50 Important Numerical of Value Added Method (National Income) with solutions class 12 CBSE Board

Hey, Welcome to Commerce School. Here we are going to solve 50 important Numerical of value added method of National Income with solutions. these numerical are very very important with point of view of the CBSE Board Examination.

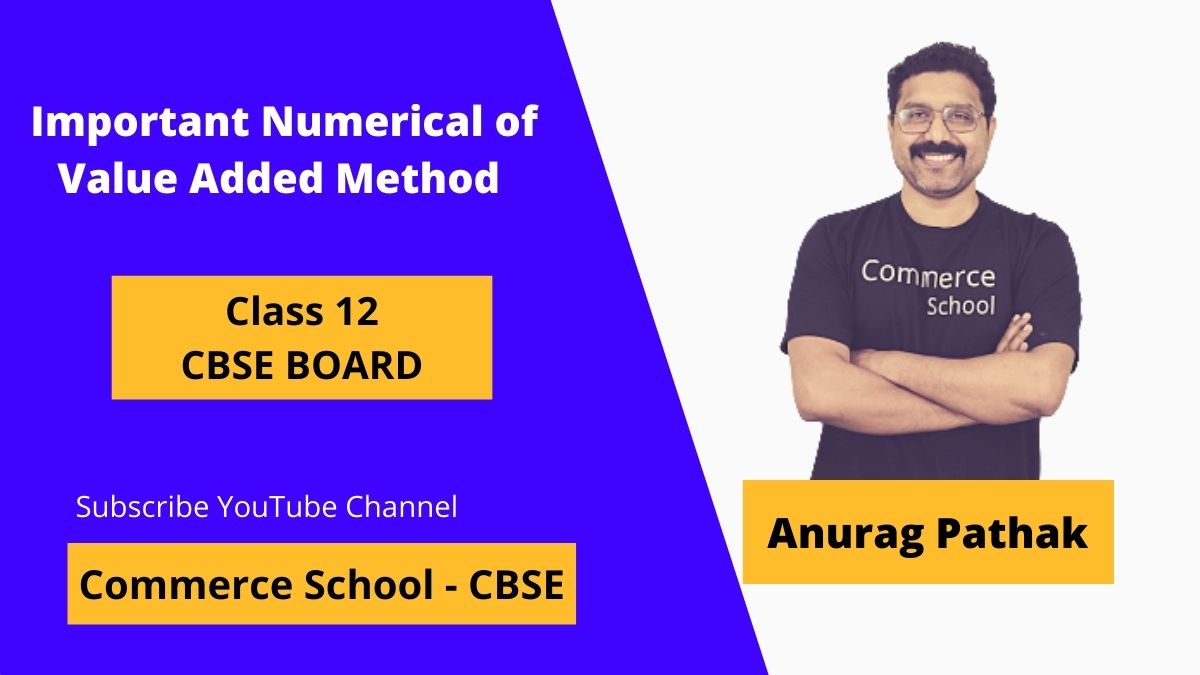

Formula of Value Added Method of National Income

Other Formulas of Sales

- Sales = Sales to households + Sales to other firms + Exports

- Sales = Sales to households + Production for self consumption + Sales to other firms + Exports

| Download Value Added Method Formula | Download |

For more detail understanding you can read below guide on Value added Method

Read Here:- Value added method formula, tricks, notes, pdf

Must do Numerical of Value Added Method of National Income with solutions (explanations).

1. On the basis of the following data about an economy which consists of only two firms, find out:

a) Value Added by firm A and B, and

b) Gross Value Added or Gross Domestic Product at Factor Cost.

Items

| Items | ₹ in lakhs |

| i) Sales by firm A | 100 |

| ii) Purchases from firm B by Firm A | 40 |

| iii) Purchases from firm A by Firm B | 60 |

| iv) Sales by firm B | 200 |

| v) Closing Stock of Firm A | 20 |

| vi) Closing Stock of Firm B | 35 |

| vii) Opening Stock of Firm A | 25 |

| viii) Opening Stock of Firm B | 45 |

| xi) Indirect taxes paid by both firms | 30 |

Answer:-

a)

Value of output of firm A = Sales of Firm A + Change in Stock (Closing Stock – Opening Stock)

Value of output of Firm A = i) + (v – vii)

Value of Output of Firm A = ₹100 + (₹20 – ₹25) = ₹ 95

Value Added by Firm A = Value of output of firm A – Intermediate Consumption of Firm A (Purchases of Firm A from other Firm)

Value Added by Firm A = ₹95 – ₹40 = ₹55 lakh

Value of output of Firm B = Sales of Firm B + Change in Stock (Closing Stock – Opening Stock)

Value of Output of Firm B = iv) + (vi – viii)

Value of Output of Firm B = ₹200 + (₹35 – ₹45) = ₹190

Value Added by Firm B = Value of output of Firm B + Intermediate Consumption of Firm B (Purchases of Firm B from other Firm)

Value Added by Firm B = ₹190 – ₹60 = ₹ 130 lakh

Read this lecture:- What is Intermediate Consumption ultimate Concept Clarity

b)

Gross Domestic Product at Factor Cost (Gross Value Added at FC) = Value Added by Firm A + Value Added by Firm B – Indirect taxes paid by both firms

Gross Domestic Product at FC = ₹55 lakh + ₹130 lakh – ₹30 lakh = ₹155 lakh

Note- 1) Purchase of a firm from another firm is considered as intermediate consumption. 2) Value added by firms A and B implies gross value added at market price.

2. Calculate:–

a) Gross Value Added at Market Price, and

b) National Income from the following data.

| Items | ₹ in lakh |

| (i) Value of Output: a) Primary Sector b) Secondary Sector c) Tertiary Sector | 800 200 300 |

| (ii) Value of Intermediate inputs purchased by: d) Primary Sector e) Secondary Sector f) Tertiary Sector | 400 100 50 |

| (iii) Indirect taxes paid by all sectors | 50 |

| (iv) Consumption of fixed capital of all sectors | 80 |

| (v) Factor income received by the residents from rest of the world | 10 |

| (vi) Factor income paid to non-residents | 20 |

| (vii) Subsidies received by all sectors | 20 |

Solution:-

a)

Gross Value added at Market Price = Value of Output of all sector – Intermediate consumption of all sector

GVA at MP = a) + b) + c) – (d + e + f)

GVA at MP = ₹800 +₹200 +₹300 – (₹400 + ₹100 + ₹50) = ₹750 lakh

b)

National Income = GVA at MP – Consumption of Fixed Capital – Net Indirect Tax (Indirect Tax – Subsidy) + NFIA (Factor income from abroad – Factor income to abroad)

National Income = ₹750 lakh – ₹80 lakh – (₹50 – ₹20) + (₹10 – ₹20)

National Income = ₹630 lakh

Note:- There are 8 aggregates of National Income. In order to derive different figures, consumption of fixed capital, net indirect tax, and NFIA is adjusted

Watch my lecture over National Income and its related aggregates.

Subscribe to my YouTube Channel for Free Content

3. Find Gross Value Added at Market Price:-

| Items | (₹ in lakh) |

| i) Depreciation | 20 |

| ii) Domestic Sales | 200 |

| iii) Net Change in Stocks | (-) 10 |

| iv) Exports | 10 |

| v) Single use producer goods | 120 |

Solutions:-

Sales = Domestic Sales + Exports

Sales – ii) + iv) = ₹200 + ₹10 = ₹210

Change in stock = Net Change in Stocks = (-) 10

Intermediate Consumption = ₹ 120

Gross Value Added at MP = Sales + Change in stock – Intermediate Consumption

GVA at MP = ₹210 + ( – ₹10) – ₹120 = ₹80

Note: Single use producer goods are intermediate consumption

CBSE Delhi – 2016

4. Find Net Value Added at Market Price:

| Items | (₹ in lakh) |

| i) Fixed capital good with a life span of 5 years | 15 |

| ii) Raw Materials | 6 |

| iii) Sales | 25 |

| iv) Net Change in Stock | (-) 2 |

| v) Taxes on production | 1 |

Solution:-

Value of Output = Sales + Change in Stock

Value of Output = iii) + iv) = 25 + ( – 2) = 23

Gross Value Added at MP = Value of Output – Intermediate Consumption

GVA at MP = ₹ 23 – ₹ 6 = ₹ 17

Net Value Added at MP = GVA at MP – Consumption of fixed Capital

Consumption of Fixed Capital = Total value of fixed Capital/life span = 15/5 = ₹ 3 lakh

NVA at MP = ₹ 17 – ₹ 3 = ₹ 14

[CBSE Delhi – 2016]

Further Resources:-

Read Here:- 50+ Numerical of Income Method of National Income (Must Do)

Read Here:- 50+ Numerical of Expenditure Method of National Income (Must Do)

5. Find Net Value Added at Factor Cost:-

| Items | (₹ in lakh) |

| i) Durable use producer goods with a life span of 10 years | 10 |

| ii) Single use producer goods | 5 |

| iii) Sales | 20 |

| iv) Unsold output produced during the year | 2 |

| v) Taxes on production | 1 |

Solution:-

Value of Output = Sales + Change in Stock

Value of Output = iii) + iv) = ₹ 20 + ₹ 2 = ₹ 22

GVA at MP = Value of Output – Intermediate Consumption

Intermediate Consumption = Single use producer goods = ₹ 5

GVA at MP = ₹ 22 – ₹ 5 = ₹ 17

Consumption of fixed capital = Total value of durable use goods/Total life span = ₹10/₹10 = ₹ 1 lakh

Net Indirect tax = Taxes on production – subsidy of production = ₹ 1 – ₹ 0 = ₹ 1

Net Value added at FC = GVA at MP – consumption of fixed capital – Net Indirect tax (Indirect Tax – Subsidy)

NVA at FC = ₹ 17 – ₹ 1 – ₹ 1 = ₹ 15

[CBSE Delhi – 2016]

6. Calculate the Net Value Added at Factor Cost:

| S.N | Items | (₹ in lakh) |

| i) | Goods and Service tax | 25 |

| ii) | Consumption of fixed Capital | 5 |

| iii) | Closing Stock | 10 |

| iv) | Corporate tax | 15 |

| v) | Opening stock | 20 |

| vi) | Sales | 540 |

| vii) | Purchase of raw materials | 140 |

Solution:-

Value of Output = Sales + Change in stock

Value of Output = vi + ( iii + v) = ₹ 540 + ( ₹ 10 – ₹ 20 ) = ₹ 530

Gross Value added at Market Price (GVA at MP) = Value of Output – Intermediate Consumption

GVA at MP = ₹ 530 – ₹ 140 = ₹ 390

Net value added at factor cost (NVA at FC) = GVA at MP – Depreciation – Net Indirect tax (Indirect tax – subsidy)

NVA at FC = ₹ 390 – 5 – (25 – 0) = ₹ 360 lakh

Note:-

1) Goods and Service tax is the indirect tax

2) Corporate tax paid by the company to government and considered as a direct tax and thus is not considered here.

3) Purchase of raw materials is a intermediate consumption.

7. Calculate the Gross Value Added at Market Price

| S.N | Items | (₹ in lakh) |

| i) | Goods and service tax | 40 |

| ii) | Consumption of fixed capital | 15 |

| iii) | Closing stock | 20 |

| iv) | Sales | 700 |

| v) | Subsidy | 5 |

| vi) | Intermediate consumption | 400 |

| vii) | Opening Stock | 10 |

Solution

Value of Output = Sales + Change in Stock

Value of Output = iv + ( iii – vii) = 700 + ( 20 – 10 ) = ₹ 710

Gross Value Added at Market Price (GVA at MP) = Value of Output – Intermediate Consumption

GVA at MP = ₹ 710 – ₹ 400 = ₹ 310 lakh

8. Calculate gross value added at market price.

| S.N | Items | (₹ lakh) |

| i) | Goods and service tax | 30 |

| ii) | Sales | 800 |

| iii) | Depreciation | 50 |

| iv) | Net Change in stocks | – 40 |

| v) | Purchase of raw materials | 360 |

| vi) | Corporate tax | 10 |

Solution:-

Value of Output = Sales + Net change in stocks

Value of Output = ii + iv = 800 + (- 40) = ₹ 760

Gross Value added at MP (GVA at MP) = Value of Output – Intermediate Consumption

GVA at MP = 760 – ₹360 = ₹ 400 Lakh

9. From the following data, calculate value added by firm X and by firm Y:-

| S.N | Items | (₹ lakh) |

| i) | Closing stock of firm X | 20 |

| ii) | Closing stock of firm Y | 15 |

| iii) | Opening stock of firm Y | 10 |

| iv) | Opening stock of firm X | 5 |

| v) | Sales by firm X | 300 |

| vi) | Purchases by firm X from firm Y | 100 |

| vii) | Purchases by firm Y from firm X | 80 |

| viii) | Sales by firm Y | 250 |

| ix) | Import of raw material by firm X | 50 |

| x) | Exports by firm Y | 30 |

Solution:-

Calculation of Value Added by firm X

Value of Output by Firm X = Sales by Firm X + Change in Stock of Firm X

Value of Output by Firm X = v – (i – iv) = 300 + (20 – 5) = ₹ 315

Value added by Firm X (GVA at MP by Firm X) = Value of Output – Intermediate Consumption (Purchases by firm X from firm Y + Import of raw material by firm X)

Value added by Firm X = 315 – (100 + 50) = ₹ 165 lakh

Calculation of Value Added by firm Y

Value of Output by Firm Y = Sales by Firm Y + Change in Stocks of Firm Y

Value of Output by Firm Y = viii + ( ii – iii ) = 250 + ( 15 – 10 ) = ₹ 255

Value added by firm Firm Y (GVA at MP by Firm Y) = Value of Output – Intermediate consumption (purchases by firm Y from firm X)

Value added by Firm Y = 255 – 80 = ₹ 175 lakh

Note:-

Item (x) is already included in item (viii) and so it is not considered.

10. Calculate Value Added by Firms A and B from the following data:-

| S.N | Items | (₹ lakh) |

| i) | Purchases by Firm B from Firm A | 40 |

| ii) | Sales by Firm B | 80 |

| iii) | Imports by Firm B | 10 |

| iv) | Rent paid by Firm B | 5 |

| v) | Opening stock of Firm B | 15 |

| vi) | Closing Stock of Firm B | 20 |

| vii) | Purchases by Firm A from Firm B | 20 |

| viii) | Closing Stock of Firm A | 20 |

| ix) | Opening Stock of Firm A | 10 |

Solution:-

Calculation of Value Added by Firm A

Value of Output by Firm A = Sales + Change in Stock (Closing Stock – Opening Stock)

Value of Output by Firm A = i + ( viii – ix ) = 40 + (20 – 10) = ₹ 50

Value Added by Firm A = Value of Output – Intermediate Consumption (Purchases by Firm A from Firm B)

Value Added by Firm A = 50 – 20 = ₹ 30

Calculation of Value Added by Firm B

Value of Output by Firm B = Sales + Change in Stock (Closing Stock – Opening Stock)

Value of Output by Firm B = ii + (vi – v) = 80 + (20 – 15) = ₹ 85

Value Added by Firm B = Value of Output – Intermediate Consumption (Purchases by firm B from firm A + Imports by firm B)

Value Added by Firm B = 85 – ( 40 + 10 ) = ₹ 35 lakh

Read Here:- 50 Important Numerical of Income Method of National Income class 12

Read Here:- 50 Important Numerical of Expenditure Method of National Income Class 12

11. Calculate net value added at factor cost:-

| S.N | Items | (₹ Crore) |

| i) | Subsidies | 5 |

| ii) | Sales | 500 |

| iii) | Intermediate Consumption | 200 |

| iv) | Closing Stock | 40 |

| v) | Consumption of fixed capital | 60 |

| vi) | Indirect tax | 30 |

| vii) | Opening Stock | 50 |

Solution:-

Value of Output = Sales + Change in Stock (Closing Stock – Opening)

Value of Output = ii + ( iv – vii) = 500 + (40 – 50) = ₹ 490

Gross Value Added at Market Price (GVA at MP) = Value of Output – Intermediate Consumption

GVA at MP = 490 – 200 = ₹ 290

Net Value Added at Factor Cost (NVA at FC) = GVA at MP – Consumption of fixed capital – Net Indirect tax (Indirect tax – Subsidy)

NVA at FC = 290 – 60 – ( 30 – 5) = ₹ 205 crore

12. From the following information about firm X, calculate gross value added by it.

| S.N | Items | (₹ lakh) |

| i) | Domestic Sales | 300 |

| ii) | Exports | 100 |

| iii) | Production for Self Consumption | 50 |

| iv) | Purchases from firm A | 110 |

| v) | Purchases from firm B | 70 |

| vi) | Imports of raw materials | 30 |

| vii) | Change in Stock | 60 |

Solution:-

Value of Output = Sales (Domestic Sales + Production for Self Consumption + Exports) + Change in stock (Closing Stock – Opening Stock)

Value of Output = (i + ii + iii) + vii = (300 + 100 + 50) + 60 = ₹ 510

Gross Value added by Firm X (GVA at MP) = Value of Output – Intermediate Consumption (Purchases from firm A + Purchases from Firm B + Imports of Raw materials)

Gross Value Added by firm X 510 – (110 + 70 + 30) = ₹ 300 lakh

13. From the following data, find out value added by firm X:

| S.N | Items | (₹ lakh) |

| i) | Sales by Firm Y to Firm X | 400 |

| ii) | Sales by Firm X to households | 500 |

| iii) | Purchases by firm Z from Firm X | 300 |

| iv) | Opening stock of firm X | 25 |

| v) | Closing stock of firm X | 75 |

Solution:-

Value of Output = Sales (Sales by Firm X to households + Purchases by firm Z from firm X) + Change in stock (Closing Stock by firm X – Opening stock of Firm X)

Value of Output = ( ii + iii) + ( v – iv) = ( 500 + 300 ) + ( 75 – 25 ) = ₹ 850

Value added by Firm X = Value of Output – Intermediate Consumption (sales by Firm Y to firm X)

Value added by Firm X = 850 – 400 = ₹ 450 lakh

14. Calculate (a) Value of output and (b) Net Value added at factor cost from the following data:

| S.N | Items | (₹ lakh) |

| i) | Goods and services tax | 100 |

| ii) | Sales | 1000 |

| iii) | Operating Surplus | 60 |

| iv) | Opening Stock | 200 |

| v) | Consumption of fixed capital | 50 |

| vi) | Closing Stock | 200 |

| vii) | Intermediate cost | 600 |

| viii) | Subsidies | 40 |

Solution:-

Value of Output = Sales + Change in stock (Closing Stock – Opening Stock)

Value of Output = ii + (vi – iv) = 1000 + (200 – 200) = ₹ 1000

Gross Value added at Market Price (GVA at MP) = Value of Output – Intermediate Consumption (intermediate cost)

GVA at MP = 1000 – 600 = ₹ 400

Net Value added at factor cost = GVA at MP – depreciation (consumption of fixed capital) – Indirect tax (Goods and service tax – subsidies)

NVA at FC = 400 – 50 – (100 – 40) = ₹ 290 lakh

14. From the data of a firm given alongside, find out net value added at factor cost:

| S.N | Items | |

| i) | Total Sales | 75000 |

| ii) | Purchase of raw materials and other inputs | 30000 |

| iii) | Indirect tax | 7500 |

| iv) | Consumption of fixed capital | 2500 |

Value of Output = Sales + Change in stock

Value of Output = 75000 + 0 = ₹ 75000

Gross value added at Market Price = Value of Output – Intermediate consumption ( Purchase of raw materials and other inputs)

GVA at MP = 75000 – 30000 = 45000

Net Value Added at Factor Cost = GVA at MP – Depreciation (consumption of fixed capital) – Net indirect tax (Indirect tax – subsidy)

NVA at MP = 45000 – 2500 – (7500 – 0)

NVA at MP = ₹ 35000

15. Given the following data, find the Net Value Added at Factor Cost by Farmer producing wheat.

| S.N | Items | (₹ in crore) |

| i) | Sale of wheat by the farmer in the local market | 6,80,000 |

| ii) | Purchase of a tracter | 5,00,000 |

| iii) | Procurement of wheat by the government from the farmer | 20,000 |

| iv) | Consumption of wheat by the farming family during the year | 5,000 |

| v) | Subsidy | 2,000 |

| vi) | Expenditure on the maintenance of existing capital stock | 10,000 |

Solution:-

Sales = i + iii + iv = 680000 + 20000 + 5000 = ₹ 705000

Value of Output = Sales + Change in Stock

Value of output = 705000 + 0 = 70500

Gross value added at MP = Value of output – Intermediate consumption (Expenditure on the maintenance of existing capital stock)

GVA at MP = 705000 – 10000 = ₹ 695000

Net value added at factor cost = GVA at MP – consumption of fixed capital – Net indirect tax (indirect tax – subsidy)

NVA at FC = 695000 – (0 + 2000) = ₹ 697000

16. Calculate Net Value Added at Factor Cost from the following data:-

| S.N | Items | (₹ in crore) |

| i) | Purchase of Machinery to be used in the production unit | 100 |

| ii) | Sales | 200 |

| iii) | Intermediate Costs | 90 |

| iv) | Indirect taxes | 12 |

| v) | Change in stock | 10 |

| vi) | Excise Duty | 6 |

| vii) | Stock of Raw Material | 5 |

Solution:-

Value of Output = Sales + Change in stock

Value of Output = ii + v = 200 + 10 = ₹ 210

Gross Value added at Market Price = Value of Output – Intermediate Costs

GVA at MP = 210 – 90 = 120

Net Value added at Factor cost = GVA at MP – Depreciation – Net Indirect tax (Indirect tax – subsidy)

NVA at FC = 120 – 0 – (12 – 0) = ₹ 108 crore

17. From the following data relating to a firm, calculate its Net Value Added at Factor Cost:

| S.N | Items | (₹ in lakh) |

| i) | Subsidy | 40 |

| ii) | Sales | 800 |

| iii) | Depreciation | 30 |

| iv) | Exports | 100 |

| v) | Closing Stock | 20 |

| vi) | Opening Stock | 50 |

| vii) | Intermediate purchases | 500 |

| viii) | Purchase of Machinery for own use | 200 |

| ix) | Import of raw material | 60 |

Solution:-

Value of Output = Sales + Change in stock (closing stock – opening stock)

Value of Output = 800 + (20 – 50) = 770

Gross value added at Factor cost = Value of Output – intermediate consumption

GVA at MP = 770 – 500 = 270

Net Value added at Factor cost = GVA at MP – Depreciation – Net Indirect tax (Indirect tax – subsidy)

NVA at Fc = 270 – 30 – ( 0 – 40) = ₹ 280 lakh

Notes:- Exports are not considered as it is already included in Sales.

18. Calculate Gross Domestic Product at Market Price by Production Method.

| S.N | Items | ₹ crore |

| i) | Intermediate consumption of: a) Primary sector b) Secondary Sector c) Tertiary Sector | 500 400 300 |

| ii) | Value of Output a) Primary Sector b) Secondary Sector c) Tertiary Sector | 1000 900 700 |

| ii) | Rent | 10 |

| ix) | Emoluments of Employees | 400 |

| v) | Mixed Income | 650 |

| vi) | Operating Surplus | 300 |

| vii) | Net Factor Income from abroad | – 20 |

| viii) | Interest | 5 |

| ix) | Consumption of fixed capital | 40 |

| x) | Net Indirect tax | 10 |

Solution:-

GDP at MP = Value of Output – Intermediate Consumption

GDP at MP = ( iia + iib + iic ) – ( ia + ib + ic )

GDP at MP = ( 1000 + 900 + 700 ) – ( 500 + 400 + 300 )

GDP at MP = 2600 – 1200

GDP at MP = 1400 crore

19. Calculate Gross Domestic Product at market price from the following data:-

| S.N | Items | (₹ lakh) |

| i) | Net Value added at market price by: a) Primary Sector b) Secondary Sector c) Tertiary Sector | 700 1000 1000 |

| ii) | Net Exports | – 10 |

| iii) | Net Indirect tax | 100 |

| iv) | Value of Intermediate consumption in: a) Primary Sector b) Secondary Sector c) Tertiary Sector | 200 300 300 |

| v) | Consumption of fixed capital in: a) Primary Sector b) Secondary Sector c) Tertiary Sector | 20 50 30 |

GDP at MP = Net Value at added at MP + Depreciation

GDP at MP = (ia + ib + ic) + (va + vb + vc)

GDP at MP = (700 + 1000 + 1000) + (20 + 50 + 30)

GDP at MP = 2700 + 100

GDP at MP = 2800 lakh

20. Calculate Net Value Added at factor cost from the following data:0

| Items | (₹ in crore) |

| 1. Purchase of machinery to be used in the production unit. | 100 |

| 2. Sales | 200 |

| 3. Intermediate costs | 90 |

| 4. Indirect taxes | 12 |

| 5. Changes in Stock | 10 |

| 6. Excise duty | 6 |

| 7. Stock of Raw Material | 5 |

Solution:-

Value of Output = Sales + change in stock

Value of Output = 200 + 10 = 210

GDP at MP = Value of Output – Intermediate consumption

GDP at MP = 210 – 90

GDP at MP = 120

Net Value added at factor cost (NDP at FC) = GDP at MP – consumption of fixed capital – Net Indirect tax (Indirect tax – subsidy)

NVA at FC = 120 – 0 – ( 12 – 0 )

NVA at FC = ₹ 108 crore

21. Find NVA at FC from the following.

| Items | (₹ in crore) |

| 1. Sales | 800 |

| 2. Taxes on production | 50 |

| 3. Depreciation | 70 |

| 4. Opening Stock | 100 |

| 5. Closing Stock | 80 |

| 6. Intermediate cost | 200 |

Solution:-

Value of output = Sales + Closing stock – Opening stock

Value of Output = 800 + 80 – 100

Value of Output = 780

GDP at MP = Value of output – Intermediate cost

GDP at MP = 780 – 200

GDP at MP = ₹ 580

NVA at FC = GDP at MP – Depreciation – Taxes on production

NVA at FC = 580 – 70 – 50

NVA at FC = ₹ 460 lakh

22. Calculate GVA at MP from the following:-

| Items | (₹ in crore) |

| 1. Purchase by Firm A from Firm B | 100 |

| 2. Purchase by Firm B from Firm A | 150 |

| 3. Sales by Firm A | 200 |

| 4. Sales by Firm B | 300 |

| 5. Exports by Firm B | 30 |

| 6. Change in stock of Firm A | – 20 |

| 7. Change in stock of Firm B | 10 |

Solution:-

GVA at MP by A = Sales by Firm A + Change in stock of Firm A – Purchase by firm a From Firm B

GVA at MP by A = 200 – 20 – 100

GVA at MP by A = ₹ 80 crore

GVA at MP by B = Sales by Firm B + Change in sock of Firm B – Purchase by Firm B from Firm A

GVA at MP by B = 300 + 10 – 150

GVA at MP by B = ₹ 160 crore

Note:- item 5th was not considered as it is already included in sales of B. Purchase from one firm by another firm is considered as intermediate consumption.

23. Calculate national income from the following data. Assume that there are only two properties, firm A and Firm B in the economy:

| Items | (₹ in crore) |

| 1. Purchases of materials, etc. by Firm A from Firm B | 20 |

| 2. Purchases of materials, etc. by Firm B from Firm A | 30 |

| 3. Value of output produced by Firm A | 100 |

| 4. Value of output produced by Firm B | 80 |

| 5. Payment of indirect tax by Firm A | 10 |

| 6. Payment of indirect tax by Firm B | 5 |

| 7. Consumption of fixed capital by Firm B | 5 |

| 8. Consumption of fixed capital by Firm A | 10 |

| 9. net change in stocks of Firm A | – 7 |

| 10. Net change in stock of Firm B | 7 |

| 11. Net factor income from abroad | – 5 |

Solution:-

Value added by Firm A (GDP at MP) = Value of output Produced by Firm A – Purchases of material, etc by firm A from firm B

Value added by Firm A = 100 – 20 = 80

Value added by Firm B = Value of output produced by Firm B – Purchases of material, etc. by firm B from Firm A

Value added by Firm B = 80 – 30 = 50

GDP at MP = Value added by Firm A + Value added by Firm B

GDP at MP = 80 + 50 = ₹ 130

NNP at FC = GDP at MP – Consumption of fixed capital by firm A – consumption of fixed capital by firm B + net factor income from abroad – payment of indirect tax by firm A – payment of indirect by Firm B

NNP at FC = 130 – 10 – 5 – 5 – 10 – 5

NNP at FC = ₹ 95 crore

24. Calculate GDP at MP and NDP at FC from the following data. Assume that there are only two sectors A and B in the economy.

| Items | (₹ in crore) |

| 1. Closing stock of sector A | 20 |

| 2. Opening stock of sector B | 5 |

| 3. Opening stock of sector A | 30 |

| 4. Closing stock of sector B | 15 |

| 5. Sales by sector B | 200 |

| 6. Sales by sector A | 150 |

| 7. Goods and Services tax paid by section A | 15 |

| 8. Consumption of fixed capital by sector B | 10 |

| 9. Consumption of fixed capital by sector A | 10 |

| 10. Subsidies to sector B | 5 |

| 11. Intermediate consumption by sector A | 70 |

| 12. Intermediate consumption by sector B | 60 |

| 13. Net factor income from abroad | 10 |

Solution:-

Value added by sector A = Sales by sector A + Closing stock of sector A – Opening stock of sector A – Intermediate consumption by sector A

Value added by sector A = 150 + 20 – 30 – 70

Value added by sector A = 70

Value added by sector B = Sales by sector B + Closing stock of sector B – Opening stock of Sector B – Intermediate consumption by sector A

Value added by sector B = 200 + 15 – 5 – 60

value added by sector B = 150

GDP at MP = Value added by sector A + Value added by sector B

GDP at MP = 70 + 150

GDP at MP = 220

NDP at FC = GDP at MP – consumption of fixed capital by sector A – consumption of fixed capital by sector B – Goods and services tax paid by sector A + subsidies to sector B

NDP at FC = 220 – 10 – 10 – 15 + 5

NDP at FC = ₹ 190 crore

25. From the following data, calculate “gross value added at factor cost.”

| Items | (₹ in crore) |

| 1. Sales | 180 |

| 2. Rent | 5 |

| 3. Subsidies | 10 |

| 4. Change in stock | 15 |

| 5. Purchase of raw materials | 100 |

| 6. Profits | 25 |

Solution:-

value of output = Sales + change in stock

Value of Output = 180 + 15

Value of Output = 195

Gross Value added at MP (GDP at MP) = Value of Output – purchase of raw materials

GDP at MP = 195 – 100

GDP at MP = 95

Gross value added at factor cost = GDP at MP – indirect tax + subsidies

Gross value added at factor cost = 95 – 0 + 10

Gross Value added at factor cost ₹ 105

26. From the following data, calculate “gross value added at factor cost.”

| Items | (₹ in crore) |

| 1. Net indirect tax | 20 |

| 2. Purchase of intermediate products | 120 |

| 3. Purchase of machines | 3oo |

| 4. Sales | 250 |

| 5. Consumption of fixed capital | 20 |

| 6. Change in stock | 30 |

Solution:-

Value of output = Sales + Change in stock

Value of output = 250 + 30

Value of output = 280

gross value added at MP (GDP at MP) = Value of output – purchase of intermediate products

gross value added at MP = 280 – 120

gross value added at MP = 160

gross value added at FC = gross value added at FC – Net indirect tax

gross value added at FC = 160 – 20

gross value added at FC = ₹ 140 crore

27. Calculate Net Value added at Market Price from the following data:-

| Items | (₹ in crore) |

| 1. Depreciation | 5 |

| 2. Sales | 100 |

| 3. Opening stock | 20 |

| 4. Intermediate consumption | 70 |

| 5. Excise Duty | 10 |

| 6. Change in stock | – 10 |

Solution

Value of Output = Sales + change in stock

Value of Output = 100 – 10 = 90

GDP at MP = Value of Output – Intermediate consumption

GDP at MP = 90 – 70

GDP at MP = 20

Net value added at MP = GDP at MP – Depreciation

Net Value added at MP = 20 – 5

Net Value added at MP = ₹ 15 crore

28. Calculate Gross Value Added at Factor Cost:-

| Items | (₹ in crore) |

| 1. Units of output sold (units) | 1000 |

| 2. Price per unit of output | 30 |

| 3. Depreciation | 1000 |

| 4. Intermediate cost | 12000 |

| 5. Closing stock | 3000 |

| 6. Opening stock | 2000 |

| 7. Excise | 2500 |

| 8. Sales Tax | 3500 |

Solution:-

Value of Output = Units of output sold * Price per unit of output + Closing stock – Opening stock

Value of Output = 1000 * 30 + 3000 – 2000

Value of Output = 30000 + 1000

Value of Output = 31000

GDP at MP = Value of output – intermediate cost

GDP at MP = 31000 – 12000

GDP at MP = 19000

Gross value added at Factor Cost = GDP at MP – Excise – sales tax

Gross value added at Factor Cost = 19000 – 2500 – 3500

Gross Value added at Factor Cost = ₹ 13000

Further Reading

| S.N | Topics |

| 1. | What is GDP Deflator |

| 2. | What are externalities in economics |

| 3. | Limitations of GDP as a measure of welfare |

| S.N | Topics |

| 1. | 150+ Numerical of Value Added Method |

| 2. | 150+ Numerical of Income Method |

| 3. | 150+ Numerical of Expenditure Method |

| 4. | 150+ Numerical of National Income and related aggregates |

| S.N | Topics |

| 1. | 250+ MCQs of National Income |

Best questions which opened the mind.

Are you from 2021-22 batch??

Please give some hard question

Provide very hard questions calculation of two aggregate with other things like mixed income interest change in stock