[ISC] Q 38 Solution Depreciation TS Grewal Class 11 (2022-23)

Are you looking for the solution of Question number 38 Depreciation TS Grewal class 11 ISC 2022-23?

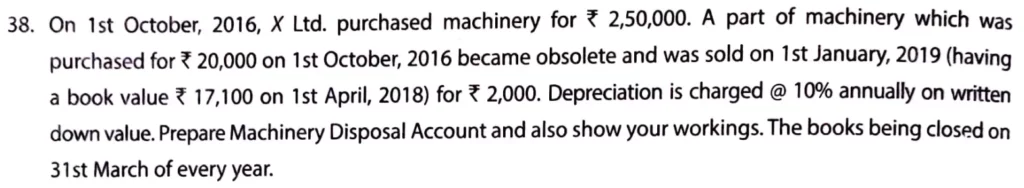

On 1st October, 2016, X Ltd. purchased machinery for ₹ 2,50,000. A part of machinery which was purchased for ₹ 20,000 on 1st October, 2016 became obsolete and was sold on 1st January, 2019 (having a book value ₹ 17,100 on 1st April, 2018) for ₹ 2,000. Depreciation is charged @ 10% annually on written down value. Prepare Machinery Disposal Account and also show your workings. The books being closed on 31st March, of every year.

Solution:-

Below is the list of all the Practical problems

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |