[ISC] Q 9 Solution Depreciation TS Grewal Class 11 (2022-23)

Are you looking for the solution of Question number 9 Depreciation TS Grewal class 11 ISC 2022-23?

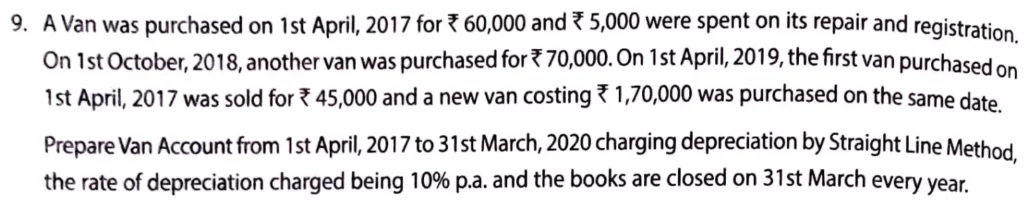

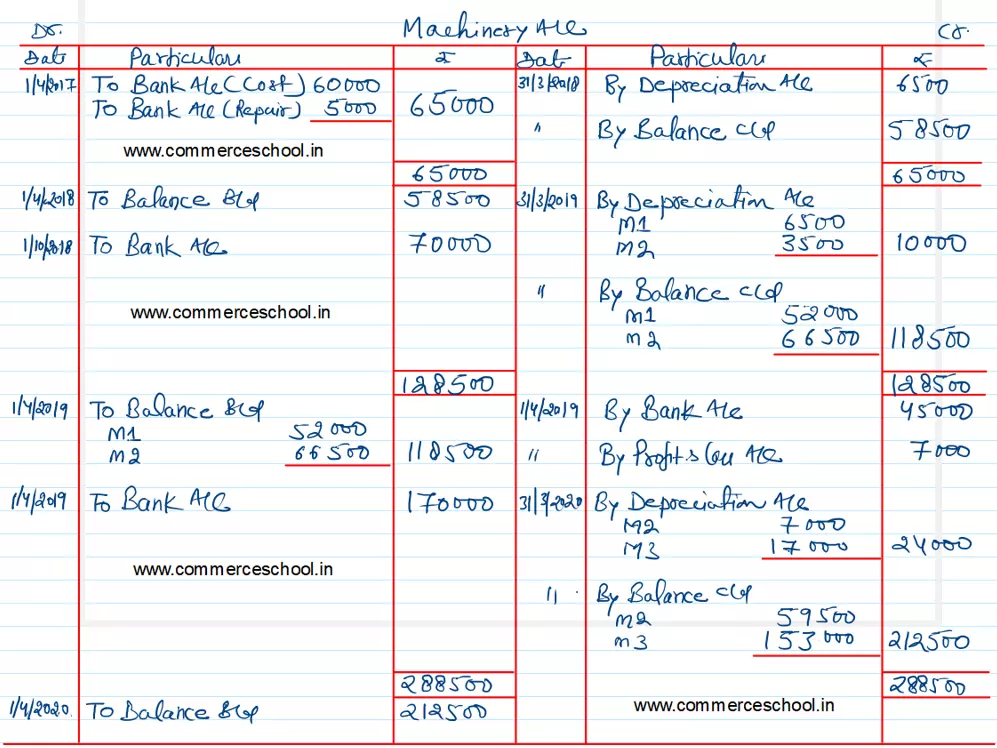

A Van was purchased on 1st April, 2017 for ₹ 60,000 and ₹ 5,000 were spent on its repair and registration. On 1st October, 2018, another van was purchased for ₹ 70,000. On 1st April, 2019, the first van purchased on 1st April, 2017 was sold for ₹ 45,000 and a new van costing ₹ 1,70,000 was purchased on the same date.

Prepare Van Account from 1st April, 2017 to 31st March, 2020 charging depreciation by Straight Line Method, the rate of depreciation charged being 10% p.a. and the books are closed on 31st March every year.

Solution:-

Below is the list of all the Practical problems

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |