50 Important Numerical of Income Method (National Income) with solutions class 12 CBSE Board

Hey, are you looking for the Important Numerical of Income method to calculate National Income with solutions as per the syllabus of Macroeconomics (Economics) class 12 CBSE Board?

I have made collection of all very very important practical numerical of Income method to calculate domestic and National income. All pervious year board questions of income method are also included in this collection.

Must do Numerical of Income method of National Income with solutions class 12 CBSE Board

If you want to have a full proof command over the Income Method. You must solve the following Numerical.

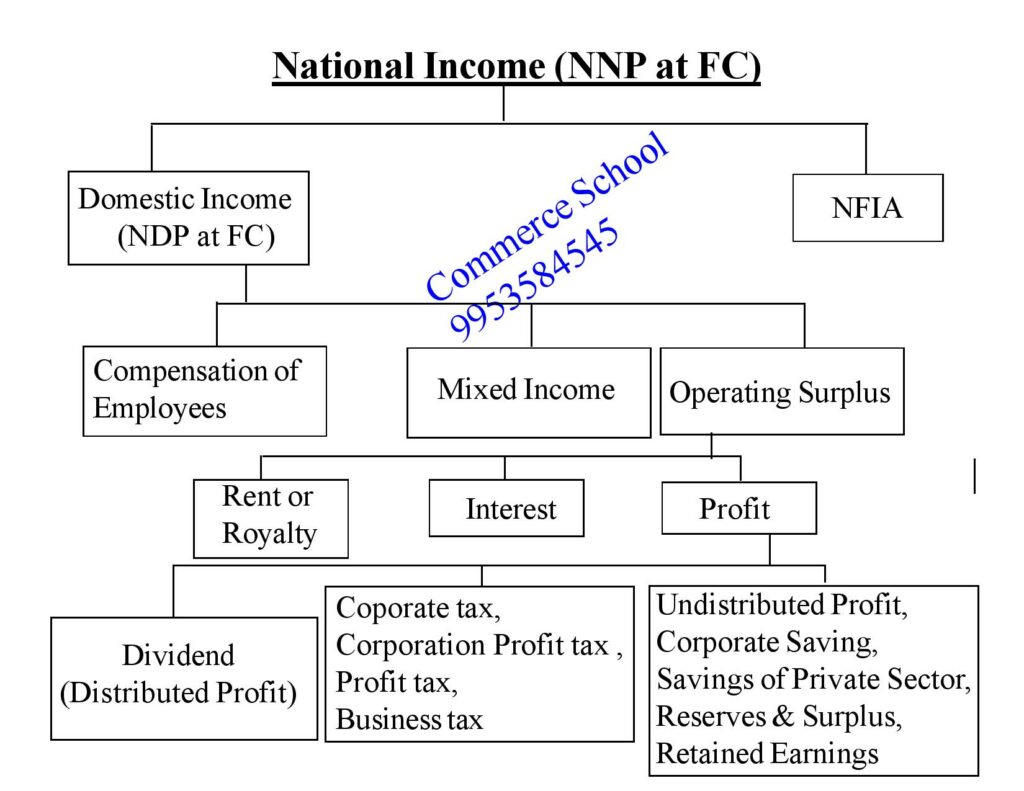

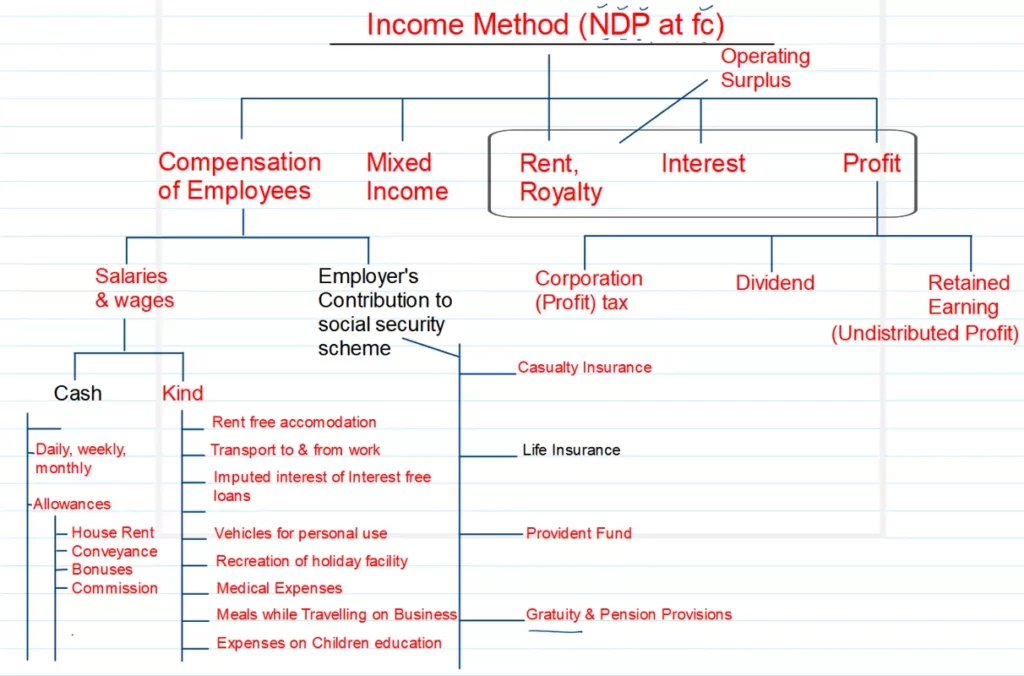

Formula of Income Method to calculate National Income

Before we start to solve, first have a look the formula of income method.

Second Chart:-

For better understanding of Income Method formula read my below lecture

Detail analysis of Income Method to calculate National income, formula, definition, examples

Lets solve some important numericals.

1 Calculate a) Operating Surplus, and b) Domestic Income;

| Items | ₹ in Crore |

| i) Compensation of Employees | 2,000 |

| ii) Rent and interest | 800 |

| iii) Indirect Taxes | 120 |

| iv) Corporation tax | 460 |

| v) Consumption of fixed capital | 100 |

| vi) Subsidies | 20 |

| vii) Dividend | 940 |

| viii) Undistributed Profits | 300 |

| ix) Net Factor Income to abraod | 150 |

| c) Mixed Income | 200 |

[CBSE – 2018]

Solution:-

Profit = Dividend + Corporation tax + Undistributed Profits

Profit = vii + iv + viii = ₹940 + ₹460 + ₹300 = ₹1700

Operating Surplus = Rent (Royalty) + Interest + Profit

a) Operating Surplus = ₹800 + ₹1700 = ₹2500

b) Domestic Income = NDP at FC = Compensation of Employees + Mixed Income + Operating Surplus

Domestic Income = ₹2000 + ₹200 + ₹2500 = ₹4700

2. Calculate National Income

| Items | (₹ in crore) |

| i) Compensation of employees | 2,000 |

| ii) Profit | 800 |

| iii) Rent | 300 |

| iv) Interest | 250 |

| v) Mixed income of self employed | 7000 |

| vi) Net current transfers to abroad | 200 |

| vii) Net Exports | – 100 |

| viii) Net indirect taxes | 1,500 |

| ix) Net Factor income to abroad | 60 |

| x) Consumption of fixed capital | 120 |

[CBSE Foreign – 2017]

Solution:-

NDP at FC = Compensation of Employees + Mixed Income + Rent (Royalty) + Interest + Profit

NDP at FC = ₹2000 + ₹7000 + ₹300 + ₹250 + ₹800 = ₹10350

NNP at FC = NDP at FC + NFIA (factor income from abraod – factor income to abroad)

NNP at FC = 10350 + (0 – 60) = 10350 – 60 = ₹10290

3. Calculate Net National Product at Market Price:

| Items | (₹ in thousand crore) |

| 1. Compensation of Employees | 250 |

| 2. Mixed income of self employed | 600 |

| 3. Profit | 80 |

| 4. Rent | 30 |

| 5. Interest | 40 |

| 6. Net factor income to abroad | – 10 |

| 7. Net exports | 15 |

| 8. Consumption of fixed Capital | 20 |

| 9. Net indirect taxes | 10 |

| 10. Net current transfers to abroad | 8 |

Solution:-

Domestic Income (NDP at FC) = Compensation of Employees + Mixed Income + Rent(royalty) + Interest + Profit

NDP at FC = 250 + 600 + 30 + 40 + 80 = ₹1000

National Income (NNP at FC) = NDP at FC + NFIA (factor income from abroad – factor income to abroad)

NNP at FC = ₹1000 + [ – (-10)] = 1000 + 10 = ₹1010

NNP at MP = NNP at FC + Net Indirect taxes (Indirect taxes – Subsidy)

NNP at MP = 1010 + 10 = ₹1020

4. Calculate National Income:

| Items | (₹ in crore) |

| 1. Profit | 1,000 |

| 2. Mixed Income of self employed | 15,000 |

| 3. Dividends | 200 |

| 4. Interest | 400 |

| 5. Compensation of employees | 7,000 |

| 6. Net factor income to abroad | 100 |

| 7. consumption of fixed capital | 400 |

| 8. Net exports | – 200 |

| 9. Net Indirect taxes | 800 |

| 10. Net Current transfers to rest of the world | 40 |

| 11. Rent | 500 |

[CBSE Foreign – 2017]

Solution:-

Domestic Income = Compensations of Employees + Mixed Income + Rent (royalty) + Interest + Profit

Domestic Income = 7,000 + 15,000 + 500 + 400 + 1,000 = ₹23900

NNP at FC = Domestic Income + NFIA

NNP at FC = 23900 – 100 = ₹23800

Further Resources:-

Read Here:- 50+ Important Numerical of Value Added Method (Must Do)

Read Here:- 50+ Important Numerical of Expenditure Method (Must Do)

5. Calculate the Gross National Product at Market Price:

| Items | (₹ in crore) |

| 1. Compensation of employees | 2500 |

| 2. Profit | 700 |

| 3. Mixed income of self employed | 7500 |

| 4. Government final consumption expenditure | 3000 |

| 5. Rent | 400 |

| 6. Interest | 350 |

| 7. Net factor income from abroad | 50 |

| 8. Net current transfers to abroad | 100 |

| 9. Net indirect taxes | 150 |

| 10. Depreciation | 70 |

| 11. Net exports | 40 |

Solution:-

Domestic Income = Compensations of Employees + Mixed Income + Rent (royalty) + Interest + Profit

Domestic Income = 2500 + 7500 + 400 + 350 + 700 = ₹11450

NNP at FC = Domestic Income + NFIA

NNP at FC = 11450 + 50 = ₹11500

GNP at MP = NNP at FC + consumption of fixed capital + Net Indirect taxes

GNP at MP = 11500 + 70 + 150 = ₹11720 crore

6. Calculate the Net National Product at Market Price

| Items | (₹ in Crore) |

| 1. Mixed income of self Employed | 8000 |

| 2. Depreciation | 200 |

| 3. Profit | 1000 |

| 4. Rent | 600 |

| 5. Interest | 700 |

| 6. Compensation of employees | 3000 |

| 7. Net indirect taxes | 500 |

| 8. Net factor income to abroad | 60 |

| 9. Net exports | (-) 50 |

| 10. Net current transfers to abroad | 20 |

Domestic Income (NDP at FC) = Compensations of Employees + Mixed Income + Rent (royalty) + Interest + Profit

Domestic Income = 3000 + 8000 + 600 + 700 + 1000 = ₹13300

NNP at FC = Domestic Income + NFIA

NNP at FC = 13300 – 60 = ₹13240

NNP at MP = NNP at FC + Net Indirect Taxes

NNP at MP = 13240 + 500 = ₹13740 crore

7. Calculate National Income:-

| 1. Compensation of employees | 2000 |

| 2. Rent | 400 |

| 3. Profit | 900 |

| 4. Dividend | 100 |

| 5. Interest | 500 |

| 6. Mixed income of self employed | 7000 |

| 7. Net factor income to abroad | 50 |

| 8. Net exports | 60 |

| 9. Net indirect taxes | 300 |

| 10. Depreciation | 150 |

| 11. Net current transfers to abroad | 30 |

[CBSE (AI) 2017]

Solution:-

National Income = NNP at FC

Domestic Income (NDP at FC) = Compensation of Employees + Mixed Income of self employed + Rent + Interest + Profit

NDP at FC = 2000 + 7000 + 400 + 500 + 900

NDP at FC = ₹ 10800

NNP at FC = NDP at FC – Net factor income to abroad

NNP at FC = 10800 – 50

NNP at FC = ₹10750

8. Find Net National Product at Market Price:

| Items | (₹ in crore) |

| 1. Personal taxes | 200 |

| 2. Wage and Salaries | 1200 |

| 3. Undistributed Profit | 50 |

| 4. Rent | 300 |

| 5. Corporation tax | 200 |

| 6. Private Income | 2000 |

| 7. Interest | 400 |

| 8. Net Indirect tax | 300 |

| 9. Net factor income to abroad | 20 |

| 10. Profit | 500 |

| 11. Social Security contributions by employers | 250 |

[CBSE Delhi 2016]

Solution:-

Compensation of Employees = Wages and salaries + Social Security contributions by employers

Compensation of Employees = 1200 + 250 = 1450

NDP at FC = Compensation of Employees + Mixed Income + Rent + Interest + Profit

NDP at FC = 1450 + 0 + 300 + 400 + 500

NDP at FC = ₹ 2650

NNP at MP = NDP at FC – Net Factor income to abroad + Net Indirect tax

NNP at MP = 2650 – 20 + 300

NNP at MP = ₹2930 crore

9. Find Net Domestic Product at Factor cost:

| Items | (₹ in crore) |

| 1. Rent | 200 |

| 2. Net Current transfers to abroad | 10 |

| 3. National debt interest | 60 |

| 4. Corporate tax | 100 |

| 5. Compensation of employees | 900 |

| 6. Current transfers to government | 150 |

| 7. Interest | 400 |

| 8. Undistributed Profits | 50 |

| 9. Dividend | 250 |

| 10. Net Factor income to abroad | – 10 |

| 11. Income accruing to government | 120 |

[CBSE DELHI 2016]

Solution

NDP at FC = Compensation of Employees + Mixed Income + Rent + Interest + Profit (Corporate tax + Dividend + Undistributed profits)

NDP at FC = 900 + 0 + 200 + 400 + (100 + 250 + 50)

NDP at FC = ₹ 1900 crore

10. Find National Income:-

| Items | (₹ in crore) |

| 1. Wages and Salaries | 1000 |

| 2. Net Current transfers to abroad | 20 |

| 3. Net Factor income paid to abroad | 10 |

| 4. Profit | 400 |

| 5. National debt interest | 120 |

| 6. Social security contributions by employers | 100 |

| 7. Current transfers from government | 60 |

| 8. National income accruing to government | 150 |

| 9. Rent | 200 |

| 10. Interest | 300 |

| 11. Royalty | 50 |

[CBSE DELHI 2016]

Solution:-

Compensation of Employee = Wages and Salaries + Social Security Contributions by employers

COE = 1000 + 100 = 1100

NDP at FC = COE + Mixed Income + Rent + Royalty + Interest + Profit

NDP at FC = 1100 + 0 + 200 + 50 + 300 + 400

NDP at FC = 2050

National Income (NNP at FC) = NDP at FC – Net Factor income paid to abroad

National Income = 2050 – 10

National Income = ₹ 2040

Read Here:- 50 Important Numerical of Expenditure Method of National Income Class 12

Read Here:- 50 Important Numerical of Value Added Method of National Income Class 12

11. Calculate Net National Product at Market Price:-

| Items | (₹ in crore) |

| 1. Net Factor Income to abroad | – 10 |

| 2. Net current transfers to abroad | 5 |

| 3. Consumption of fixed capital | 40 |

| 4. Compensation of employees | 700 |

| 5. Corporate tax | 30 |

| 6. Undistributed Profits | 10 |

| 7. Interest | 90 |

| 8. Rent | 100 |

| 9. Dividends | 20 |

| 10. Net Indirect tax | 110 |

| 11. Social security contributions by employees | 11 |

[CBSE (F) 2015]

Solution:-

NDP at FC = Compensation of employees + Mixed Income + Rent + Interest + Profit ( Corporate tax + Dividend + Undistributed profits)

NDP at FC = 700 + 0 + 100 + 90 + (30 + 20 + 10)

NDP at FC = 950

NNP at MP = NDP at FC – net factor income to abroad + Net Indirect tax

NNP at MP = 950 – (- 10 ) + 110

NNP at MP = ₹ 1070

12. Calculate the Gross National Product at Market Price:

| Items | (₹ in crore) |

| 1. Wages and Salaries | 800 |

| 2. Personal tax | 150 |

| 3. Operating Surplus | 200 |

| 4. Undistributed Profits | 10 |

| 5. Social Security contributions by employers | 100 |

| 6. Corporate tax | 50 |

| 7. Net factor income to abroad | – 20 |

| 8. Personal disposable income | 1200 |

| 9. Net indirect tax | 70 |

| 10. Consumption of fixed capital | 30 |

| 11. Mixed income of self employed | 500 |

| 12. Royalty | 9 |

[CBSE F 2015]

Solution

Compensation of Employees = Wages and Salaries + Social Security Contributions by Employers

COE = 800 + 100 = 900

NDP at FC = Compensation of Employees + Mixed Income + Operating Surplus

NDP at FC = 900 + 500 + 200

NDP at FC = ₹ 1600

GNP at MP = NDP at FC + Consumption of fixed capital – Net Factor income to abroad + Net indirect tax

GNP at MP = 1600 + 30 – (- 20) + 70

GNP at MP = ₹ 1720

13. Calculate National Income

| Items | (₹ in crore) |

| 1. Rent | 200 |

| 2. Net Factor income to abroad | 10 |

| 3. National debt interest | 15 |

| 4. Wages and Salaries | 700 |

| 5. Current transfers from government | 10 |

| 6. Undistributed profits | 20 |

| 7. Corporation tax | 30 |

| 8. Interest | 150 |

| 9. Social Security Contributions by employers | 100 |

| 10. Net domestic product accruing to government | 250 |

| 11. Net Current transfers to rest of the world | 5 |

| 12. Dividend | 50 |

[CBSE AI 2015]

Solution

Compensation of Employees (COE) = Wages and Salaries + Social Security Contributions of employers

COE = 700 + 100 = 800

Profit = Corporate tax + Dividend + Undistributed Profits

Profit = 30 + 50 + 20 = 100

NDP at FC = COE + Mixed Income + Rent + Interest + Profit

NDP at FC = 800 + 0 + 200 + 150 + 100

NDP at FC = 1250

NNP at FC = NDP at FC – Net Factor Income to abroad

NNP at FC = 1250 – 10

NNP at FC = ₹ 1240 crore

14. Calculate ‘Gross National Product at Market Price.

| Items | (₹ in crore) |

| 1. Rent | 100 |

| 2. Net Current transfers to rest of the world | 30 |

| 3. Social Security contributions by employers | 47 |

| 4. Mixed Income | 600 |

| 5. Gross Domestic Capital Formation | 140 |

| 6. Royalty | 20 |

| 7. Interest | 110 |

| 8. Compensation of Employees | 500 |

| 9. Net Domestic Capital Formation | 120 |

| 10. Net Factor income from abroad | – 10 |

| 11. Net Indirect tax | 150 |

| 12. profit | 200 |

[CBSE DELHI 2015]

Solution

NDP at FC = Compensation of Employees + Mixed Income + Rent + Royalty + Interest + Profit

NDP at FC = 500 + 600 + 100 + 20 + 110 + 200

NDP at FC = 1530

GNP at MP = NDP at FC + Depreciation (Gross Domestic Capital Formation – Net Domestic Capital Formation) + Net Factor income from abroad + Net Indirect tax

GNP at MP = 1530 + (140 – 120) + ( – 10 ) + 150

GNP at MP = ₹ 1690 crore

15. Calculate Net Domestic Product at Market Price from the following.

| Items | (₹ in crore) |

| 1. Income from domestic product accruing to government | 120 |

| 2. Wages and Salaries | 400 |

| 3. National Debt Interest | 60 |

| 4. Profit | 200 |

| 5. Net Factor income to abroad | – 20 |

| 6. Rent | 100 |

| 7. Current transfers from government | 30 |

| 8. Interest | 150 |

| 9. Social Security contribution by employers | 50 |

| 10. Net indirect tax | 70 |

| 11. Net current transfers to abroad | – 10 |

[CBSE F 2014]

Solution

NDP at FC = COE (Wages & Salaries + Social Security contribution of employers) + Mixed Income + Rent + Interest + Profit

NDP at FC = ( 400 + 50 ) + 0 + 100 + 150 + 200

NDP at FC = 900

NDP at MP = NDP at FC + Net Indirect tax

NDP at MP = 900 + 70

NDP at MP = ₹ 970 crore

16. Calculate ‘Gross National Product at Market Price’ from the following.

| Items | (₹ in crore) |

| 1. Net factor income to abroad | – 10 |

| 2. Net current transfers to abroad | 20 |

| 3. Wages and Salaries | 400 |

| 4. Corporation tax | 50 |

| 5. Profit after corporation tax | 150 |

| 6. Social Security contributions by employers | 50 |

| 7. Rent | 100 |

| 8. Interset | 70 |

| 9. Mixed income of self employed | 300 |

| 10. Net Indirect tax | 140 |

| 11. Consumption of fixed capital | 80 |

[CBSE F 2014]

Solution:-

NDP at FC = COE (Wages & Salaries + Social Security contribution of employers) + Mixed Income + Rent + Interest + Profit (Corporation tax + profit after corporation tax)

NDP at FC = (400 + 50) + 300 + 100 + 70 + (50 + 150)

NDP at FC = 1120

GNP at MP = NDP at FC + Consumption of fixed capital – Net factor income to abroad + Net Indirect tax

GNP at MP = 1120 + 80 – (- 10) + 140

GNP at MP = ₹ 1350 crore

Read Here:- List of lectures of National Income and Related Aggregates chapter

17. Calculate ‘Net National Product at Factor Cost from the following:-

| Items | (₹ in crore) |

| 1. Social Security contributions by employees | 90 |

| 2. Wages and Salaries | 800 |

| 3. Net Current transfers to abraod | – 30 |

| 4. Rent and Royalty | 300 |

| 5. net factor income to abraod | 50 |

| 6. Social security contributions by employers | 100 |

| 7. Profit | 500 |

| 8. Interest | 400 |

| 9. Consumption of fixed capital | 200 |

| 10. Net indirect tax | 250 |

[CBSE AI 2014]

Solution:-

NDP at FC = COE (Wages & Salaries + Social Security contribution of employers) + Mixed Income + Rent and Royalty + Interest + Profit

NDP at FC = 800 + 100 + 0 + 300 + 400 + 500

NDP at FC = 2100

NNP at FC = NDP at FC – Net factor income to abraod

NNP at FC = 2100 – 50

NNP at FC = ₹ 2050 crore

18. Calculate ‘Net National Product at Factor Cost from the following:-

| Items | (₹ in crore) |

| 1. National debt interest | 60 |

| 2. Wages and salaries | 600 |

| 3. Net current transfers to abroad | 20 |

| 4. Rent | 200 |

| 5. Transfer payments by government | 70 |

| 6. Interest | 300 |

| 7. Net domestic product at factor cost accruing to government | 400 |

| 8. Social security contributions by employers | 100 |

| 9. Net factor income paid to abroad | 50 |

| 10. Profits | 300 |

[CBSE DELHI 2014]

Solutions:-

NDP at FC = COE (Wages & Salaries + Social Security contribution of employers) + Mixed Income + Rent + Interest + Profit

NDP at FC = (600 + 100) + 0 + 200 + 300 + 300

NDP at FC = 1500

NNP at FC = NDP at FC – Net factor income paid to abroad

NNP at FC = 1500 – 50

NNP at FC = ₹ 1450 crore

19. From the following data, calculate National Income:-

| Items | (₹ in crore) |

| 1. Profit | 1500 |

| 2. Rent | 1300 |

| 3. Net Indirect taxes | 350 |

| 4. Mixed income of self employed | 600 |

| 5. Compensation of employees | 3000 |

| 6. Reimbursement to the employees for medical expenses | 300 |

| 7. Depreciation | 200 |

| 8. Excess of factor income to rest of the world over factor income from rest of the world | 50 |

| 9. Excess of imports over exports | 40 |

| 10. Interest | 1100 |

Solution:-

NDP at FC = Compensation of Employees + Mixed Income + Rent + Interest + Profit

NDP at FC = 3000 + 600 + 1300 + 1100 + 1500

NDP at FC = 7500

NNP at FC = NDP at FC + NFIA

NNP at FC = 7500 + ( – 50)

NNP at FC = ₹ 7450 crore

20. Calculate Operating Surplus from the following data:-

| Items | (₹ in crore) |

| 1. Compensation of employees | 300 |

| 2. Indirect taxes | 200 |

| 3. Consumption of fixed Capital | 100 |

| 4. Subsidies | 50 |

| 5. Gross Domestic Product at market price | 600 |

Solution:-

NDP at FC = GDP at MP – consumption of fixed capital – (indirect taxes – subsidies)

NDP at FC = 600 – 100 – (200 – 50)

NDP at FC = 350

NDP at FC = Compensation of employees + Mixed Income + Operating Suplus

350 = 300 + 0 + Operating Surplus

Operating surplus = ₹ 50 crore

21. The following information is available for an economy, On the basis of this information using income method, calculate: a) Domestic Income, and b) National Income

| Items | (₹ in crore) |

| 1. Wages | 10,000 |

| 2. Rent | 5,000 |

| 3. Interest | 400 |

| 4. Dividend | 3,000 |

| 5. Mixed Income | 400 |

| 6. Undistributed profit | 200 |

| 7. Social Security Contribution | 400 |

| 8. Corporate profit tax | 400 |

| 9. Net factor income from abroad | 1000 |

Solution:-

Domestic Income (NDP at FC) = Wages + Social Security Contribution + Mixed Income + Rent + Interest + Corporate Profit tax + Dividend + Undistributed profit

Domestic Income = 10000 + 400 + 400 + 5000 + 400 + 400 + 3000 + 200

Domestic Income = ₹ 19800 crore

National Income = NDP at FC + net factor income from abroad

National Income (NNP at FC) = 19800 + 1000

National Income = ₹ 20800 crore

22. Given the following data and using income method calculate:-

a) Net Domestic Income

b) Gross Domestic Income

c) Net National Income

d) Net National Product at Market Price

| Items | (₹ in crore) |

| 1. Indirect taxes | 9000 |

| 2. Subsidies | 1800 |

| 3. Depreciation | 1700 |

| 4. Mixed Income of self employed | 28000 |

| 5. Operating surplus | 10000 |

| 6. Net factor income from abroad | – 300 |

| 7. Compensation of employees | 24000 |

Solution:-

Net Domestic Income (NDP at FC) = Compensation of employees + Mixed income of self employed + Operating Surplus

Net Domestic Income = 24000 + 28000 + 10000

Net Domestic Income = ₹ 62000 crore

Gross Domestic Income (GDP at FC) = NDP at FC + Depreciation

Gross Domestic Income = 62000 + 1700

Gross Domestic Income = ₹ 63700 crore

Net National Income (NNP at FC) = NDP at FC + Net Factor income from abroad

Net National Income = 62000 – 300

Net National Income = ₹ 61700 crore

Net National Product at Market Price (NNP at MP) = NNP at FC + Indirect taxes – subsidies

Net National Product at Market Price = 61700 + 9000 – 1800

Net National Product at Market Price = ₹ 68900 crore

23. Calculate the national income from the following data:-

| Items | (₹ in crore) |

| 1. Mixed income of self employed | 200 |

| 2. Old age pension | 20 |

| 3. Dividends | 100 |

| 4. Operating surplus | 900 |

| 5. Wages and Salaries | 500 |

| 6. Profits | 400 |

| 7. Employer’s contribution to social security schemes | 50 |

| 8. Net factor income from abroad | – 10 |

| 9. Consumption of fixed capital | 50 |

| 10. Net indirect tax | 50 |

Solution:-

Compensation of Employee = Wages and Salaries + Employer’s contribution to social security schemes

Compensation of Employee = 500 + 500 = 550

Net Domestic Income (NDP at FC) = Compensation of Employee + Mixed Income + Operating surplus

NDP at FC = 550 + 200 + 900

NDP at FC = ₹ 1650

National Income (NNP at FC) = NDP at FC + Net factor income from abroad

National Income = 1650 – 10

National Income = ₹ 1640 crore

24. Calculate National Income from the following data:-

| Items | (₹ in crore) |

| 1. Rent | 80 |

| 2. Interest | 100 |

| 3. Profits | 210 |

| 4. Tax on Profits | 30 |

| 5. Employee’s contribution to social security schemes | 25 |

| 6. Mixed income of self employed | 250 |

| 7. Net indirect tax | 60 |

| 8. Employer’s contributions to social security schemes | 50 |

| 9. Compensation of employees | 500 |

| 10. Net factor income from abroad | – 20 |

Solution:-

Domestic Income (NDP at FC) = Compensation of Employees + Mixed income of self employed + Rent + Interest + Profits

NDP at FC = 500 + 250 + 80 + 100 + 210

NDP at FC = ₹ 1140

National Income (NNP at FC) = NDP at FC + Net factor income from abroad

National Income = 1140 – 20

National Income = ₹ 1120 crore

25. Calculate National Income from the following data:-

| Items | (₹ in crore) |

| 1. Compensation of employees | 400 |

| 2. Profits | 200 |

| 3. Rent | 150 |

| 4. Interest | 100 |

| 5. Dividends | 120 |

| 6. Employer’s contributions to social security schemes | 40 |

| 7. Mixed income of self employed | 500 |

| 8. Direct tax | 100 |

| 9. Net factor income from abroad | – 50 |

Solution:-

NDP at FC = Compensation of employees + Mixed income of self employed + Rent + Interest + Profits

NDP at FC = 400 + 500 + 150 + 100 + 200

NDP at FC = 1350

National Income (NNP at FC) = NDP at FC + Net factor income from abroad

National Income = 1350 – 50

National Income = ₹ 1300 crore

26. From the following data, calculate Gross National Product at Market prices:-

| Items | (₹ in crore) |

| 1. Undistributed profits of private corporate enterprises | 200 |

| 2. Rent | 400 |

| 3. Interest | 200 |

| 4. Profits | 600 |

| 5. Dividends | 300 |

| 6. Wages and Salaries | 225 |

| 7. Net exports | – 20 |

| 8. Net indirect tax | 70 |

| 9. Consumption of fixed capital | 30 |

| 10. Compensation of employees | 250 |

| 11. Mixed income of self employed | 100 |

| 12. Net factor income from abroad | – 10 |

Solution:-

Domestic Income (NDP at FC) = Compensation of employees + Mixed income of self employed + Rent + Interest + Profits

NDP at FC = 250 + 100 + 400 + 200 + 600

NDP at FC = ₹ 1550

Gross National Product at Market Price (GNP at MP) = NDP at FC + consumption of fixed capital + Net factor income from abroad + Net indirect tax

GNP at MP = 1550 + 30 – 10 + 70

GNP at MP = ₹ 1640 crore

27. Calculate national income from the following data:

| Items | (₹ in crore) |

| 1. Interest | 50 |

| 2. Corporate tax | 10 |

| 3. Net indirect tax | 40 |

| 4. Rent | 20 |

| 5. Dividends paid | 30 |

| 6. Compensation of employees | 200 |

| 7. Consumption of fixed capital | 15 |

| 8. Undistributed profits | 5 |

| 9. Net factor income received from abroad | – 5 |

| 10. Royalty | 10 |

Solution:-

Profits = Corporate tax + Dividends paid + Undistributed profits

Profits = 10 + 30 + 5

Profits = 45

NDP at FC = Compensation of employees + Mixed Income + Rent + Royalty + Interest + Profits

NDP at FC = 200 + 0 + 20 + 10 + 50 + 45

NDP at FC = 325

NNP at FC = NDP at FC + Net factor income received from abroad

NNP at FC = 325 – 5

NNP at FC = ₹ 320

28. Calculate GDP at MP and GNP at FC from the following data:-

| Items | (₹ in crore) |

| 1. Operating Surplus | 700 |

| 2. Profit | 100 |

| 3. Wages and Salaries (cash) | 1000 |

| 4. Interest | 200 |

| 5. Consumption of fixed capital | 50 |

| 6. Net factor income from abroad | – 10 |

| 7. Value of benefits in kind provided to employees | 200 |

| 8. Goods and service tax | 150 |

| 9. Subsidies | 10 |

Solution:-

Compensation of employees = Wages and Salaries + value of benefits in kind provided to employees

Compensation of employees = 1000 + 200 = 1200

NDP at FC = Compensation of employees + Mixed Income + Operating Surplus

NDP at FC = 1200 + 0 + 700

NDP at FC = 1900

GDP at MP = NDP at FC + consumption of fixed capital + goods and service tax – subsidies

GDP at MP = 1900 + 50 + 150 – 10

GDP at MP = ₹ 2090 crore

GNP at FC = NDP at FC + consumption of fixed capital + Net factor income from abroad

GNP at FC = 1900 + 50 – 10

GNP at FC = ₹ 1940 crore

29. Calculate GNP at MP:-

| Items | (₹ in crore) |

| 1. Mixed income of the self employed | 800 |

| 2. Consumption of fixed capital | 50 |

| 3. Wage and salaries | 700 |

| 4. Compensation of employees from abroad | 20 |

| 5. Rent on land | 200 |

| 6. Royalty of sub soil assets | 30 |

| 7. Interest paid by production units | 150 |

| 8. Interest paid by consumers | 100 |

| 9. Profits | 300 |

| 10. Social security contribution by employers | 100 |

| 11. Property and entrepreneurial income from abroad | – 20 |

| 12. Net indirect tax | 200 |

Solution:-

Compensation of Employees (COE):- Wages and Salaries + Employers contribution to social security schemes

COE = 700 + 100 = ₹ 800

NDP at FC = COE + Mixed Income + Rent + Royalty + Interest + Profits

NDP at FC = 800 + 800 + 200 + 30 + 150 + 300

NDP at FC = ₹ 2280

NFIA = compensation of employees from abroad + Property and entrepreneurial income from abroad

NFIA = 20 – 20 = ₹ 0

GNP at MP = NDP at FC + consumption of fixed capital + NFIA + Net indirect tax

GNP at MP = 2280 + 50 + 0 + 200

GNP at MP = ₹ 2530

Note:- Interest paid by consumers is not included in income as it does not lead to value addition.

30. Calculate GDP at MP

| Items | (₹ in crore) |

| 1. Dividend paid | 20 |

| 2. Depreciation | 25 |

| 3. Rent | 75 |

| 4. Interest | 125 |

| 5. Undistributed profits | 50 |

| 6. Subsidies | 10 |

| 7. Goods and services tax (GST) | 40 |

| 8. Corporation tax | 30 |

| 9. Mixed Income | 500 |

| 10. Net factor income from abroad | – 20 |

| 11. Compensation of employees | 300 |

Solution:-

Profits = corporation tax + Dividend Paid + Undistributed profits

Profits = 30 + 20 + 50 = ₹ 100

NDP at FC = compensation of employees + Mixed Income + Rent + Interest + Profits

NDP at FC = 300 + 500 + 75 + 125 + 100

NDP at FC = ₹ 1100

GDP at MP = NDP at FC + Depreciation + Net Indirect tax (Goods and services tax – subsidies)

GDP at MP = 1100 + 25 + (40 – 10)

GDP at MP = ₹ 1155 crore

31. Calculate Operating Surplus

| Items | (₹ in crore) |

| 1. GNP at market price | 1000 |

| 2. Wages and Salaries | 400 |

| 3. Consumption of fixed capital | 50 |

| 4. Net factor income to abroad | – 10 |

| 5. GST | 100 |

| 6. Social security contributions by employees | 60 |

| 7. Subsidies | 20 |

| 8. Mixed income of the self employed | 200 |

| 9. Interest | 40 |

| 10. Social security contribution by employers | 100 |

Solution:-

NDP at FC = GNP at MP – consumption of fixed capital + Net factor income to abroad – Indirect tax (GST – Subsidies)

NDP at FC = 1000 – 50 – 10 – (100 – 20)

NDP at FC = ₹ 860

Compensation of employee = Wages and Salaries + Social security contribution of employers

Compensation of employee = 400 + 100

Compensation of employee = 500

NDP at FC = compensation of employees + Mixed Income + Operating Surplus

910 = 500 + 200 + Operating Surplus

Operating Surplus = 860 – 700

Operating Surplus = ₹ 160 crore

Further Reading

| S.N | Topics |

| 1. | What is GDP Deflator |

| 2. | What are externalities in economics |

| 3. | Limitations of GDP as a measure of welfare |

| S.N | Topics |

| 1. | 150+ Numerical of Value Added Method |

| 2. | 150+ Numerical of Income Method |

| 3. | 150+ Numerical of Expenditure Method |

| 4. | 150+ Numerical of National Income and related aggregates |

| S.N | Topics |

| 1. | 250+ MCQs of National Income |

Good.. Its useful for Economics teachers and students.. Hats off to the team members..