Value added Method Formul class 12 concept notes pdf

Are you looking for the value-added method formula concepts of the national income chapter class 12 macroeconomics CBSE Board?

I have explained everything ranging from its different formulas and tricks.

Value-added method to calculate national income is also known as Product Method

There are three methods to calculate the National Income of a country.

- Value-added method

- Income method

- Expenditure method

In this lecture, we will only discuss, how to calculate National Income by value-added method strictly according to the syllabus of the Class 12 CBSE Board.

What is the alternative name of Value Added Method

Value Added Method is also known as

- Product Method

- Inventory Method

- Net Output Method

- Industrial Origin Method

- Commodity Service Method

What is Value Added Method

Generally, Value-added refers to the measure of value addition in the raw material (non-factor units) by a production unit, through its production activities.

Value-added, in fact, is a value-added to intermediate products.

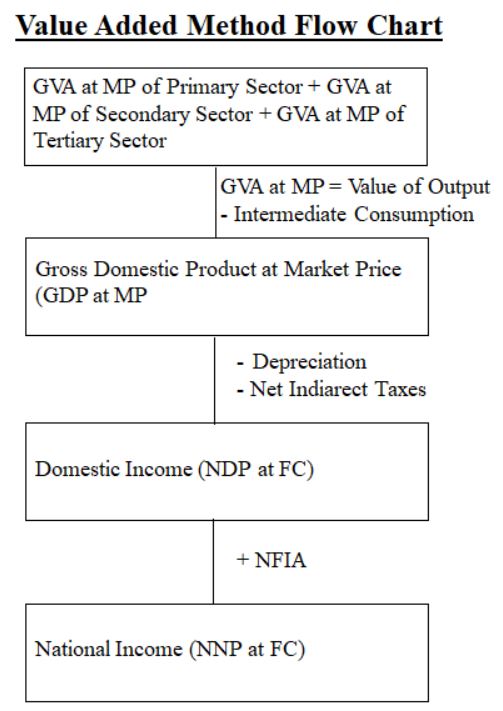

So, the sum of value added by all production units within the domestic territory of the country during the year is equal to the market value of GDP. It is also called as GDP at MP.

Value of GDP at MP further can be converted into National Income by adjusting depreciation, Net indirect tax, and NFIA (Net Factor Income from Abroad).

Let’s first understand the concept of value addition with an example

Concept of Value Added Method with Example

Let’s assume a carpenter purchase wood worth ₹ 1,000 and converts it into a chair worth ₹ 2500. Through production activity, the carpenter adds ₹ 1500 value to the wood.

We can define three different aspects out of this example

- Raw material worth ₹ 1000

- Value addition Worth ₹ 1500

- Value of output worth ₹ 2500

Economics only considers value addition as income. As per the economics, only ₹ 1500 is considered as income.

So the value-added method is meant to determine only value addition contributed by all production units within the domestic territory of a country.

Practically, we don’t have the monetary value of ‘value addition’ directly. What we have is the money value of raw material and the market value of output.

So, by deducting the money value of Raw material out of the money value of final output we can get Value addition.

So, you have to follow the following procedure to calculate domestic and national income by the value-added method

Note:-

Through this method, we first get Gross Value added at Market Price (Gross Domestic Product at MP). By adjusting depreciation, net tax, and NFIA we can arrive at different National Income Aggregates

Read our guide:- How to Calculate Different National income aggregates

Formula of Value Added Method

Value Added = Value of Output – Intermediate Consumption

GDP at MP (GVA at MP) = Value of Output – Intermediate Consumption

‘Value-added’ equals Gross value added at Market Price. as the value of output is inclusive of taxes and depreciation (consumption of fixed capital).

The value added by the economy as a whole is called domestic product

Note:-

Value-added = Gross value added at market price = GVA at MP = Sum total of GVA at MP of all sectors = Gross Domestic Product at MP = GDP at MP

Different Name of Value added

- Value Added

- Gross Value added at Market Price

- Gross Domestic Product at MP

- Sum total of GVA at MP of all sectors (Primary, Secondary, Tertiary)

- GVA at MP

- GDP at MP

In order to arrive at various national income aggregates, we have to adjust depreciation, net tax, and NFIA to arrive at the different figures.

But the story does not end yet. you must have a command over to calculate the value of output and Intermediate Consumption.

How to Calculate Value of Output and its Formulas

The value of output in a domestic economy is the money value of total production by all production units in a year. it includes intermediate consumption in itself.

In the above example, we illustrated when a carpenter purchased wood worth ₹ 1000 and converted it into a chair of worth ₹ 2500. he added a value of ₹ 1500 to it. But he is going to sell it for ₹ 2500 in the market.

So, his value of output is ₹ 2500.

Formula of Value of Output

Case – I

When the entire output is sold in an accounting year

Value of Output = Sales

Case – II

When the entire output is not sold in an accounting year

Value of Output = Sales + Change in Stock (closing Stock – Opening Stock)

Sales can also further be calculated in different ways. following are the formulas.

Sales = Quantity * Price

Sales = Domestic Sales + Export

Domestic Sales = Sales to households + Sales to government + Sales to other firms + production for self-consumption

Note:-

When only sales are given. It is assumed that exports are already included in it. If exports are given in the question, it is not considered.

For example:-

1st Case:-

(i) Sales ₹ 2500, (ii) Exports ₹ 500

Ans:- Sales ₹ 2500

2nd Case:-

(i) Domestic Sales ₹ 2500, (ii) Exports ₹ 500

Ans:- Sales ₹ 2500 + ₹ 500 = ₹ 3000

How to calculate Intermediate consumption and its different Formulas

Let’s first understand what intermediate consumption actually is

“Intermediate Consumption refers to the expenditure incurred by production units on purchasing goods and services from another production unit, Which are meant for resale or for using up completely in further production during the same year.“

In the above example, wood purchased by the carpenter was the intermediate consumption.

Anything, purchased by production units and converted into final goods and resold within a year, is termed as intermediate consumption.

But the Machinery that is used in the production process is not the intermediate consumption. as neither, it is meant for resale nor converted into final goods within a year.

So you must have expertise in differentiating between intermediate and Final Consumption expenditure, exclusively of a producer.

Few example of Intermediate consumption

- Milk purchased by a sweets shop

- Wood purchased by a carpenter

- Iron purchased by

- Gold purchased by Gold Smith

- Vegetable purchased by the vegetable seller

- raw material purchased by any production unit

- chalk, duster, stationery purchased by a school

Now we will understand the relationship between raw material and intermediate consumption in detail and how can we derive Intermediate consumption expenditure out of given information.

Intermediate consumption = Purchase of raw material

Intermediate Consumption = Purchase of Raw Material from Domestic Firm + Imports

Intermediate Consumption = Domestic Intermediate Consumption + Imports

Intermediate consumption = Domestic Intermediate cost + Imports

Note:- When Intermediate consumption and purchase of raw material is given, it includes imports in itself. If imports are given in question it is not considered.

Lets understand this with three different case:

1st Case:-

(i) Intermediate Consumption = ₹ 1,200, (ii) Imports = ₹ 300

Ans:- Intermediate consumption is ₹ 1,200 as imports is included in it.

2nd Case:-

(i) Purchase of Raw Material = ₹ 1,200, (ii) Imports = ₹ 300

Ans:- Intermediate Consumption is ₹ 1,200 as imports is included in it.

3rd Case:-

(i) Purchase of Raw Material from Domestic firm (Domestic Intermediate consumption) is ₹ 1,200, (ii) Imports ₹ 300

Ans:- Intermediate Consumption = ₹ 1500

Steps to Calculate National Income by Value Added Method

Step – 1

First Identify Different sectors of an economy. All the producing units are divided into three sectors.

- Primary Sector

- Secondary Sector

- Tertiary Sector

Step – 2

Sum up the Value added by all sectors to arrive at Gross value added in an economy.

Gross Value added at MP = Sum of Gross value added by all three sectors of an economy.

GVA at MP = GVA (GDP) at MP of Primary Sector + GVA at MP of Secondary Sector + GVA at MP of Tertiary Sector

GVA at MP = Sales + Change in stock – Intermediate consumption, as discussed earlier.

Step – 3

Calculate Domestic Income (NDP at FC)

NDP at FC = GVA (GDP) at MP – consumption of Fixed Capital – Net indirect tax (indirect tax – subsidy)

Step – 4

Calculate National Income (NNP at FC)

NNP at FC = NDP at FC + NFIA (Factor income from abroad – Factor income to abroad)

There are 8 Income aggregates of a nation. I have write a comprehensive lecture over it

Read Hear:- National income and its related aggregates, definition, formulas, examples, questions

Flow Chart of Value Added Method

Precautions while calculating National Income by Value Added Method

1. Sale and Purchase of Second Hand Goods:-

The money value of the sale and purchase of second-hand goods is not included in the estimation of GDP through the value-added method. As the value of second-hand goods was already added when they were first produced during the year.

2. Include the value of own account production in the total output:-

Own account production means output produced by the producer for its own use (consumption) and investment. Such output is also taken into account while calculating income through the value-added method. The reason behind this is, as they have a price in the market. Because these goods are like those produced for the market. This output is not sold as owing to their need by producers themselves.

For example:- wheat produced by farmers and used for his own consumption, the car produced by the car manufacturer and used in its own factory, milk produced by the milkman and consumed by his family, etc.

3. Imputed rent of owner-occupied houses:-

People who stay in their own houses, do not pay any rent. But they enjoy all services of the house. If they were to pay rent it would be from their own income. Hence, the value of the market rent of such a house is included in estimating national income.

For Example:-

A person earns ₹ 10,000 and lives in his own house which market rent value is ₹ 5000. In this case his income would be ₹ 10,000 + ₹ 5,000 = ₹ 15,000

4. Value of Intermediate Goods:-

As the value of intermediate goods is already included in final goods. It is not taken into accounts in estimating national income. it will lead to double counting.

5. Production of Services for self-consumption:-

The value of services for self-consumption is not taken into account. As the estimation of the market value of such services is not possible due to a lack of data.

These services involve love, affection, and other emotional feelings. Hence actual market value estimation is not possible.

6. Commission earned on the sale of second-hand goods:-

If we add value whether in second-hand goods. Such value is included in national income. the broker provides his services for both buyer and seller. Hence commission earned is a value addition in the economy. It must be included in estimating national income.

7. Change in the stock of Goods will be included:-

Change in stock is the balance of closing stock – opening stock. It is the value of output produced in the economic territory of a country hence included in national income.

Few Questions and Answers of Value Added Method to calculate National Income

Further Reading:-

| S.N | Topics |

| 1. | What is GDP Deflator |

| 2. | What are externalities in economics |

| 3. | Limitations of GDP as a measure of welfare |

| S.N | Topics |

| 1. | 150+ Numerical of Value Added Method |

| 2. | 150+ Numerical of Income Method |

| 3. | 150+ Numerical of Expenditure Method |

| 4. | 150+ Numerical of National Income and related aggregates |

| S.N | Topics |

| 1. | 250+ MCQs of National Income |