Assertion Reason MCQs of Accounting for Partnership Firm Fundamentals with answers Class 12

Looking for important Assertion Reason Based MCQs of Accounting for partnership firms – Fundamentals chapter 1 with answers class 12 CBSE, ISC, CUET and state Board.

Free PDF Download of CBSE Accountancy Assertion Reason Multiple Choice Questions for Class 12 with Answers Chapter 1 Accounting for Partnership Firms — Fundamentals. Assertion Reason Accountancy MCQs for Class 12 Chapter Wise with Answers PDF Download was Prepared Based on Latest Exam Pattern. Students can solve NCERT Class 12 Accountancy Accounting for Partnership Firms — Fundamentals MCQs Pdf with Answers to know their preparation level.

Assertion Reason Multiple Choice Questions of chapter 2 of Accountancy class 12

Let’s Practice

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Partnership is the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all.

Reason (R): It is defined in the Partnership Act, 1932.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) and Reason (R) are not correct.

Ans – a)

Explanation:- The definition of partnership is written in the partnership act 1932. The assertion and reason is true and reason is the correct explanation.

Read Here:- Important MCQs of Fundamentals of Partnership Accountancy class 12

Read Here:- Matching Type MCQs of Fundamentals of Partnership Accountancy class 12

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Partners distribute profits and losses in their profit sharing ratio and not in the ratio of their capitals.

Reason (R): If The amount of appropriations, is more than the amount of profit available for distribution, profit is distributed in the ratio of appropriations.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) and Reason (R) are not correct.

Ans – b)

Explanation:- Yes, partners generally distribute profit in their profit sharing ratio. Assertion is true. Reason are is also true, when appropriations are more than the available profit. Profit is distributed in the ratio of appropriation. But reason does not explain why profits are distributed in the profit sharing ratio.

Read Here:- Important MCQs of Goodwill Accountancy class 12

Read Here:- Assertion Reason MCQs of Goodwill Accountancy class 12

Read Here:- Matching Type MCQs of Goodwill Accountancy class 12

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): The partners are the agents as well as principals of the firm.

Reason (R): Partnership is a business relationship among two or more persons to share profits and losses of the business, carried on by all or any one of them acting for all.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) and Reason (R) are not correct.

Ans – a)

Explanation:- Partners are the agents and principal as well Assertion is true. Reason are also true, this is the definition of the partnership mentioned in partnership act. The deficition last part carried on by all or any one of them acting for all explain that the partners are the principal and agests as well.

Read Here:- Important MCQs of Change in Profit Sharing Ratio Accountancy class 12

Read Here:- Assertion Reason MCQs of Change in Profit Sharing Ratio Accountancy class 12

Read Here:- Matching Type MCQ of Change in Profit Sharing Ratio Accountancy class 12

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Rent payable to a partner is transferred to the credit of Partner’s Capital Account and not to Rent Payable Account.

Reason (R): Rent payable to a partner for letting the firm use his personal property for business is a transaction that is not related to him being a partner. Therefore, it is credited to Rent Payable Account.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is false but Reason (R) is true.

Ans – d)

Rent payable to partner is the external liability of the firm not the appropriation. Thus it is credited to rent payable account. only appropriations are transferred to partners capital account. Thus assertion is false. and reason is true

Read Here:- Important MCQs of Admission of Partner Accountancy class 12

Read Here:- Assertion Reason MCQs of Admission of Partner Accountancy class 12

Read Here:- Matching Type MCQ of Admission of Partner Accountancy class 12

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Partnership Deed is a legal document signed by all the partners

Reason (R): Any type of charitable institution running as a not-for-profit organization will not be considered as a business.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) and Reason (R) are not correct.

Ans – b)

Explanation:- Both Assertion and Reason are true. But Reason does not explain why partnership deed is a legal document.

Read Here:- Important MCQs of Financial Statement of Company Accountancy class 12

Read Here:- Assertion Reason MCQs of Financial Statement of Company Accountancy class 12

Read Here:- Matching Type MCQs of Financial Statement of Company Accountancy class 12

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Rent to a partner is transferred to the debit of Profit and Loss Account but is not transferred to the debit of Profit and Loss Appropriation Account.

Reason (R): Rent to a Partner is an expense that is a charge against profits and not an appropriation of profit. Hence, it is transferred to the debit of the Profit and Loss Account.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) and Reason (R) are not correct.

Ans – a)

Explanation:- Both Assertion and Reason are true and Reason correctly explain the assertion.

Read Here:- Important MCQs of Financial Statement Analysis Accountancy class 12

Read Here:- Assertion Reason MCQs of Financial Statement Analysis Accountancy class 12

Read Here:- Matching Type MCQs of Financial Statement Analysis Accountancy class 12

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Salary and commission are payable to the working partners for their efforts.

Reason (R): No partner shall be paid such remuneration as salary, commission, etc. If the partnership deed is silent on such a matter.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is false but Reason (R) is true

Ans – b)

Explanation:- Both Assertion and Reason are true. But Reason does not

explain why salary are paid to the partners.

Read Here:- Important MCQs of Accounting Ratios Accountancy class 12

Read Here:- Assertion Reason MCQs of Accounting Ratios Accountancy class 12

Read Here:- Matching Type MCQs of Accounting Ratios Accountancy class 12

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Interest on Loan to partner is charged @ 6% p.a. If Partnership Deed does not provide for the charging of interest.

Reason (R): In the absence of Partnership Deed, provisions of the Partnership Act, 1932 apply. Thus, Interest on loan to Partner should be charged @6% p.a. otherwise, interest is allowed at the agreed rate of interest.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) and Reason (R) is not True

Ans – a)

Explanation:- Both assertion and reason are true and reason is the correct explanation of the assertion. Partners are paid interest on loan of partner @6% p.a if partnership deed does not have provision against it. In this case provisions of the partnership act 1932 are applied.

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): A profit and Loss adjustment account is required for the rectification of errors or omissions.

Reason (R): This account is prepared to rectify those errors or omissions which are left while preparing final accounts and found after distribution of profits among partners.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) and Reason (R) are not correct.

Ans – a)

Read Here:- Important MCQs of Money and Banking Macroeconomics Class 12

Read Here:- Assertion Reason MCQs of Money and Banking Macroeconomics Class 12

Read Here:- Matching Type MCQs of Money and Banking Macroeconomics Class 12

Read Here:- Case/source Based MCQs of Money and Banking Macroeconomics class 12

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Interest on Loan by Partner is allowed at the agreed rate of interest and in the absence of agreement, it is allowed @ 8%.

Reason (R): In the absence of Partnership Deed, interest on Loan by Partner is not allowed.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) and Reason (R) are not true.

Ans – d)

Explanation:- The interest on partner loan is provided @ 6% p.a. in the absence of partnership deed otherwise at the agreed rate mentioned in the partnership deed.

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Partnership Firm is a separate and distinct entity from partners from the viewpoint of accounting.

Reason (R): According to Business Entity Concept, transactions of the business are recorded from the viewpoint of the firm. Hence, it is a separate and distinct entity from partners from the viewpoint of accounting.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) and Reason (R) are not correct.

Ans – a)

Read Here:- Important MCQs of Government Budget Macroeconomics Class 12

Read Here:- Assertion Reason MCQs of Government Budget Macroeconomics class 12

Read Here:- Matching Type MCQs of Government Budget Macroeconomics class 12

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Avinash, a partner in the firm gave a loan of ₹5,00,000 to the firm without an agreement as to the rate of interest. Interest on Loan by Avinash is to be allowed @ 6% p.a.

Reason (R): In the absence of Partnership Deed, provisions of the Partnership Act, 1932 apply. Thus, interest on Loan to partner should be charged @ 6% p.a.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) and Reason (R) are not correct.

Ans – a)

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): The partnership deed may be either written or oral.

Reason (R): In order to avoid all misunderstandings and disputes, it is always the best course to have a written agreement duly signed and registered under the Act.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) and Reason (R) are not correct.

Ans – a)

Read Here:- Important MCQs of Foreign Exchange Rate Macroeconomics class 12

Read Here:- Assertion Reason MCQs of Foreign Exchange Rate Macroeconomics class 12

Read Here:- Matching Type MCQs of Foreign Exchange Rate Macroeconomics class 12

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Bharat, a partner in the firm gave a loan of ₹5,00,000 to the firm without an agreement as to the rate of interest. At the year-end, the remaining partners agreed to allow interest on Loan by Bharat @ 8% p.a.

Reason (R): In the absence of Partnership Deed, provisions of the Partnership Act, 1932 apply. Thus, Interest on Loan to Partner should be charged @ 6% p.a. and not @ 8% p.a.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is false but Reason (R) is true.

Ans – d)

In the absence of agreement of interest on loan of partner, it is provided @ 6% p.a.

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Interest on capital to a partner is payable only out of profits.

Reason (R): Interest on capital is an appropriation of profits that is required to be provided irrespective of profits and loss.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) if false and Reason (R) is true

Ans – c),

Explanation:- Interest on capital is an appropriaton and is provided when there is profit if no further information is given.

Read Here:- Important MCQs of Balance of Payments Macroeconomics class 12

Read Here:- Assertion Reason MCQs of Balance of Payments Macroeconomics class 12

Read Here:- Matching Type MCQs of Balance of Payments Macroeconomics class 12

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Amit, Bharat, and Charu are partners in the firm. The partnership Deed Provided for salary to Amit of ₹60,000 p.a. Bharat and Charu also asks for salaries of ₹60,000 each. Salaries to Bharat and Charu are to be allowed.

Reason (R): In the absence of Partnership Deed, provisions of the Partnership Act, 1932 apply. Thus, salaries are not to be allowed to Bharat and Charu.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) if false and Reason (R) is true

Ans – a)

Explanation:- In the absence of any agreement regarding salary in partnership deed. The provisions of partnership act 1932 are applied. Thus no salary would be provided to partners..

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): A firm can have a minimum of 2 with a maximum of 50 partners.

Reason (R): The limit of two partners flows from the definition in the Partnership Act, 1932. The maximum limit of partners is also prescribed in the Partnership Act, 1932.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) and Reason (R) are not correct.

Ans – c)

Explanation:- The minimum limit of the partners is mentioned in partnership Act 1932 and maximum limit is mentioned in Company act 2013.The section 464 of companies act 2013 empowers the central government to prescribe maximum numbers of partners upto maximum limit of 50. The central government than prescribed maximum partners to be 50 as per vide rule of the companies (Miscellaneous Rules, 2014.

Read Here:- Important MCQs of Nature and Significance of Management BST class 12

Read Here:- Assertion Reason MCQs of Nature and Significance of Management BST class 12

Read Here:- Matching Type MCQs of Nature and Significance of Management BST class 12

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Dharam, Ebrahim, and Farooq are partners in the firm. The partnership deed provided, salary to Ebrahim of ₹5,000 per month. Dharam and Farooq also demand the same salary, i.e., ₹60,000 p.a. each. Thus salaries are allowed.

Reason (R): In the absence of Partnership Deed, provisions of the Partnership act, 1932 apply. Thus salaries are not be allowed to them.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is false but Reason (R) is true.

Ans – d),

Explanation:- In the absence of an agreement regarding salary to some particular partners salary will not be allowed as per the provisions of the partnership act 1932.

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): A profit and Loss Appropriation Account is prepared to show the distribution of profits among partners as per the provision of Partnership Deed.

Reason (R): Only working partner(s) can inspect the books of accounts

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) and Reason (R) are not correct.

Ans – c)

Explanation:- Profit and Loss Appropriation Account is prepared to show the distribution of profits among the partners Assertion is true. All partners whether working or non working can nispect the books of the firm. Reason is false.

Read Here:- Important MCQs of Principles of Management BST class 12

Read Here:- Assertion Reason MCQs of Principles of Management BST class 12

Read Here:- Matching Type MCQs of Principles of Management BST class 12

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Ganesh, Harish, and Iqbal are partners. The Partnership Deed provided for salary to Iqbal of ₹5,000 Per month. Ganesh and Harish demand a salary of ₹60,000 p.a. each. They agreed and provided provision in the partnership deed. But the profit for the year is ₹1,20,000. Profit will be shared by the partners equally.

Reason (R): They have agreed to allow salaries to the partners. Hence, salaries will be allowed to them. Since profit is not adequate to allow fully salary to each partner, profit is to be distributed in the ratio of 6: 6:6 i.e., equally

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) and Reason (R) are not correct.

Ans – a)

Explanation:- When profit is less than the appropriation. Profit is distributed in their appropriations ratio that is 60,000:60,000:60,000 that comes to 6:6:6.

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A) It is considered desirable to have a partnership agreement in writing.

Reason (R) It helps in settling any disputes with regard to the terms of partnership and acts as evidence in the court of law.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is false but Reason (R) is true.

Ans – d)

Explanation:- The agreement can be oral also does not necessary written agreement. Assertion is false. But the written agreement helps in settlement of future dispute and can be served as the evidence in court.

Read Here:- Important MCQs of Business Environment BST class 12

Read Here:- Assertion Reason MCQs of Business Environment BST Class 12

Read Here:- Matching Type MCQs of Business Environment BST class 12

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Jiten, Karan, and Lalit are partners with capitals of ₹2,00,000, 6,00,000, and ₹8,00,000 respectively sharing profits in the ratio 3:2:1. The Partnership Deed allowed salary of ₹60,000 p.a. to Jiten and Interest on capitals @5% p.a. Net profit for the year is ₹1,20,000.

Reason (R): Distributable profit for the year is not adequate to allow all appropriations. Therefore, divisible profit will be distributed in the ratio of appropriations, i.e. 7:3:4.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is false but Reason (R) is True.

Ans – a)

Explanation:- The Jiten will receive 60000 + 10000, Karan ₹30,000 as interest on capital, Lalit ₹40,000 as interest on capital. It comes to ₹ 1,40,000 that is more than the available profit. Thus profit would be distributed in appropriatoins ratio that is 70,000:30,0000:40,000

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): In order to compensate a partner for contributing capital to the firm in excess of the profit-sharing ratio, the firm pays interest on the partner’s capital.

Reason (R): Interest on capital is treated as a charge against profit.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) and Reason (R) are not correct.

Ans – c)

Explanation:- Yes if profit sharing ratio is less than what is contributed as capital by the partner, he is compensated by the interest on capital. Thus Assertion is true. Interest on capital is treated as appropriations if no further information is given. Thus Assertion is false.

Read Here:- Important MCQs of Planning chapter BST class 12

Read Here:- Assertion Reason MCQs of Planning chapter BST class 12

Read Here:- Matching Type MCQs of Planning chapter BST class 12

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Mohan, Naman, and Onkar are partners with fixed capitals of ₹8,00,000 each. The Partnership deed allowed a salary of ₹1,00,000 p.a. to Onkar and Interest on Capitals @5% p.a. Net Profit for the year is ₹5,00,000. Balance profit will be distributed among them equally.

Reason (R): Distributable profit for the year is adequate to allow all appropriations. Divisible profit will be distributed among the partners equally as is provided in the Partnership Act, 1932.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) and Reason (R) are not correct.

Ans – a)

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): In a partnership when the profit sharing ratio is agreed upon, partners share the losses also in the same ratio.

Reason (R): Although in the definition it is written that profits will be shared. However, profits include losses also.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Only Assertion (A) is correct

d) Only Reson (R) is correct

Ans – a)

Read Here:- Important MCQs of Organising chapter BST class 12

Read Here:- Assertion Reason MCQs of Organising chapter BST class 12

Read Here:- Matching Type MCQs of Organising chapter BST class 12

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Param, Qasim, and Ramesh are partners with fixed capitals of ₹8,00,000 each. The partnership Deed allowed a salary of ₹1,00,000 p.a. to Onkar and Interest on Capitals @ 5% p.a. Net profit for the year is ₹5,00,000. Amounts of appropriations will be credited to their respective Capital Accounts.

Reason (R): When Capital Accounts are fixed, all appropriations are credited/debited in the Partner’s Capital Accounts.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Only Assertion (A) is correct

d) Both Assertion (A) and Reason (R) are false

Ans – d)

Explanation:- When capital accounts are fixed. All appropriations are credited/debited in their partner’s current account.

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A) The capital account of a partner does not show a debit balance in spite of regular and consistent losses year after year in the case of the Fixed Capital Method.

Reason (R): All transactions relating to loss or profit, drawings, salaries, etc are shown in the current account and not in the capital account in case of fixed capital.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Only Assertion (A) is correct

d) Only Reson (R) is correct

Ans – a),

Explanation:- In the case of Fixed Capital Method. All regular transactions such as interest on capital, drawings, salary, commission and distribution of profits are shown in current account. Thus Under Fixed Capital Method, Capital account always shows a credit balance.

Read Here:- Important MCQs of Marketing Management BST class 12

Read Here:- Assertion Reason MCQs of Marketing Management BST class 12

Read Here:- Matching Type MCQs of Marketing Management BST class 12

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Shyam, Tarun, and Umesh are partners. The partnership deed provided to charge interest on drawings @6% p.a. Each Partner withdrew ₹5,000 per month at the beginning of the month. The firm incurred a loss of ₹1,00,000. Therefore, interest will not be charged on drawings.

Reason (R): Interest on Drawings will be charged @6% p.a. on ₹60,000 for 6.5 months from each partner, it being a withdrawal against anticipated profit.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is false

d) Assertion (A) is false but Reason (R) is True

Ans – d),

Interest on drawings is charged even if there is a loss. It is an income to the firm. Thus would reduce overall loss of the firm.

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): The Capital Account of the partner, in the case of the fixed capital method, always shows a credit balance in spite of consistent losses.

Reason (R): All losses are debited to the current account of the partners, so the capital account does not show a debit balance.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Only Assertion (A) is correct

d) Only Reson (R) is correct

Ans – a)

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Varun, Waryam, and Yogesh are partners. The Partnership deed provided to charge interest on drawings @6% p.a. Varun withdrew ₹5,000 per month at the beginning of the month. Waryam in the middle of the month while Yoges withdrew at the end of the month. Interest will be charged on drawings of ₹60,000 from Varun for 6.5 months, Waryam for 6 months, and Yogesh for 5.5 months.

Reason (R): Interest on Drawings is charged at the agreed rate of interest, i.e., p.a. on ₹60,000 for the period amount is withdrawn by a partner. Varun has drawn in the beginning of the month and therefore, interest will be charged for 6.5 months from him and on the same basis from Waryam and Yogesh for 6 months and 5.5 months respectively.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Only Assertion (A) is correct

d) Only Reson (R) is correct

Ans – a)

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): The business of the partnership should be lawful although not specifically included in the definition.

Reason (R): Any unlawful activity can not be carried in the country. Thus, the business should also be lawful to be carried out.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) and Reason (R) are not correct.

Ans – a)

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): A partnership firm has no separate legal entity, from the partners constituting it.

Reason (R): The Central government has prescribed the maximum number of partners in a firm to be 100.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) and Reason (R) are not correct.

