[ISC] Q 42 Solution Depreciation TS Grewal Class 11 (2022-23)

Are you looking for the solution of Question number 42 Depreciation TS Grewal class 11 ISC 2022-23?

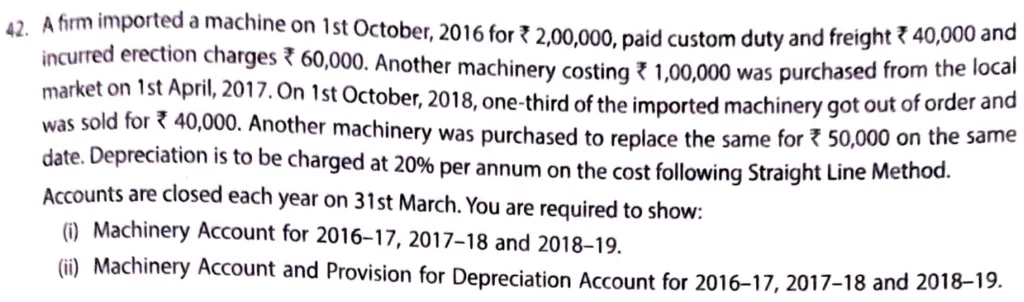

A firm imported a machine on 1st October, 2016 for ₹ 2,00,000, paid custom duty and freight ₹ 40,000 and incurred erection charges ₹ 60,000. Another machinery costing ₹ 1,00,000 was purchased from the local market on 1st April, 2017. On 1st October, 2018, one-third of the imported machinery got out of order and was sold for ₹ 40,000. Another machinery was purchased to replace the same for ₹ 50,000 on the same date. Depreciation is to be charged at 20% per annum on the cost following Straight Line Method.

Account are closed each year on 31st March. You are required to show:

(i) Machinery Account for 2016 – 17, 2017 – 18 and 2018 – 19.

(ii) Machinery Account and Provision for Depreciation Account for 2016 – 17, 2017 – 18 and 2018 – 19.

Solution:-

Below is the list of all the Practical problems

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |