Expenditure Method Class 12 Economics, formula, definition, notes, pdf

Are you looking for the formula and steps of expenditure method to calculate national income as per the syllabus of Macroeconomics class 12 CBSE Board.

After reading this article to the end. you would be able to solve any kind of numerical problem concerned with this topic.

In this lecture, we will discuss how to calculate national income by the Expenditure Method. our approach would be restricted to the syllabus of class 12 CBSE Board.

What is Expenditure Method for Calculating GDP in National Income Chapter

According to this method, National income is measured as sum total of expenditure incurred on final goods and services produced by households, business firms, government and foreigners with in the economic territory during a given year.

The total of final expenditure is equal to gross domestic product at market price (GDP at MP).

What are other name of Expenditure Method

- Final Expenditure Method

- Consumption and Investment Method

- Income Disposal Method

Components & Concepts of Expenditure Method

In an economy all sectors Households, Government, Firms and the Foreign Sector carry out the expenditure activities. We only consider expenditure on final goods and services by all sectors.

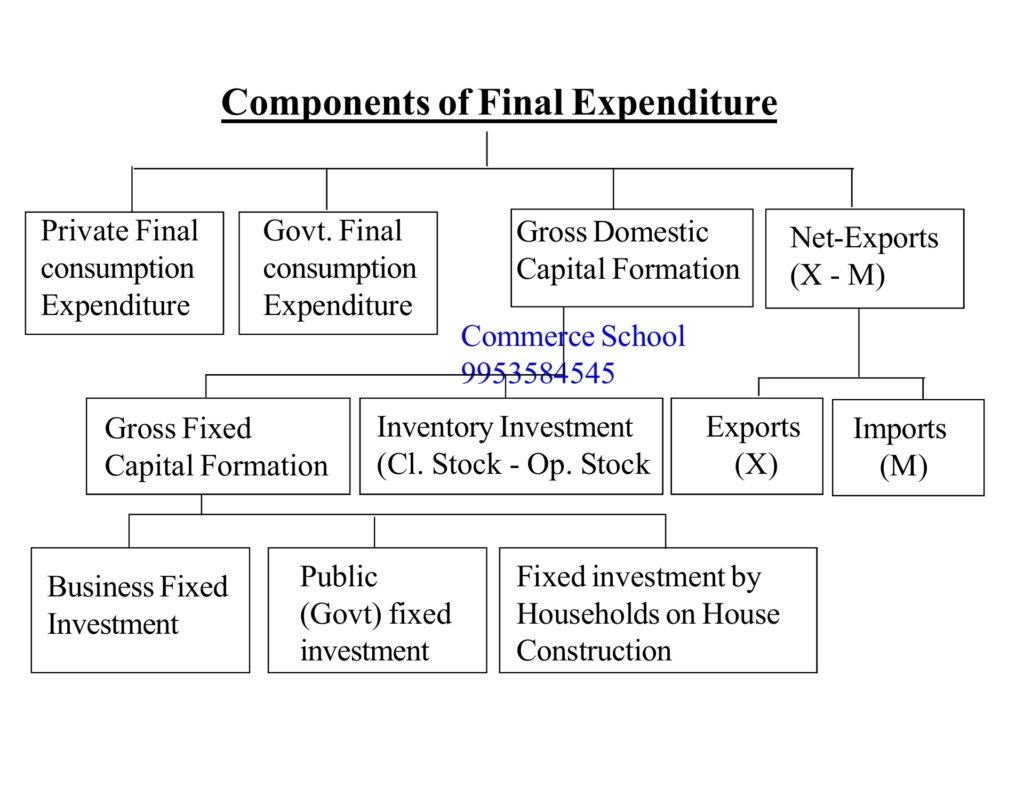

Following are the components of Final Expenditure Method

Download our Android App:- Commerce School

1. Private Final Consumption Expenditure (PFCE):-

It refers to the sum total of all final consumption expenditure by household and non-profit institutions serving households

final consumption expenditure includes expenditure on durable goods (except construction of house), semi-durable, non-durable and services.

PFCE = Household final consumption expenditure + non-profit institutions serving households final consumption expenditure

Points to Remember:-

Expenditure by households on construction of new house is not considered as private final consumption expenditure. It is part of ‘Gross Domestic Capital Formation’.

All final expenditure incurred by normal residents of a country within the domestic territory and outside is considered. If a resident. All expenses of normal residents on foreign tour (abroad) is considered as PFCE.

Any expenditure incurred by non-residents on final goods in domestic territory is deducted out of PFCE.

2. Government Final Consumption Expenditure:-

It refers to the imputed value of services produced and provided by general government to the people free of cost. It includes services like

- Defence

- Law and Order

- Education

3. Gross Domestic Capital Formation (Gross Investment) GDCF:-

It represents addition to capital stock of an economy during a given period. In other words, it refers to expenditure incurred by producers within the domestic territory in acquiring goods for investment.

It has two components

1) Gross Fixed Capital Formation:-

It refers to the expenditure incurred by production units in acquiring fixed assets (durable goods).

It has three components

i) Gross Business fixed Investment:- it includes expenditure in acquiring new machinery, building, plant, furniture etc. such goods support production activities for a long time.

ii) Gross Residential Fixed Investment on House Construction:- it includes expenditure in construction and acquiring new house by Households

iii) Gross Public (Govt) Fixed Investment:- It includes expenditure on construction of public building, flyover, bridges, roads, etc. by the government.

2) Inventory Investment (Change in Stock):-

It refers to the physical change in the stock of raw material, semi finished goods and finished goods. It is calculated as the difference between closing stock – opening stock of the year.

4. Net Exports (X – M):–

It refers to the difference between the Exports and Imports of a country during a given year.

i) Exports:- It refers to the expenditure of foreigners on the purchase of domestic products.

ii) Imports:- It refers to the expenditure by residents on foreign products.

Precautions of Expenditure Method

Further Reading:-

| S.N | Topics |

| 1. | What is GDP Deflator |

| 2. | What are externalities in economics |

| 3. | Limitations of GDP as a measure of welfare |

| S.N | Topics |

| 1. | 150+ Numerical of Value Added Method |

| 2. | 150+ Numerical of Income Method |

| 3. | 150+ Numerical of Expenditure Method |

| 4. | 150+ Numerical of National Income and related aggregates |

| S.N | Topics |

| 1. | 250+ MCQs of National Income |