Profit and Loss Appropriation Account Format, Features, Definition Class 12

Are you confused about why the profit and loss appropriation account is prepared in partnership? I have explained everything about the Profit and loss appropriation account ranging from its format, features, definition, and reasons to prepare it as per the syllabus of the Class 12 Accountancy CBSE Board.

Why Profit and Loss Appropriation Account is prepared in partnership Firm.

You have so far studies proprietorship in 11th class. In proprietorship there is only a single owner of the business. So no need to distribute profit of the firm.

But in Partnership there are at least two owner. So in order to distribute profit among partner profit and loss appropriation account is prepared.

In this account, profit is distributed among partners as interest on capital, salary and commission and remaining profit is divided in profit sharing ratio between partners.

Following transactions between firm and partners are termed as appropriation.

- Interest on Capital

- Interest on Drawings

- Salary to partners

- Commission to partners

- Allocation of Reserves

- division of distributable profits

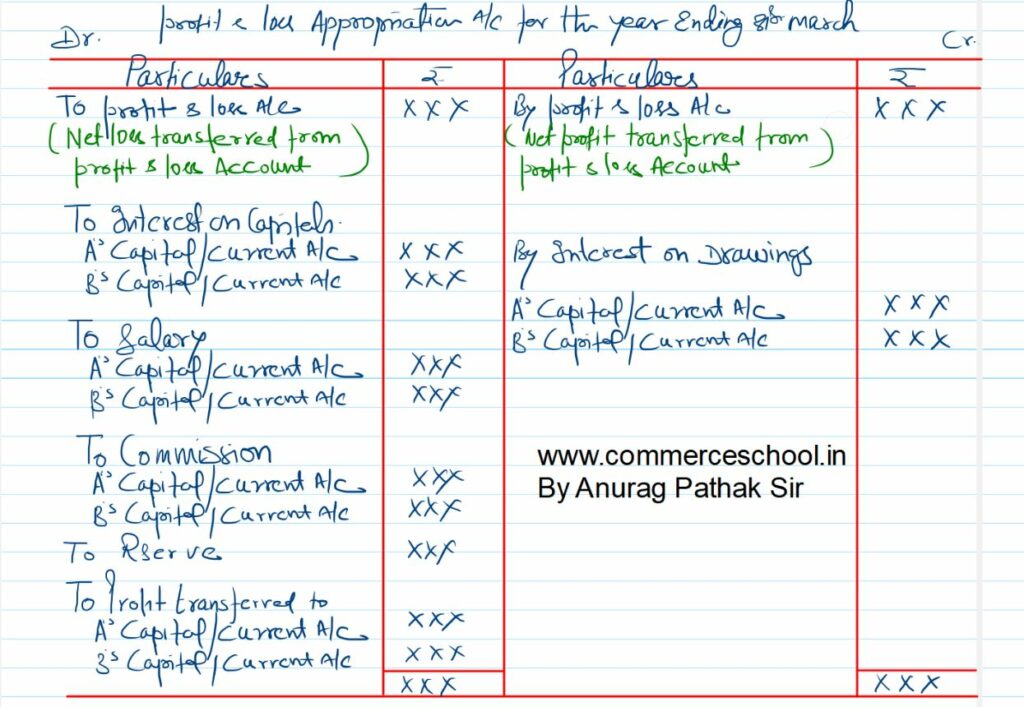

Format of Profit and Loss Appropriation Account Class 12 Accountancy

Note:- Capital account is used if firm practice Fluctuating Capital Method. Current Account is used if firm maintain its account on Fixed Capital Method.

Features of Profit and Loss Appropriation Account

Following are the features of profit and loss appropriation account.

- It is prepared just after the profit and loss account. Thus it is an extension of the profit and loss account.

- It is prepared only by partnership firm.

- It is a nominal Account.

- It shows the appropriation of the net profit and loss for the accounting period among partners.

- Entries in this account are made giving effect to the Partnership Deed and/or the Indian Partnership Act, 1932.

Items that are not considered as appropriation

There are few items that are concerned with partners but are not recorded in profit and loss appropration account rather are considered as charge against profit.

Such items are recorded as expenses in profit and loss account and charge even if the firm incur losses.

Such items are:-

- Interest on loan of partners

- Rent to partners on their property.

- Manager’s commissions.

MCQs Practice Questions

What is the main purpose of preparing a Profit and Loss Appropriation Account in a partnership firm?

a) To record business expenses

b) To calculate net profit

c) To distribute profits among partners

d) To prepare final accounts

Ans:- c)

Explanation: It allocates net profit among partners after adjustments like interest and salary.

Which of the following is NOT shown in the Profit and Loss Appropriation Account?

a) Partner’s salary

b) Interest on drawings

c) Interest on capital

d) Depreciation on assets

Ans:- d)

Explanation: Depreciation is recorded in the Profit and Loss Account, not in the Appropriation Account.

Interest on drawings is shown on which side of the Profit and Loss Appropriation Account?

a) Debit side

b) Credit side

c) Asset side

d) Liability side

Ans:- b)

Explanation: It is income for the firm and hence credited.

Partner’s salary is shown on which side of the Profit and Loss Appropriation Account?

a) Credit side

b) Debit side

c) Asset side

d) Liability side

Ans:- b)

Explanation: It is an appropriation of profit and hence debited.

Net profit transferred from the Profit and Loss Account is shown on which side of the Profit and Loss Appropriation Account?

a) Debit side

b) Credit side

c) Asset side

d) Liability side

Ans:- b)

Explanation: Net profit is credited as it is available for distribution.

Which account is prepared after the Profit and Loss Account in a partnership firm?

a) Revaluation Account

b) Capital Account

c) Profit and Loss Appropriation Account

d) Current Account

Ans:- c)

Explanation: It follows the Profit and Loss Account to allocate profits.

Which of the following is credited in the Profit and Loss Appropriation Account?

A) Partner’s salary

B) Interest on capital

C) Interest on drawings

D) Commission to partners

Ans:- c)

Explanation: Interest on drawings is income for the firm.

In the absence of a partnership deed, how are profits shared among partners?

a) In the capital ratio

b) Equally

c) As per seniority

d) As per mutual agreement

Ans:- b)

Explanation: Profits are shared equally if no deed exists.

Which of the following is debited in the Profit and Loss Appropriation Account?

a) Interest on drawings

b) Reserve fund

c) Partner’s salary

d) Net profit

Ans:- c)

Explanation: Partner’s salary is an appropriation and hence debited.

Which item is transferred to partners’ capital or current accounts from the Profit and Loss Appropriation Account?

a) Depreciation

b) Interest on capital

c) Drawings

d) Net profit

Ans:- b)

Explanation:Interest on capital is credited to partners’ accounts.

Transfer to General Reserve is shown on which side of the Profit and Loss Appropriation Account?

a) Debit Side

b) Credit Side

c) Either side

d) Not shown

Ans:- a)

The Profit and Loss Appropriation Account is prepared by:

a) Sole Proprietor

b) Partnership Firm

c) Company

d) Non-profit Organization

Ans:- b)

The Profit and Loss Appropriation Account is prepared to show:

a) Financial position of the business

b) Distribution of net profit among partners

c) Gross profit

d) Total assets and liabilities

Ans:- b)

What is the opening item on the credit side of the Profit and Loss Appropriation Account?

a) Interest on drawings

b) Net profit from Profit and Loss Account

c) Partner’s salary

d) Commission to partners

Ans:- b)

Interest on capital is shown on which side of the Profit and Loss Appropriation Account?

a) Credit Side

b) Both sides

c) Debit Side

d) Not shown

Ans:- c)

Partner’s salary and commission are:

a) Appropriations of profit

b) Charges against profit

c) Income for the firm

d) Hidden reserves

Ans:- a)

Interest on drawings is shown on which side of the Profit and Loss Appropriation Account?

a) Debit Side

b) Credit Side

c) Both sides

d) Not shown

Ans:- b)

When there is a net loss in the Profit and Loss Account, the Profit and Loss Appropriation Account will show:

a) Net profit on credit side

b) Net loss on debit side

c) Net profit on debit side

d) No entry

Ans:- b)

If the partnership deed is silent about the distribution of profits, they are shared:

a) In proportion to capital

b) Equally among partners

c) Based on seniority

d) None of these

Ans:- b)

What is the nature of the Profit and Loss Appropriation Account?

a) Real Account

b) Personal Account

c) Nominal Account

d) Representative Personal Account

Ans:- c)

Transfer to General Reserve is shown on which side of the Profit and Loss Appropriation Account?

a) Debit Side

b) Credit Side

c) Either side

d) Not shown

Ans:- a)