisation Account, Partner’s Capital Accounts and Bank Account.

Solution:-

Here is the list of solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |