Income and expenditure account NPO Format, Features, meaning class 12

Looking for, Income and Expenditure account of NPO format, features and meaning for class 12 CBSE, ISC and State Boards

Income and expenditure is one of the account prepared by non-profit organizations.

It is prepared on the accrual basis of accounting.

In this lecture, we will the definition (meaning), features and format of income and expenditure account as prescribed by CBSE board for class 12 commerce stream.

What is income and expenditure account class 12

Not for profit organizations do not prepare profit and loss account as there is no motive to earn profit from organization activities.

However, every organization has to maintain proper records of financial activities during the accounting period.

Hence instead of preparing a profit and loss account, an income and expenditure account is prepared.

It is also prepared in the same manner as profit and loss accounts. The only difference is its format and nomenclature (naming)

In this account, profit and losses are written as surplus and deficit.

Definition of Income and Expenditure account

Income and expenditure account is prepared by the non-profit organization at the end of the accounting period. Where revenue receipts are matched with revenue expenses to determine surplus or deficit.

Features of Income and Expenditure Account

Nature:-

It is a nominal account. Hence all incomes are credited and expenses are debited.

Basis of accounting:-

It is prepared on the basis of accrual basis of accounting. Only revenue and expenses pertaining to accounting period whether paid or received are recorded.

Accounting Period:-

It records only those expenses and revenue pertaining to the current accounting period whether paid or not and received or not.

Adjustments:-

As this account is prepared on the accrual basis of accounting. Hence all adjustments of accrual and received in advance revenue, outstanding and prepaid expenses, provision for depreciation, or doubtful debts are made.

Opening and Closing Balances:-

It does not have any closing and opening Balance.

Profit and losses:-

As income and expenditure accounts is prepared by a non-profit organization, profit and losses are written as surplus and deficit. If the credit side of the income and expenditure account is greater than the debit side it results in a surplus. On the other hand, if the debit side of the income and expenditure account is greater than the credit side it results in a deficit. the surplus is added to the capital fund and the deficit is deducted out of it.

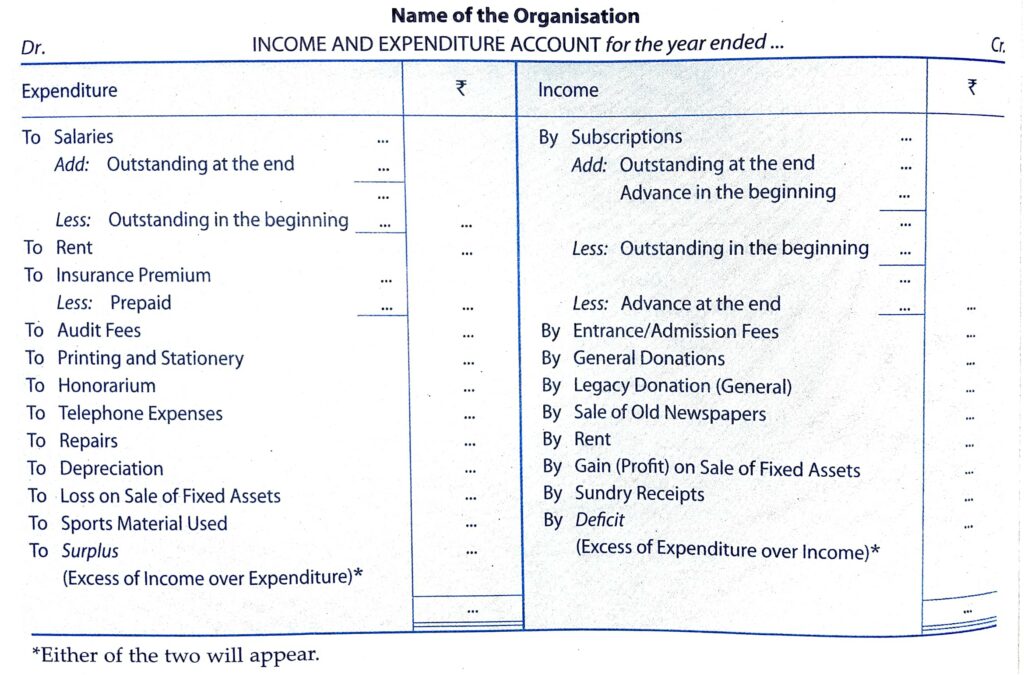

Format of Income and Expenditure account

While preparing income and expenditure accounts, the following points must be kept in mind.

- It is prepared on the accrual basis of accounting

- Only Revenue Expenses for the accounting period are taken, whether they have been paid or not.

- Only Revenue Incomes for the accounting period are taken, whether has been received or not.

- Capital Incomes or receipts are not recorded, such as a donation for a specific purpose.

- Capital Expenditures are also not recorded such as the purchase of land, machine, furniture etc

- Non-cash expenses such as depreciation are taken into account as expenses.

Further Reading:-

| S.N | NPO Chapter Solution |

| 1. | TS Grewal NPO Chapter solution 2021-22 Edition |

| 2. | DK Goyal NPO Chapter solution 2021-22 Edition |

| 3. | SK Sharma NPO Chapter solution 2021-22 Edition |