[ISC] Q 5 Solution Depreciation TS Grewal Class 11 (2022-23)

Are you looking for the solution of Question number 5 Depreciation TS Grewal class 11 ISC 2022-23?

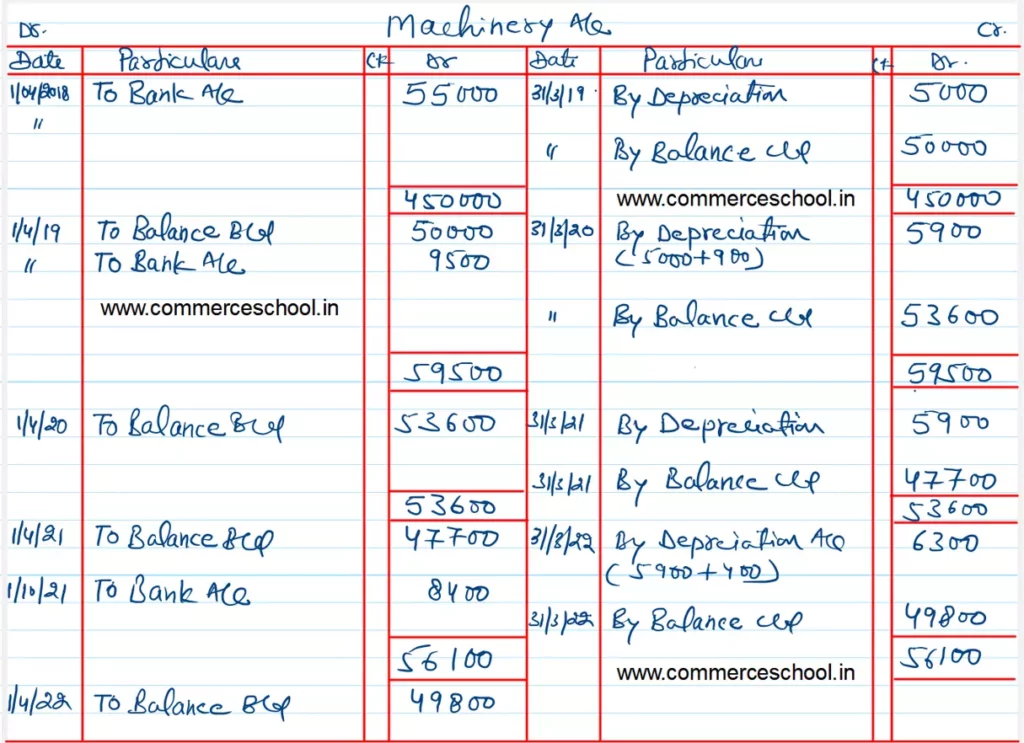

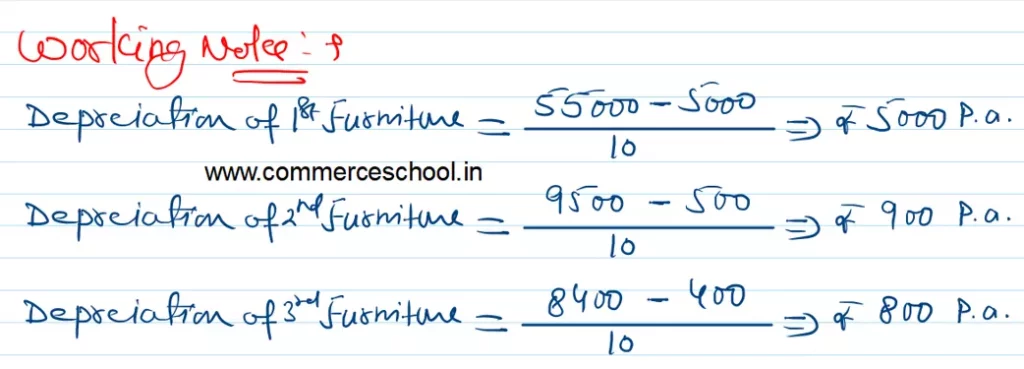

On 1st April, 2018, Amrit purchased office furniture for ₹ 55,000. It is estimated to have useful life of 10 years at the end of which it can be sold for ₹ 5,000. Additions were made on 1st April, 2019 and 1st October, 2021 costing ₹ 9,500 and ₹ 8,400 (Residual values ₹ 500 and ₹ 400 respectively).

Prepare Furniture Account for the first four years ended 31st March, if depreciation is written off according to the Straight Line Method.

Solution:-

Below is the list of all the Practical problems

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |