[ISC] Q 40 Solution Depreciation TS Grewal Class 11 (2022-23)

Are you looking for the solution of Question number 40 Depreciation TS Grewal class 11 ISC 2022-23?

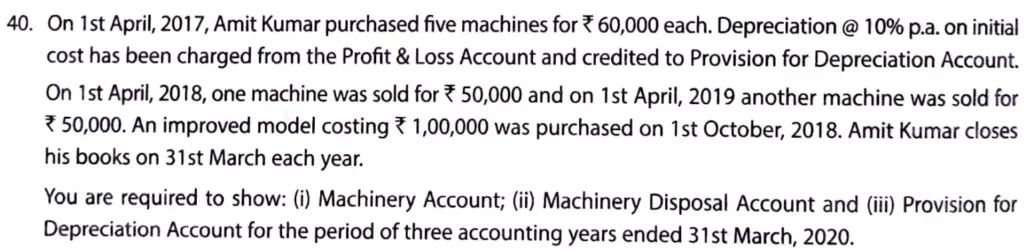

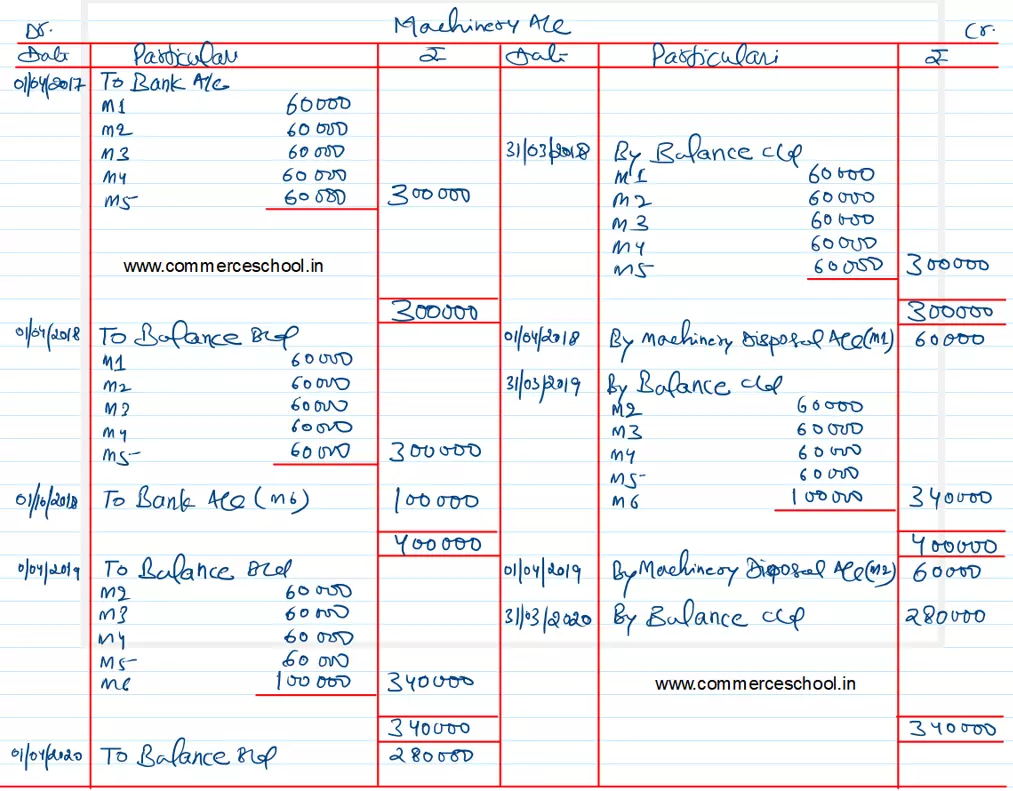

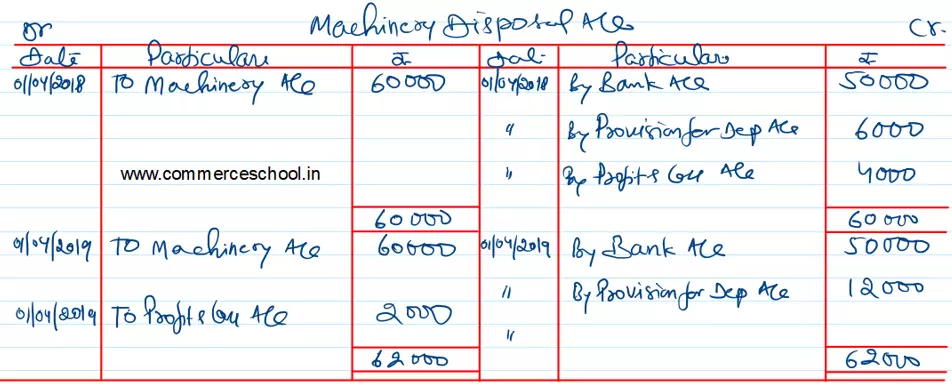

On 1st April, 2017, Amit Kumar purchased five machines for ₹ 60,000 each. Depreciation @ 10% p.a. on initial cost has been charged from the Profit & Loss Account and credited to Provision for Depreciation Account.

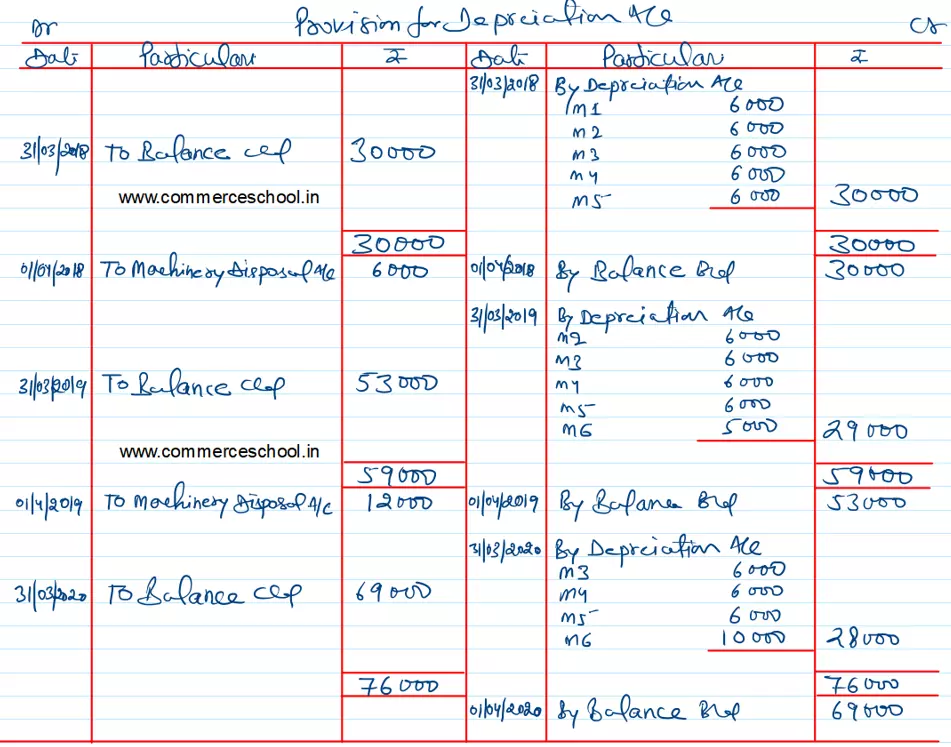

On 1st April, 2018, one machine was sold for ₹ 50,000 and on 1st April, 2019 another machine was sold for ₹ 50,000. An improved model costing ₹ 1,00,000 was purchased on 1st October, 2018. Amit Kumar closes his books on 31st March each year.

You are required to show: (i) Machinery Account; (ii) Machinery Disposal Account and (iii) Provision for Depreciation Account for the period of three accounting years ended 31st March, 2020.

Solution:-

Below is the list of all the Practical problems

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |