Income Method Class 12 Economics, formula, definition, notes, pdf

Are you looking for the formulas and steps of Income method to calculate national income as per the syllabus of Macroeconomics class 12 CBSE Board.

See, In Economics, a country’s national income is calculated by three different method. Product (value added) method, Income Method and Expenditure Method.

Here in this lecture we will discuss, How to calculate National income by Income Method formula. Here our discussion would strictly be restricted to the syllabus of 12 Economics CBSE Board.

We also have discussed Value added Method in detail here is the below link

Read Here:- How to Calculate National Income by Value Added Method

What is Income Method of calculating National Income?

As we studied earlier, Income moves in a circle, first, it is generated in Production units then it is distributed among factor owners as factor payments for offering factor services. Then it is disposed of by the factor owner in purchasing goods and services produced by production units.

Read Here:- What is Circular Flow of Income in Macroeconomics

The income again return back to production units. seeing the demand of goods, production units again hire the factor owners for producing the goods, and income circle again goes on.

Thats why it is said Income generated in all three phases are equal.

When income is generated in the production unit. It is calculated through value added method.

When it is distributed among factor owners as factor payments, It is calculated by Income Method. Thats what we are going to discuss here.

Definition of Income Method

According to this method, all the incomes that accrue to the factors of production by way of wages, profits, rent, interest, etc. are summed up to obtain the national income.

Book, Sandeep Garg

What are the other name of Income Method?

Income method is also known as

- Distributed Share Method

- Factor Payment Method

Few Concepts of National Income Method

Lets understand each terms of income method definition one by one.

What are factor owners?

Households are considered as the factor owners of factors of production.

What are factor of production?

There are 4 types of factor of production.

- Land

- Labour

- Capital

- Entrepreneur

What are Factor Incomes?

When these factor owners provide their factor services in production units, they receive factor income as a reward.

- Land receives rent as a factor income

- Labour receives wages/salaries as a factor income

- Capital receives interest as a factor income

- Entrepreneur receives profit as a factor income

Components of National Income Method

As production units only pay for value addition to the factor owners. The sum total of all factor income provided within the domestic territory of a country is called as net domestic product at factor cost (NDP at FC).

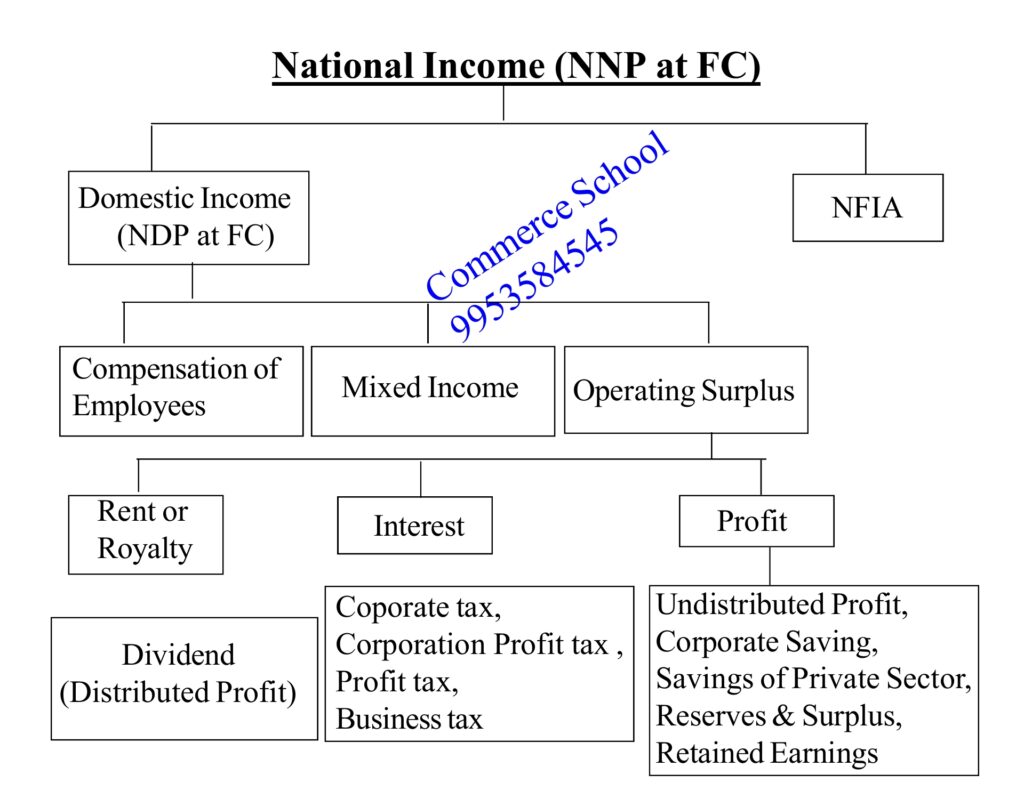

NDP at FC = Compensation of Employees + Operating Surplus + Mixed Income

Operating Surplus = Rent or Royalty + Interest + Profit

NDP at FC = sum total of all factor payments = Compensation of Employees for labour + Rent to Land owner + Interest for capital + Profit for Entrepreneur

NNP at FC = NDP at FC + NFIA (factor income from abroad – factor income to abroad)

Factor incomes can be divided broadly into three section.

- Compensation of Employees

- Operating Surplus

- Mixed Income

Lets understand each components one by one.

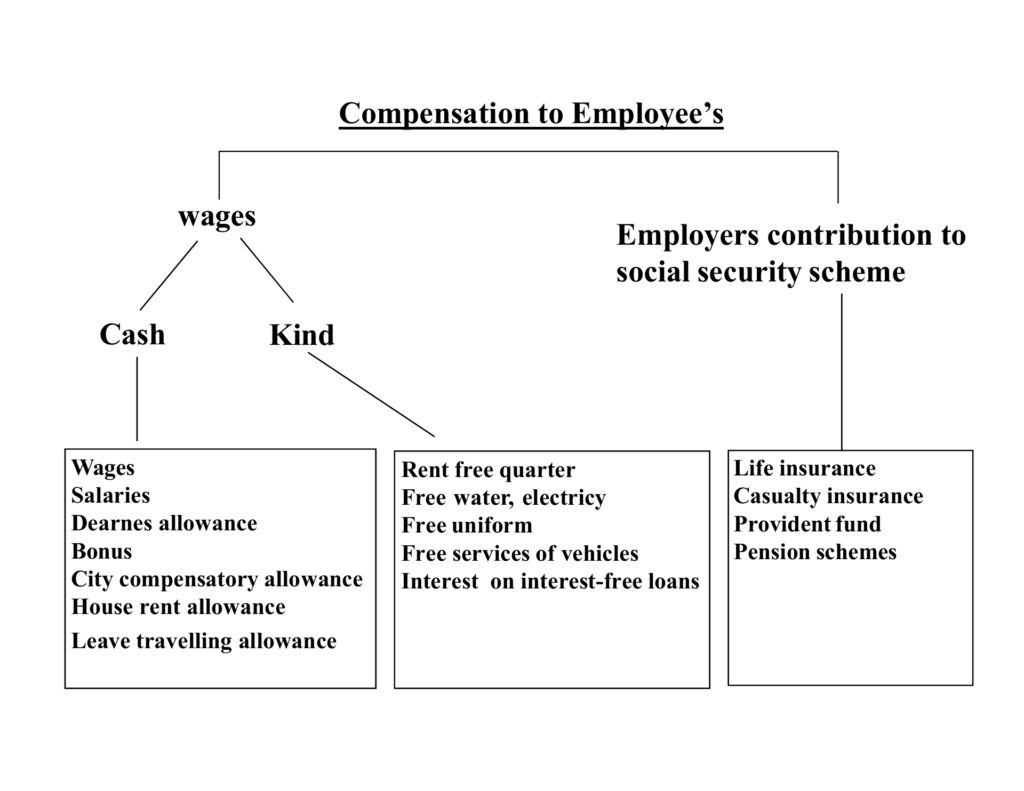

1. Compensation of Employees

Here are the different components of Compensation of Employees.

Wages and Salaries in Cash:-

It refers to cash paid to factor owners as reward for the work done during the period of accounting year. It includes all

- Wages

- Salaries

- Bonus

- Dearness allowances

- Commission

- City Compensatory allowance

- House rent allowance

- Leave traveling allowance

Wages & Salaries in Kind:-

it includes all non-monetary payments as reward by employers to employee, such as

- Rent free accommodation

- free car

- free medical

- free educational facility for children

- Free water, electricity

- Free uniform

- Free services of vehicle

- Interest on interest free loan

Employer’s Contribution to Social Security:-

It includes contributions made by employer for the social security of employees. it includes

- Provident Fund

- Gratuity

- Labour welfare funds

- Life Insurance

- Casualty Insurance

- Pension Schemes

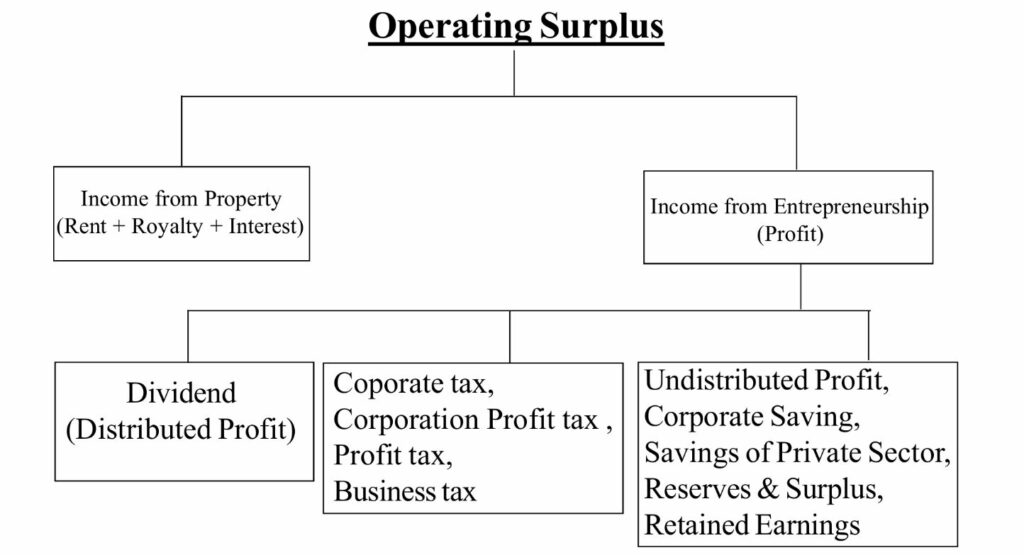

2. Operating Surplus

It refers to income from Property and entrepreneurship. It includes the following items.

- Rent

- Interest

- Profit

Profit further can be divided into three component.

Dividends:- It is part of the profit distributed among shareholders. It is also called ‘distributed profit’

Corporate/Corporation Profit Tax:- It is the part of profit which is paid to the government by way of profit tax.

Undistributed Profit:- It is the part of the profit which is retained by the firms for future use. It is also known as ‘corporate saving’ or ‘undistributed profits’.

3. Mixed Income

Here, mixed income refers to the income of the self-employed persons. If a person is self employed, he uses his own labour, land, capital and enterpreneurship in business.

Income of a self employed person is the mixture of wages, rent, interest and profit. It is also not possible to estimate different sources of income (wages, rent interest and profit) seperately as factors of production are not hired or purchased from the market.

Precautions on Income Method

Further Reading:-

| S.N | Topics |

| 1. | What is GDP Deflator |

| 2. | What are externalities in economics |

| 3. | Limitations of GDP as a measure of welfare |

| S.N | Topics |

| 1. | 150+ Numerical of Value Added Method |

| 2. | 150+ Numerical of Income Method |

| 3. | 150+ Numerical of Expenditure Method |

| 4. | 150+ Numerical of National Income and related aggregates |

| S.N | Topics |

| 1. | 250+ MCQs of National Income |