[ISC] Q. 27 solution of Dissolution of Partnership Firm Chapter TS Grewal Book Class 12 (2022-23)

Are you looking for the solution to Question number 27 of the Dissolution of Partnership Firm Chapter of TS Grewal Book 2022-23 Edition for the ISC Board?

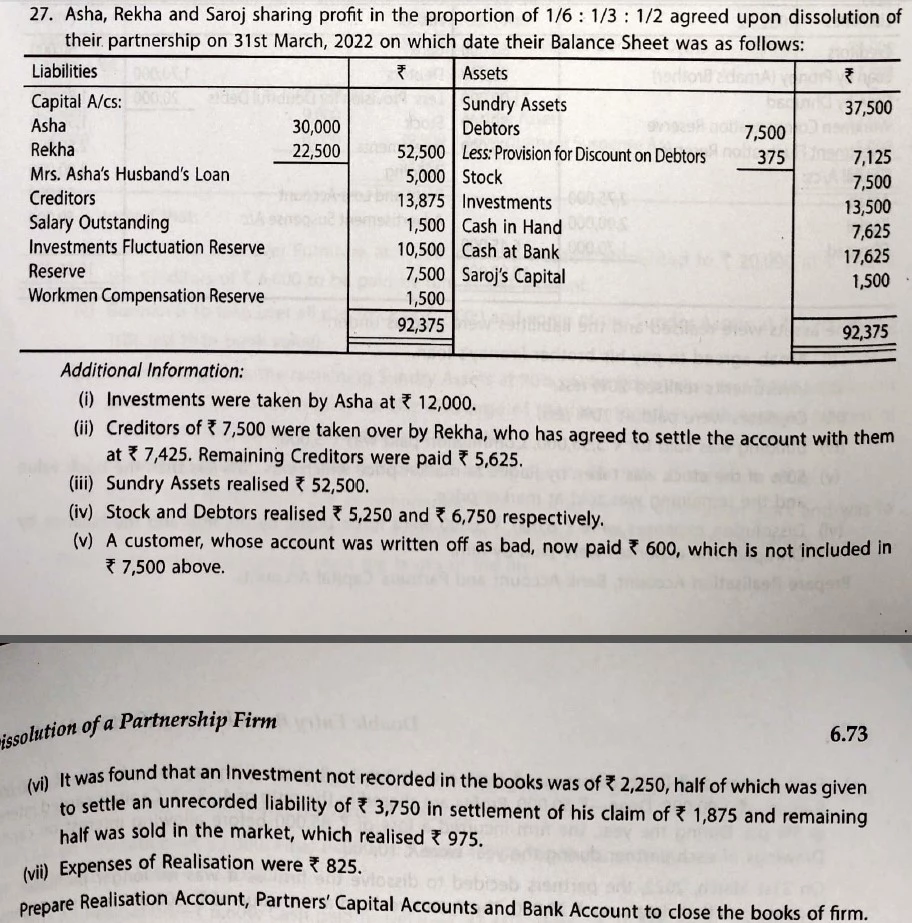

Asha, Rekha and Saroj sharing profit in the proportion of 1/6 : 1/3 : 1/2 agreed upon dissolution of their partnership on 31st March, 2022 on which date their Balance Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Asha Rekha Mrs. Asha’s Husband’s Loan Creditors Salary Outstanding Investments Fluctuation Reserve Reserve Workmen Compensation Reserve | 30,000 22,500 5,000 13,875 1,500 10,500 7,500 1,500 | Sundry Assets Debtors Less: PDD Stock Investments Cash in Hand Cash at Bank Saroj’s Capital | 37,500 7,125 7,500 13,500 7,625 17,625 1,500 |

| 92,375 | 92,375 |

Additional Information:

(i) Investments were taken by Asha at ₹ 12,000.

(ii) Creditors of ₹ 7,500 were taken over by Rekha, who has agreed to settle the account with them at ₹ 7,425. Remaining Creditors were paid ₹ 5,625.

(iii) Sundry Assets realised ₹ 52,500.

(iv) Stock and Debtors realised ₹ 5,250 and ₹ 6,750 respectively.

(v) A customer, whose account was written off as bad, now paid ₹ 600, which is not included in ₹ 7,500 above.

(vi) It was found that an Investment not recorded in the books was of ₹ 2,250, half of which was given to settle an unrecorded liability of ₹ 3,750 in settlement of his claim of ₹ 1,875 and remaining half was sold in the market, which realised ₹ 975.

(vii) Expenses of Realisation were ₹ 825.

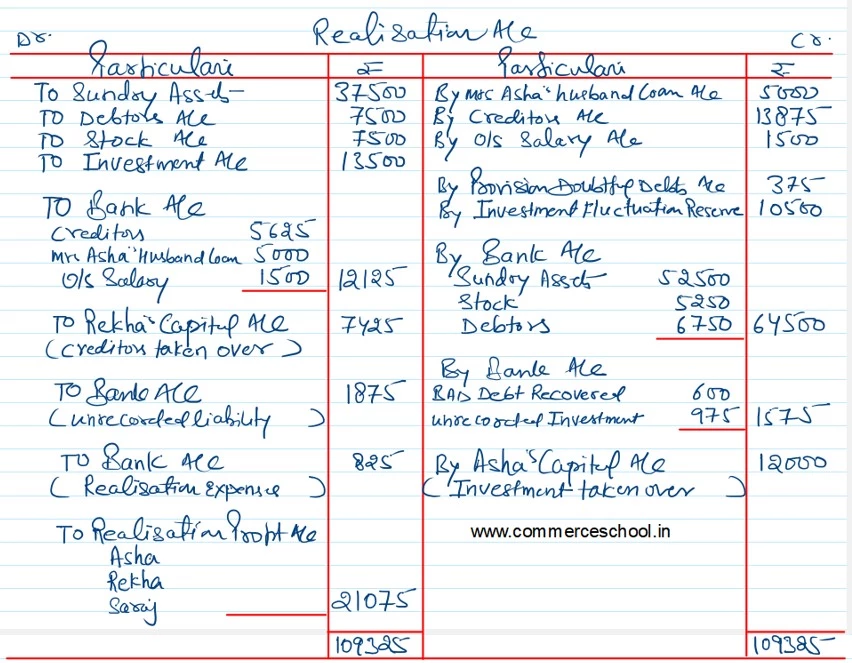

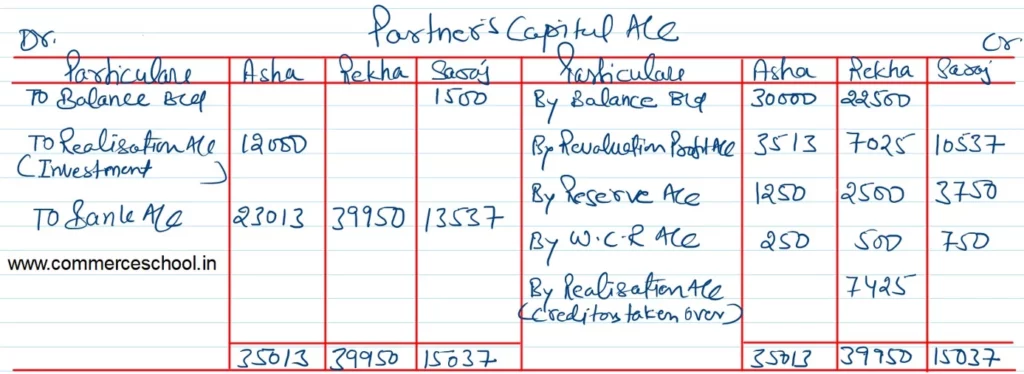

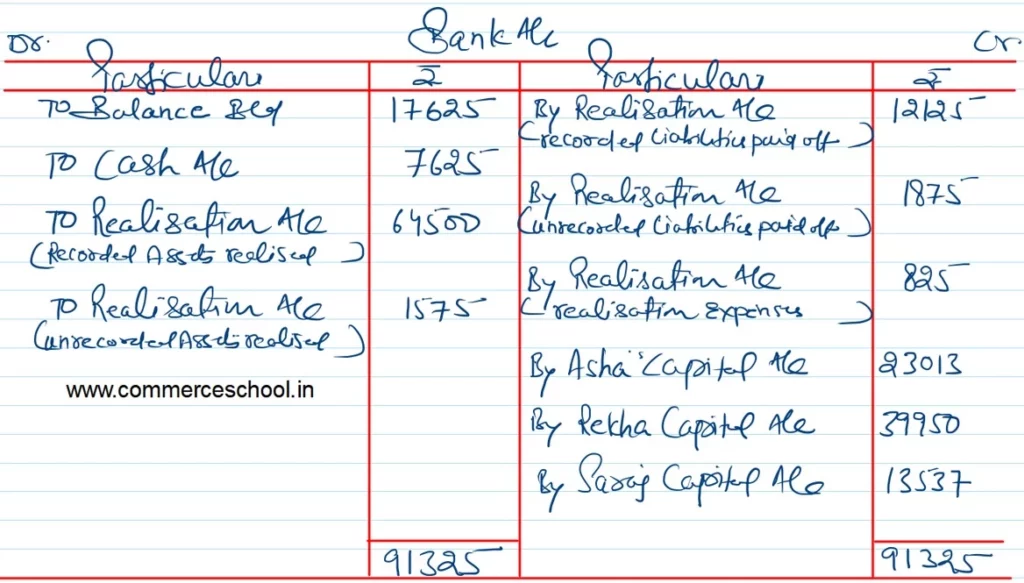

Prepare Realisation Account, Partner’s Capital Accounts and Bank Account to close the books fo the firm.

Solution:-

Here is the list of solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |