Receipts and Payments account of NPO format, features, limitations

Looking for Receipts and Payments account of NPO format, features and limitations.

See, Not-for-profit organizations prepare three types of accounts.

Receipts and payments accounts are one of them.

It is a kind of real account and is prepared as a cash book with a minor change in format.

Here in this lecture, we will discuss, what is receipts and payments account, its features, limitations, and format as given in the syllabus of class 12 CBSE Board.

What is receipts and payments accounts in NPO Chapter class 12

“In simple words, receipts and payments account is the summary of cash and bank receipts and payments during an accounting period.”

It is one of the accounts prepared by NPO organizations. It is prepared with the same concept as a cashbook by the business firm.

But there is a few format difference between both.

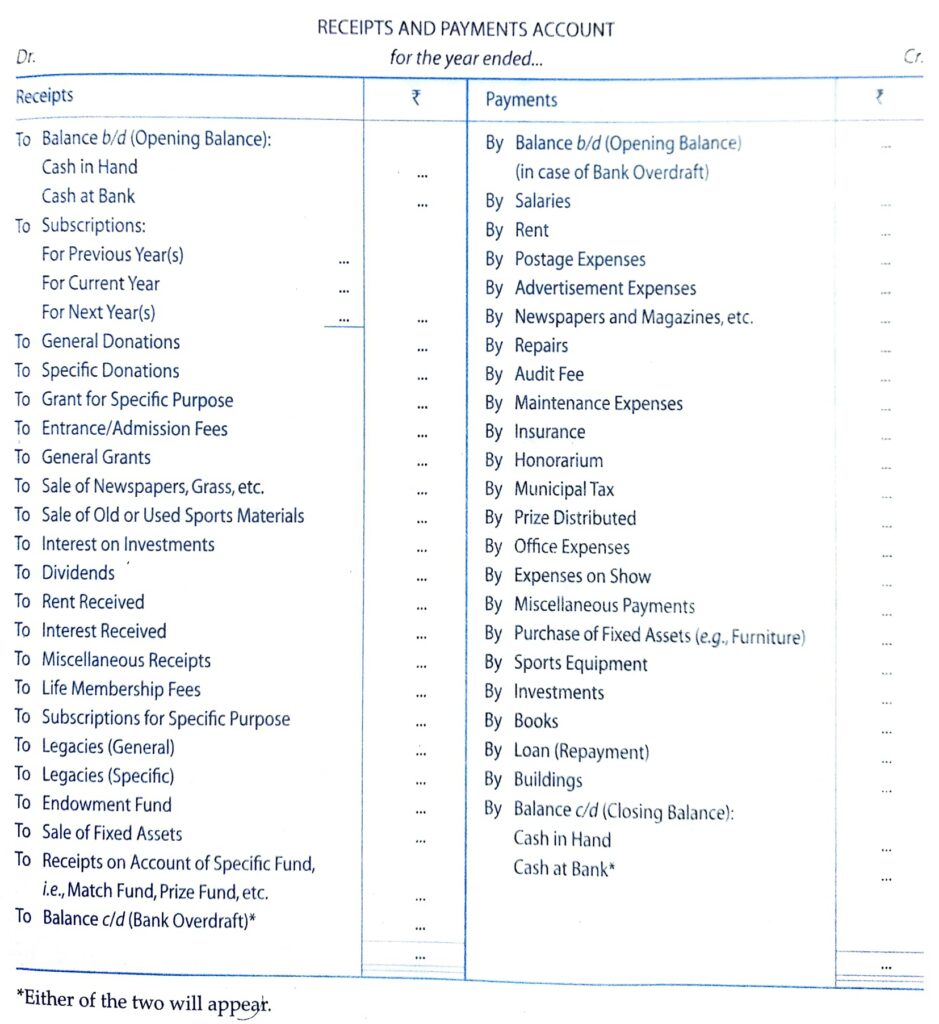

Format of Receipts and Payments Account in NPO Chapter

Here are a few points you should keep in mind while preparing it.

- It starts with opening cash and bank balance on the debit side.

- It ends with closing cash and bank balance at the credit side

- it records both cash and bank receipts and payments.

- Receipts are shown on the Debit side.

- Payments are shown on the Credit side

Here is the format

Features (Characteristics) of Receipts and Payments Account

Nature:-

The nature of this is an asset (real) account. it records cash and bank receipts and payments.

Basis:-

It is prepared on the cash basis of accounting.

Period:-

It is prepared at the end of the accounting period and records cash and bank transactions whether it related to current, previous, and succeeding (next) accounting periods.

Purpose:-

The main purpose is to show cash amounts received and paid under the different heads during the accounting year.

Nature of transactions recorded:-

It records all revenue and capital nature transactions.

Opening and Closing Balances:-

Its opening balances show cash in hand and cash at a bank in the beginning of the accounting period and closing balance shows cash in hand and at bank at the end of the accounting period.

Adjustments:-

No adjustments of outstanding, prepaid expenses and accrued, received in advance income is made in receipts and payments account as it is prepared on cash basis of accounting.

Limitations of Receipts and Payments Account

- As it is prepared on the Cash Basis of Accounting. It does no show actual expenses and income pertaining to given accounting period. besides showing revenue receipts and payments, it also shows capital receipts and payments in same account.

- It does not show whether organization is able to meet its day to day expenses out of its income or not.

Difference between Receipts and Payments Account and Cash Book

| Basis | Receipts and Payments Account | Cash Book |

| Basis | It is prepared out of a cash book as a summary of it. | It records each transactions of receipt and payment separately |

| Period | It is prepared at the end of the accounting period | It is prepared on daily basis. |

| Date | Transactions are not shown date wise rather in summarised form. Transactions of the same nature in one place. | Transactions are recorded date-wise. |

| Institutions | It is prepared by Not for Profit Organisation | It is prepared by all kind of organizations, be it business firm or NPO |

| Sides | Its format contains receipts and payments side. | It is divided into debit and credit sides |

| Ledger Folio | There is no column for ledger folio | Cash Book has a separate column for Ledger Folio |

Receipts and Payments account is a Real Account

Yes, It is a real (Assets) account.

The receipts and Payments account is a Nominal Account.

No, it is not a nominal account. It is in fact a real (asset) account.

Which organization prepares receipts and Payment account.

Not-for-profit organization generally prepare receipts and payment account.

Further Reading:-

| S.N | NPO Chapter Solution |

| 1. | TS Grewal NPO Chapter solution 2021-22 Edition |

| 2. | DK Goyal NPO Chapter solution 2021-22 Edition |

| 3. | SK Sharma NPO Chapter solution 2021-22 Edition |