[ISC] Q 22 Solution Depreciation TS Grewal Class 11 (2022-23)

Are you looking for the solution of Question number 22 Depreciation TS Grewal class 11 ISC 2022-23?

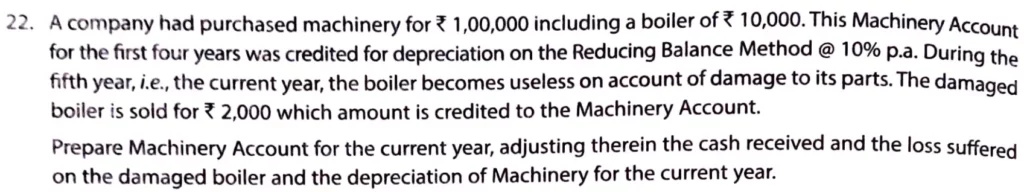

A company had purchased machinery for ₹ 1,00,000 including a boiler of ₹ 10,000. This Machinery Account for the first four years was credited for depreciation on the Reducing Balance Method @ 10% p.a. During the fifth year, i.e., the current year, the boiler becomes useless on account of damage to its parts. The damaged boiler is sold for ₹ 2,000 which amount is credited to the Machinery Account.

Prepare Machinery Account for the current year, adjusting therein the cash received and the loss suffered on the damaged boiler and the depreciation of Machinery for the current year.

Solution:-

Below is the list of all the Practical problems

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |