50 Important Numerical of Expenditure Method (National Income) with solutions class 12 CBSE Board

Numerical of national income by expenditure method. National Income. important numerical of expenditure method of national income

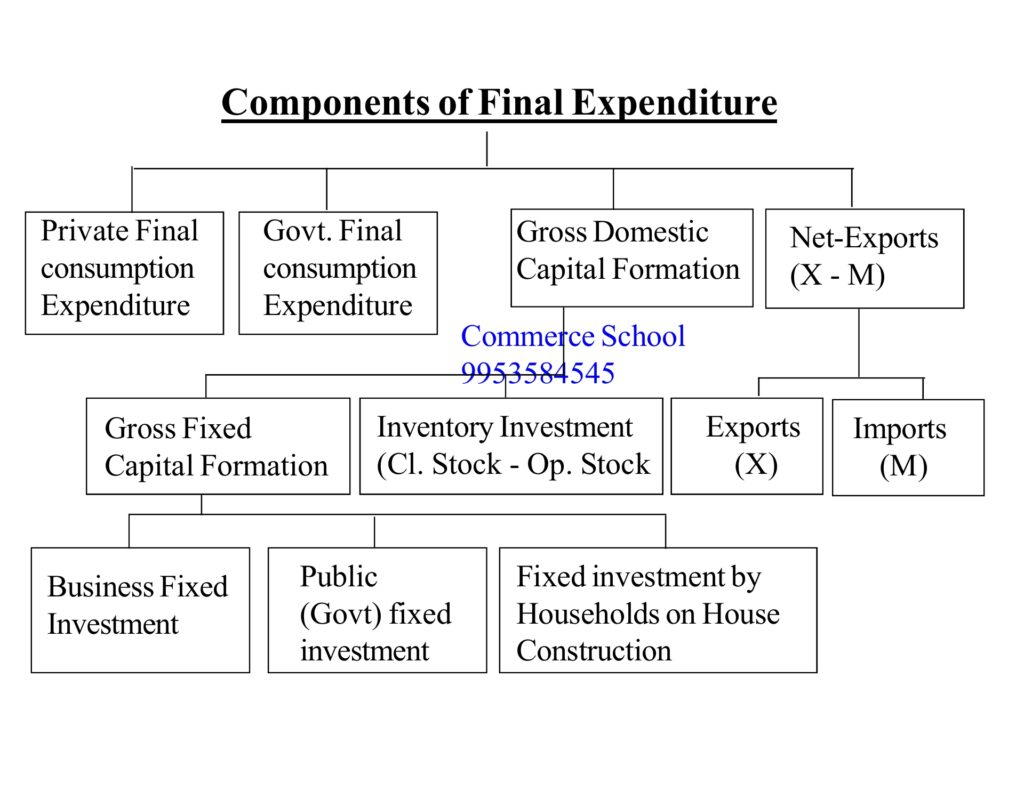

Formula of Expenditure Method to Calculate National Income

for better understanding of expenditure method read my lecture

Deep concept clarity of expenditure method of National Income

Must do Numerical of Expenditure Method of National Income

I am solving some very important numerical of expenditure method with board examination point of view.

1 Calculate Net National Product at Market Price:

| Items | (₹ in crore) |

| 1. Gross domestic fixed capital formation | 400 |

| 2. Private final consumption expenditure | 8000 |

| 3. Government final consumption expenditure | 3000 |

| 4. Change in Stock | 50 |

| 5. consumption of fixed capital | 40 |

| 6. Net indirect taxes | 100 |

| 7. Net exports | – 60 |

| 8. Net factor income to abroad | – 80 |

| 9. Net current transfers from abroad | 100 |

| 10. Dividend | 100 |

[CBSE Delhi – 2017]

Solution:-

Gross Domestic Capital Formation = Gross Domestic fixed capital formation + change in stock

Gross Domestic Capital Formation = 400 + 50 = ₹450

GDP at MP = Private Final consumption expenditure + Government Final Consumption Expenditure + Gross domestic capital formation + Net Exports

GDP at MP = 8000 + 3000 + 450 – 60

GDP at MP = ₹11390

NNP at MP = GDP at MP – consumption of fixed capital + NFIA

NNP at MP = 11390 – 40 – (- 80) = ₹11430

2. Calculate National Income

| Items | (₹ in crore) |

| 1. Net factor income to abroad | – 50 |

| 2. Net indirect taxes | 800 |

| 3. Net current transfers from rest of the world | 100 |

| 4. Net imports | 200 |

| 5. Private final consumption expenditure | 5000 |

| 6. Government final consumption expenditure | 3000 |

| 7. Gross domestic capital formation | 1000 |

| 8. consumption of fixed capital | 150 |

| 9. change in stock | – 50 |

| 10. Mixed income | 4000 |

| 11. Scholarship to students | 80 |

[CBSE Delhi – 2017]

Solution:-

GDP at MP = Private Final consumption expenditure + Government Final Consumption Expenditure + Gross domestic capital formation + Net Exports

GDP at MP = 5000 + 3000 + 1000 + (- 200) = ₹8800

National Income = NNP at FC = GDP at MP – consumption of fixed capital – Net Indirect tax + NFIA

National Income = 8800 – 150 – 800 + 50 = ₹7900 crore

3. Calculate Net Domestic Product at Factor Cost

| Items | (₹ in crore) |

| 1. Private final consumption expenditure | 8000 |

| 2. Government final consumption expenditure | 1000 |

| 3. Exports | 70 |

| 4. Imports | 120 |

| 5. Consumption of fixed capital | 60 |

| 6. Gross domestic fixed capital formation | 500 |

| 7. Change in stock | 100 |

| 8. Factor income to abroad | 40 |

| 9. Factor income from abroad | 90 |

| 10. Indirect taxes | 700 |

| 11. Subsidies | 50 |

| 12. Net Current transfers to abraod | (-) 30 |

[CBSE Delhi – 2017]

Solution:-

Gross Domestic Capital Formation = Gross Domestic Fixed capital formation + Change in stock

Gross Domestic Capital Formation = 500 + 100 = ₹600

GDP at MP = Private Final consumption expenditure + Government Final Consumption Expenditure + Gross domestic capital formation + Net Exports (Exports – Imports)

GDP at MP = 8000 + 1000 + 600 + (70 – 120) = ₹9550

NDP at FC = GDP at MP – consumption of fixed capital – Net indirect tax (Indirect tax – subsidies)

NDP at FC = 9550 – 60 – (700 – 50) = ₹8840 crore

4. Calculate National Income

| Items | (₹ in crore) |

| 1. Corporation tax | 100 |

| 2. Private final consumption expenditure | 900 |

| 3. Personal income tax | 120 |

| 4. Government final consumption expenditure | 200 |

| 5. Undistributed profits | 50 |

| 6. Change in stocks | – 20 |

| 7. Net Domestic fixed capital formation | 120 |

| 8. Net Imports | 10 |

| 9. Net Indirect tax | 150 |

| 10. Net factor income from abroad | – 10 |

| 11. Private Incom | 1000 |

[CBSE (AI) 2016]

Solution:-

Gross Domestic Fixed capital formation = Net domestic fixed capital formation + consumption of fixed capital formation

Gross Domestic Fixed Capital Formation = 120 + 0 = 120

Gross Domestic Capital Formation = Gross Domestic Fixed capital formation + Change in stock

Gross Domestic Capital Formation = 120 + ( – 20) = ₹100

GDP at MP = Private Final consumption expenditure + Government Final Consumption Expenditure + Gross domestic capital formation + Net Exports (Exports – Imports)

GDP at MP = 900 + 200 + 100 + ( – 10) = ₹1190

National Income = NNP at FC = GDP at MP – Consumption of fixed capital + NFIA – Net Indirect tax

National Income = 1190 – 0 + (- 10) – 150 = ₹1030 crore

Further Resources:-

Read Here:- 50+ Numerical of Income Method of National Income (Must Do)

Read Here:- 50+ Numerical of Value Added Method of National Income (Must Do)

5. Calculate Net National Product at Market Price:

| Items | (₹ in crore) |

| 1. Net Current transfers to abroad | 10 |

| 2. Private final consumption expenditure | 500 |

| 3. Current transfers from government | 30 |

| 4. Net factor income to abroad | 20 |

| 5. Net exports | – 20 |

| 6. Net indirect tax | 120 |

| 7. National debt interest | 70 |

| 8. Net Domestic Capital formation | 80 |

| 9. Income accruing to government | 60 |

| 10. Government final consumption expenditure | 100 |

[CBSE (AI) 2016]

Solution:-

Gross Domestic capital formation = Net domestic capital formation + consumption of fixed capital formation

Gross Domestic Capital Formation = 80 + 0 = ₹80

GDP at MP = Private Final consumption expenditure + Government Final Consumption Expenditure + Gross domestic capital formation + Net Exports (Exports – Imports)

GDP at MP = 500 + 100 + 80 + (- 20) = ₹660

NNP at MP = GDP at MP – consumption of fixed capital + NFIA

NNP at MP = 660 – 0 – 20 = ₹ 640 crore

6. Find Gross National Product at Market Price:

| Items | (₹ in crore) |

| 1. Private final consumption expenditure | 800 |

| 2. Net Current transfers to abroad | 20 |

| 3. Net factor income to abroad | – 10 |

| 4. Government final consumption expenditure | 300 |

| 5. Net Indirect tax | 150 |

| 6. Net Domestic Capital Formation | 200 |

| 7. Current transfers from government | 40 |

| 8. Depreciation | 100 |

| 9. Net Imports | 30 |

| 10. Income accruing to government | 90 |

| 11. National debt interest | 50 |

Solution:-

Gross Domestic Capital Formation = Net Domestic Capital Formation + Depreciation

Gross Domestic Capital Formation = 200 + 100 = ₹ 300

GDP at MP = Private final consumption expenditure + Government final consumption expenditure + Gross Domestic Capital Formation – Net Imports

GDP at MP = 800 + 300 + 300 – 30

GDP at MP = ₹ 1370

GNP at MP = GDP at MP – Net factor income to abroad

GNP at MP = 1370 – ( – 10)

GNP at MP = ₹ 1380 crore

7. Calculate National Income

| Items | (₹ in crore) |

| 1. Net imports | 5 |

| 2. Net domestic capital formation | 15 |

| 3. Personal Income | 90 |

| 4. National debt interest | 10 |

| 5. Corporate tax | 25 |

| 6. Government final consumption expenditure | 20 |

| 7. Net factor income to abroad | – 5 |

| 8. Net indirect tax | 10 |

| 9. Undistributed profits | 0 |

| 10. Private final consumption expenditure | 100 |

[CBSE (F) 2015]

Solution

NDP at MP = Private final consumption expenditure + Government final consumption expenditure + Net domestic capital formation – net imports

NDP at MP = 100 + 20 + 15 – 5

NDP at MP = 130

National Income (NNP at FC) = NDP at MP – Net factor income to abroad – Net indirect tax

NNP at FC = 130 – (- 5) – 10

NNP at FC = ₹ 125 crore

8. Calculate Net Domestic Product at Market Price.

| Items | (₹ in crore) |

| 1. Private Final consumption expenditure | 400 |

| 2. Opening stock | 10 |

| 3. Consumption of fixed capital | 25 |

| 4. Imports | 15 |

| 5. Government final consumption expenditure | 90 |

| 6. Net current transfers to rest of the world | 5 |

| 7. Gross domestic fixed capital formation | 80 |

| 8. Closing stock | 20 |

| 9. Exports | 10 |

| 10. Net factor income to abroad | – 5 |

[CBSE AI 2015]

Solution

GDP at MP = Private final consumption expenditure + Government final consumption expenditure + Gross Domestic Fixed Capital formation + Closing stock – Opening stock + Net Exports (Exports – Imports)

GDP at MP = 400 + 90 + 80 + (20 – 10) + ( 10 – 15 )

GDP at MP = 575

NDP at MP = GDP at MP – Consumption for fixed capital

NDP at MP = 575 – 25

NDP at MP = ₹ 550

9. Calculate Net National Product at Market Price

| Items | (₹ in crore) |

| 1. Transfers Payments by government | 7 |

| 2. Government final consumption expenditure | 50 |

| 3. Net imports | – 10 |

| 4. Net domestic fixed capital formation | 60 |

| 5. Private final consumption expenditure | 300 |

| 6. Private Income | 280 |

| 7. Net factor income to abroad | – 5 |

| 8. Closing Stock | 8 |

| 9. Opening stock | 8 |

| 10. Depreciation | 12 |

| 11. Corporate tax | 60 |

| 12. Retained earnings of corporations | 20 |

[CBSE AI 2015]

Solution

NDP at MP = Private final consumption expenditure + Government final consumption expenditure + Net Domestic Fixed Capital formation + Closing stock – Opening stock – Net Imports

NDP at MP = 300 + 50 + 60 + 8 – 8 – ( – 10)

GDP at MP = 420

NNP at MP = NDP at MP – Net Factor income to abroad

NNP at MP = 420 – (-5)

NNP at MP = ₹ 425 crore

Read Here:- List of all lectures of National Income and Related Aggregates chapter

10. Calculate Net Domestic Product at Factor Cost:

| Items | (₹ in crore) |

| 1. Net Current transfers to abroad | 15 |

| 2. Private final consumption expenditure | 800 |

| 3. Net imports | – 20 |

| 4. Net domestic capital formation | 100 |

| 5. Net factor income to abroad | 10 |

| 6. Depreciation | 50 |

| 7. Change in stocks | 17 |

| 8. Net indirect tax | 120 |

| 9. Government final consumption expenditure | 200 |

| 10. Exports | 30 |

[CBSE DELHI 2015]

Solution

NDP at MP = Private final consumption expenditure + Government final consumption expenditure + Net domestic capital formation – Net imports

NDP at MP = 800 + 200 + 100 – (-20)

NDP at MP = 1120

NDP at FC = NDP at MP – Net Indirect tax

NDP at FC = 1120 – 120

NDP at FC = ₹ 1000 Crore

Read Here:- 50 Important Numerical of Value Added Method of National Income Class 12

Read Here:- 50 Important Numerical of Income Method of National Income class 12

11. Calculate ‘National Income’.

| Items | (₹ in crore) |

| 1. Personal tax | 80 |

| 2. Private final consumption expenditure | 600 |

| 3. Undistributed profits | 30 |

| 4. Private Income | 650 |

| 5. Government final consumption expenditure | 100 |

| 6. Corporate tax | 50 |

| 7. Net Domestic fixed capital formation | 70 |

| 8. Net Indirect tax | 60 |

| 9. Depreciation | 14 |

| 10. Change in stocks | – 10 |

| 11. Net imports | 20 |

| 12. Net factor income to abroad | 10 |

[CBSE DELHI 2015]

Solution:-

NDP at MP = Private final consumption expenditure + Government final consumption expenditure + Net Domestic fixed capital formation + change in stocks – Net imports

NDP at MP = 600 + 100 + 70 + (- 10) – 20

NDP at MP = 740

NNP at FC = NDP at MP – Net Factor income to abroad – Net Indirect tax

NNP at FC = 740 – 10 – 60

NNP at FC = ₹ 670 crore

12. Calculate ‘National Income’ from the following

| Items | (₹ in crore) |

| 1. Net Imports | 60 |

| 2. Net current transfers to abroad | – 10 |

| 3. Net domestic fixed capital formation | 300 |

| 4. Government final consumption expenditure | 200 |

| 5. Private final consumption expenditure | 700 |

| 6. Consumption of fixed capital | 70 |

| 7. Net change in stocks | 30 |

| 8. Net factor income to abroad | 20 |

| 9. Net indirect tax | 100 |

[CBSE F 2014]

Solution:-

NDP at MP = Private final consumption expenditure + Government final consumption expenditure + Net Domestic fixed capital formation + change in stocks – Net imports

NDP at MP = 700 + 200 + 300 + 30 – 60

NDP at MP = 1170

NNP at FC = NDP at MP – Net factor income to abroad – Net Indirect tax

NNP at FC = 1170 – 20 – 100

NNP at FC = ₹ 1050

13. Calculate ‘Net National Product at Market Price’ from the following.

| Items | (₹ in crore) |

| 1. Closing stock | 10 |

| 2. Consumption of fixed capital | 40 |

| 3. Private final consumption expenditure | 600 |

| 4. Exports | 50 |

| 5. Opening stock | 20 |

| 6. Government final consumption expenditure | 100 |

| 7. Imports | 60 |

| 8. Net domestic fixed capital formation | 80 |

| 9. Net current transfers to abroa | – 10 |

| 10. Net factor income to abroad | 30 |

[CBSE AI 2014]

Solution:-

NDP at MP = Private final consumption expenditure + Government final consumption expenditure + Net domestic fixed capital formation + (closing stock – Opening stock) + Net Exports (Exports – Imports)

NDP at MP = 600 + 100 + 80 + (10 – 20) + (50 – 60)

NDP at MP = 760

NNP at MP = NDP at MP – Net factor income to abraod

NNP at MP = 760 – 30

NNP at MP = ₹ 730

14. Calculate National Income from the following.

| Items | (₹ in crore) |

| 1. Net change in stocks | 50 |

| 2. Government final consumption expenditure | 100 |

| 3. Net current transfers to abroad | 30 |

| 4. Gross domestic fixed capital formation | 200 |

| 5. Private final consumption expenditure | 500 |

| 6. Net imports | 40 |

| 7. Depreciation | 70 |

| 8. Net factor income to abroad | – 10 |

| 9. Net Indirect tax | 120 |

| 10. Net capital transfers to abroad | 25 |

Solution:-

GDP at MP = Private final consumption expenditure + Government final consumption expenditure + Gross domestic fixed capital formation + Net change in stocks – Net imports

GDP at MP = 500 + 100 + 200 + 50 – 40

GDP at MP = 810

NNP at FC = GDP at MP – Depreciation – Net factor income to abroad – Net Indirect tax

NNP at FC = 810 – 70 – (-10) – 120

NNP at FC = ₹ 630 crore

15. Calculate ‘Net Domestic Product at Factor Cost’ from the following:-

| Items | (₹ in crore) |

| 1. Net Current transfers to abroad | 5 |

| 2. Government final consumption expenditure | 100 |

| 3. Net indirect tax | 80 |

| 4. Private final consumption expenditure | 300 |

| 5. Consumption of fixed capital | 20 |

| 6. Gross domestic fixed capital formation | 50 |

| 7. Net imports | – 10 |

| 8. Closing stock | 25 |

| 9. Opening stock | 25 |

| 10. Net factor income to abroad | 10 |

[CBSE DELHI 2014]

Solution:-

GDP at MP = Private final consumption expenditure + Government final consumption expenditure + Gross Domestic fixed capital formation + (Closing stock – Opening stock) – Net imports

GDP at MP = 300 + 100 + 50 + (25 – 25) – (- 10)

GDP at MP = 460

NDP at FC = GDP at MP – Consumption of fixed capital – Net indirect tax

NDP at FC = 460 – 20 – 80

NDP at FC = ₹ 360 crore

16. Calculate National Income from the following:

| Items | (₹ in crore) |

| 1. Net current transfers to abroad | – 15 |

| 2. Private final consumption expenditure | 600 |

| 3. Subsidies | 20 |

| 4. Government final consumption expenditure | 100 |

| 5. Indirect tax | 120 |

| 6. Net imports | 20 |

| 7. Consumption of fixed capital | 35 |

| 8. Net change in stocks | – 10 |

| 9. Net factor income to abroad | 5 |

| 10. Net domestic capital formation | 110 |

[CBSE DELHI 2014]

Solution:-

NDP at MP = Private final consumption expenditure + Government final consumption expenditure + Net Domestic capital formation – Net imports

NDP at MP = 600 + 100 + 110 – 20

NDP at MP = 790

NNP at FC = NDP at FC – Net factor income to abroad – (Indirect tax – subsidies)

NNP at FC = 790 – 5 – (120 – 20)

NNP at FC = 785 – 100

NNP at FC = ₹ 685 crore

17. Calculate Gross Fixed Capital Formation from the following data:-

| Items | (₹ in crore) |

| 1. Private final consumption expenditure | 1000 |

| 2. Government final consumption expenditure | 500 |

| 3. Net Exports | – 50 |

| 4. Net Factor income from abroad | 20 |

| 5. Gross Domestic product at market price | 2500 |

| 6. Opening Stock | 300 |

| 7. Closing Stock | 200 |

Solution:-

GDP at MP = Private final consumption expenditure + Government final consumption expenditure + Gross Domestic capital formation + Net Exports

2500 = 1000 + 500 + Gross Domestic Capital Formation – 50

Gross Domestic Capital Formation = ₹ 1050

Gross Domestic Capital Formation = Gross Fixed Domestic Capital Formation + Change in stock (Closing Stock – Opening Stock)

1050 = Gross Fixed Domestic Capital Formation + (200 – 300)

Gross Fixed Domestic Capital Formation = 1050 + 100

Gross Fixed Domestic Capital Formation = ₹ 1150 crore

18. Find NDP at FC from the following data.

| Items | (₹ in crore) |

| 1. Gross Domestic fixed investment | 10000 |

| 2. Inventory investment | 5000 |

| 3. Depreciation | 2000 |

| 4. Indirect taxes | 1000 |

| 5. Subsidies | 2000 |

| 6. Consumption Expenditure | 20000 |

| 7. Residential Construction Investment | 6000 |

Solution:-

GDP at MP = Consumption Expenditure + Gross Domestic Fixed Investment + Inventory Investment

GDP at MP = 20000 + 10000 + 5000

GDP at MP = ₹ 35000

NDP at FC = GDP at MP – Depreciation – (Indirect taxes – Subsidies)

NDP at FC = 35000 – 2000 – (1000 – 2000)

NDP at FC = ₹ 34000 crore

19. From the following data, calculate the GDP at both (a) Market price, and (b) Factor Cost.

| Items | (₹ in crore) |

| 1. Gross investment | 90 |

| 2. Net exports | 10 |

| 3. Net indirect taxes | 5 |

| 4. Depreciation | 15 |

| 5. Net factor income from abroad | – 5 |

| 6. Private consumption expenditure | 350 |

| 7 Government purchases of goods and services | 100 |

Solution:-

GDP at MP = Private consumption expenditure + Government purchases of goods and services + Gross Investment + net exports

GDP at MP = 350 + 100 + 90 + 10

GDP at MP = ₹ 550 crore

GDP at FC = GDP at MP – Net Indirect taxes

GDP at FC = 550 – 5

GDP at FC = ₹ 545 crore

20. Calculate the gross national product at factor cost from the following data:-

| Items | (₹ in crore) |

| 1. Net Domestic Fixed capital formation | 350 |

| 2. Closing Stock | 100 |

| 3. Government final consumption expenditure | 200 |

| 4. Net indirect tax | 50 |

| 5. Opening stock | 60 |

| 6. Consumption of fixed capital | 50 |

| 7. Net exports | – 10 |

| 8. Private final consumption expenditure | 1500 |

| 9. Imports | 20 |

| 10. Net factor income from abroad | – 10 |

Solution:-

Gross Domestic capital formation = net domestic fixed capital formation + consumption of fixed capital + Closing stock – Opening stock

Gross Domestic Capital formation = 350 + 50 + 100 – 60

Gross Domestic Capital formation = ₹ 440

GDP at MP = Private Final Consumption Expenditure + Government final consumption expenditure + Gross Domestic capital formation + net exports

GDP at MP = 1500 + 200 + 440 – 10

GDP at MP = ₹ 2130

Gross National Product at FC (GNP at FC) = GDP at MP + Net factor income from abroad – Net Indirect tax

GNP at FC = 2130 – 10 – 50

GNP at FC = ₹ 2070 crore

21. Calculate Gross Domestic Product at market price from the following data:-

| Items | (₹ in crore) |

| 1. Consumption of fixed capital | 50 |

| 2. Closing stock | 40 |

| 3. Private final consumption expenditure | 500 |

| 4. Opening stock | 60 |

| 5. Net factor income from abroad | – 35 |

| 6. Exports | 25 |

| 7. Government final consumption expenditure | 200 |

| 8. Imports | 40 |

| 9. Net indirect tax | 100 |

| 10. net domestic capital formation | 300 |

Solution:-

Gross Domestic Capital Formation = Net Domestic Capital Formation + consumption of fixed capital

Gross Domestic capital formation = 300 + 50 = ₹ 350

GDP at MP = Private final consumption expenditure + Government final consumption expenditure + Gross domestic capital formation + Net Exports (Exports – Imports)

GDP at MP = 500 + 200 + 350 + (25 – 40)

GDP at MP = ₹ 1035 crore

22. Calculate national income from the following data:-

| Items | (₹ in crore) |

| 1. Gross Domestic capital formation | 100 |

| 2. Net change in stocks | 10 |

| 3. Consumption of fixed capital | 20 |

| 4. Private final consumption expenditure | 500 |

| 5. Government final consumption expenditure | 200 |

| 6. Exports | 80 |

| 7. Imports | 70 |

| 8. Net indirect tax | 60 |

| 9. Net factor income received from abroad | – 10 |

Solution:-

GDP at MP = Private final consumption expenditure + Government final consumption expenditure + Gross Domestic capital formation + exports – imports

GDP at MP = 500 + 200 + 100 + 80 – 70

GDP at MP = 810

NNP at FC = GDP at MP – consumption of fixed capital + Net factor income received from abroad – Net indirect tax

NNP at FC = 810 – 20 – 10 – 60

NNP at FC = ₹ 720 crore

23. Calculate NNP at MP from the following data:-

| Items | (₹ in crore) |

| 1. Household final consumption expenditure | 1000 |

| 2. Net domestic fixed capital formation | 100 |

| 3. Government final consumption expenditure | 200 |

| 4. Final consumption expenditure of private non-profit institutions serving households | 50 |

| 5. Net change in stocks | 40 |

| 6. Net exports | – 20 |

| 7. Net factor income from abroad | 10 |

| 8. Indirect tax | 70 |

| 9. Subsidies | 20 |

Solution:-

NDP at MP = Household final consumption expenditure + Final consumption expenditure of private non profit institutions serving households + Government final consumption expenditure + Net domestic fixed capital formation + net change in stocks + net exports

NDP at MP = 1000 + 50 + 200 + 100 + 40 – 20

NDP at MP = 1370

NNP at MP = NDP at MP + Net factor income from abroad

NNP at MP = 1370 + 10

NNP at MP = 1380 crore

24. Calculate GNP at MP from the following data:-

| Items | (₹ in crore) |

| 1. Government final consumption expenditure | 300 |

| 2. Net domestic fixed capital formation | 200 |

| 3. Private final consumption expenditure | 2000 |

| 4. Consumption of fixed capital | 40 |

| 5. Closing stock | 50 |

| 6. Opening stock | 40 |

| 7. Net exports | – 5 |

| 8. Net indirect tax | 30 |

| 9. Net factor income from abroad | – 10 |

Solution:-

Gross Domestic capital formation = Net domestic fixed capital formation + consumption of fixed capital + closing stock – opening stock

Gross Domestic capital formation = 200 + 40 + 50 – 40

Gross Domestic Capital formation = 250

GDP at MP = Private final consumption expenditure + Government final consumption expenditure + G- ross Domestic capital formation + Net exports

GDP at MP = 2000 + 300 + 250 – 5

GDP at MP = 2545

GNP at MP = GDP at MP + Net factor income from abroad

GNP at MP = 2545 – 10

GNP at MP = ₹ 2535 crore

25. Calculate NVA at FC from the following data:-

| Items | (₹ in crore) |

| 1. Indirect tax | 60 |

| 2. Closing stock | 100 |

| 3. Sales | 1000 |

| 4. Intermediate cost | 420 |

| 5. Opening stock | 80 |

| 6. Consumption of fixed capital | 50 |

| 7. Subsidies | 10 |

Solution:-

Value of output = Sales + closing stock – opening stock

Value of output = 1000 + 100 – 80

Value of output = 1020

NVA at MP = Value of Output – Intermediate cost

NVA at MP = 1020 – 420

NVA at MP = 600

NVA at FC = NVA at MP – (Indirect tax – subsidies)

NVA at FC = 600 – 60 + 10

NVA at FC = ₹ 550 crore

26. Find value added by firm X from the following data:-

| Items | (₹ in crore) |

| 1. Sales by firm X to firm Z | 200 |

| 2. Purchases by firm Y form firm X | 100 |

| 3. Sale by firm Z to firm X | 150 |

| 4. Closing stock of firm X | 40 |

| 5. Closing stock of firm Z | 30 |

| 6. Opening stock of firm X | 50 |

Solution:-

Value of output of firm X = Sales by firm X to firm Z + Purchases by firm Y from firm X + closing stock of firm X – Opening stock of firm X

Value of output of firm X = 200 + 100 + 40 – 50

Value of output of firm X = 290

Value added by firm X = Value of output of firm X – Sale by firm Z to firm X

Value added by firm X = 290 – 150

Value added by firm X = ₹ 140

27. A Farmer purchases ₹ 1,000 worth of seeds, ₹ 2000 worth of fertilisers, and pays ₹ 1500 as water charges to raise a wheat crop. He produces 50 quintals of wheat and sells the same at ₹ 200 per quintal. Calculate value added by the farmer.

Solution:-

farmer Value of Output = quantity * price = 50 * 200 = 10000

Intermediate consumption of farmer = seeds + fertilisers + water charges

Intermediate consumption of farmer = 1000 + 2000 + 1500

Intermediate consumption of farmer = 4500

Value added by farmer = Value of output – Intermediate consumption

Value added by farmer = 10000 – 4500

Value added by farmer = ₹ 5500

28. There are two firms A and B. A buys, ₹ 200 worth of raw materials from B. B buys ₹ 300 worth of raw materials from A. The value of total output of firm A is ₹ 1000 and that of B is ₹ 1,500. Find out value added by A and B. What measure of Value added is this?

Solution:-

Value added by firm A = value of output – purchase of raw material by firm A from B

Value added by firm A = 1000 – 200 = ₹ 800

Value added by firm B = Value of Output – purchase of raw material by firm B form A

Value added by firm B = 1500 – 300

Value added by firm B = ₹ 1200

29. Calculate NDP at factor cost:-

| Items | (₹ in crore) |

| 1. Net domestic fixed capital formation | 70 |

| 2. Private final consumption expenditure | 300 |

| 3. Exports | 20 |

| 4. Consumption of fixed capital | 10 |

| 5. Government final consumption expenditure | 100 |

| 6. Closing stock | 15 |

| 7. Imports | 30 |

| 8. Opening stock | 5 |

| 9. Net indirect tax | 80 |

| 10. Net factor income to abroad | – 10 |

Solution:-

NDP at MP = Private final consumption expenditure + Government final consumption expenditure + Net domestic fixed capital formation + Closing stock – Opening stock + Net Exports (Exports – Imports)

NDP at MP = 300 + 100 + 70 + 15 – 5 + (20 – 30)

NDP at MP = ₹470

NDP at FC = NDP at MP – Net Indirect tax

NDP at FC = 470 – 80

NDP at FC = ₹ 390 crore

30. Calculate National Income:-

| Items | (₹ in crore) |

| 1. Net imports | 15 |

| 2. Net current transfers from abroad | 10 |

| 3. Goods and services tax (GST) | 30 |

| 4. Net change in stocks | 5 |

| 5. Net domestic capital formation | 60 |

| 6. Private final consumption expenditure | 350 |

| 7. Government expenditure on providing free services | 75 |

| 8. Depreciation | 10 |

| 9. Net factor income to abroad | – 15 |

| 10. Subsidies | 5 |

Solution:-

NDP at MP = Private final consumption expenditure + Government expenditure on providing free services + Net domestic capital formation – Net imports

NDP at MP = 350 + 75 + 60 – 15

NDP at MP = ₹ 470

NNP at FC = NDP at MP – Net factor income to abroad – Net indirect tax (GST – Subsidies)

NNP at FC = 470 + 15 – (30 – 5)

NNP at FC = ₹ 460 crore

31. Calculate NNP at MP:-

| Items | (₹ in crore) |

| 1. Gross domestic fixed capital formation | 80 |

| 2. Government final consumption expenditure | 150 |

| 3. Closing stock | 20 |

| 4. Private final consumption expenditure | 500 |

| 5. Net domestic capital formation | 70 |

| 6. Opening stock | 20 |

| 7. Net imports | – 30 |

| 8. Factor income paid to abroad | 15 |

| 9. Net indirect tax | 40 |

| 10. Factor income received from abroad | 10 |

Solution:-

NDP at MP = Private final consumption expenditure + Government final consumption expenditure + Net Dometic capital formation + closing stock – opening – Net imports

NDP at MP = 500 + 150 + 70 + 20 – 20 + 30

NDP at MP = ₹ 750

NNP at MP = NDP at MP + NFIA (Factor income received from abroad – Factor income paid to abroad)

NNP at MP = 750 + (10 – 15)

NNP at MP = ₹ 745 crore

Further Reading

| S.N | Topics |

| 1. | What is GDP Deflator |

| 2. | What are externalities in economics |

| 3. | Limitations of GDP as a measure of welfare |

| S.N | Topics |

| 1. | 150+ Numerical of Value Added Method |

| 2. | 150+ Numerical of Income Method |

| 3. | 150+ Numerical of Expenditure Method |

| 4. | 150+ Numerical of National Income and related aggregates |

| S.N | Topics |

| 1. | 250+ MCQs of National Income |

Why you use something Ndpmp,gdpmp

9yupftzoyfupxux