Ans – c)

The Partnership Firm does not have seperate legal identity from the partners. If any fraud occurs in the hand of any partner. The legal action would be taken against partners not the firm. Assertion is true. The central government has prescribed maximum 50 parters.

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Salary paid to a partner is debited to profit and loss account.

Reason (R): Salary paid to a partner is an appropriation of profit.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is false but Reason (R) is true.

Ans – d)

Explanation:- Salary paid to the partner is the appropriation and recorded at credit side of appropriaton account not at debit side of profit and loss account.

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

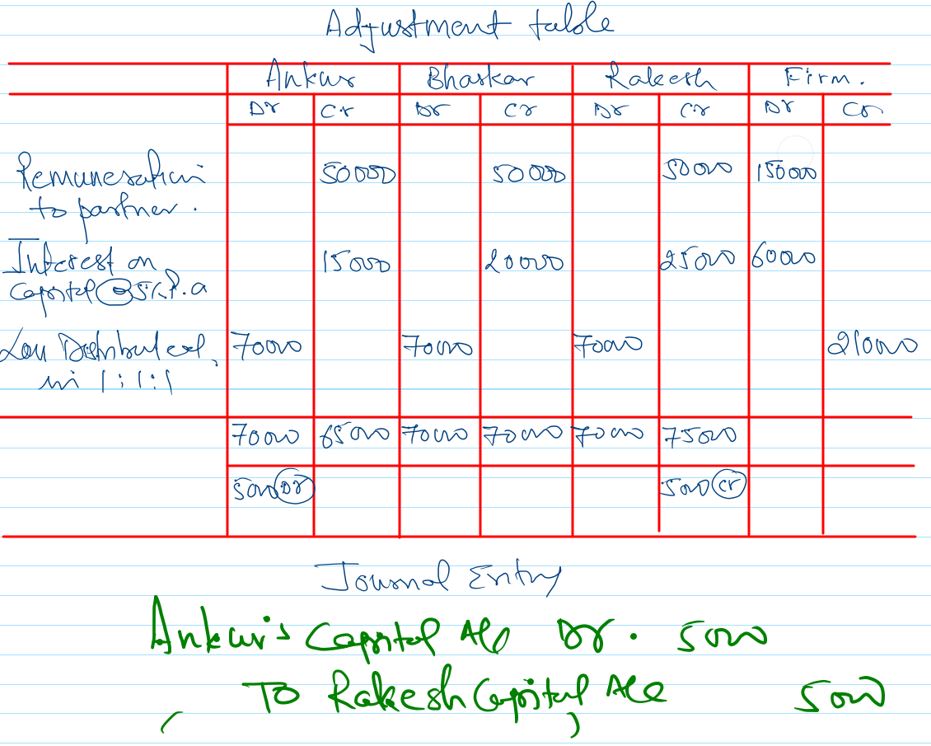

Assertion (A): Ankur, Bhaskar, and Rakesh are partners with capitals of ₹3,00,000; ₹4,00,000, and ₹5,00,000 respectively. The partnership deed provided to allow remuneration to each partner of ₹50,000 p.a. and interest on Capital @ 5% p.a. Profit for the year ended 31st March 2021 of ₹2,10,000 was distributed without allowing remuneration and interest on capital. Rectifying entry for the above will be Dr. Ankur and Cr Rakesh by ₹5,000.

Reason (R): Remuneration and interest to Anku, Bhaskar, and Rakesh are ₹65,000, ₹70,000, and ₹75,000 respectively. Each Partner was credited ₹70,000. As a result, Ankur was excess credited by ₹5,000, and Rakesh was short credited by ₹5,000. Thus, Ankur will be debited and Rakesh will be credited by ₹5,000.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Both Assertion (A) and Reason (R) are not correct.

Ans – a)

Explanation:-

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Each partner carrying on the business is the principal as well as the agent for all the other partners.

Reason (R): Only an active partner is entitled to participate in the conduct of the affairs of its business.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is False

d) Assertion (A) is false but Reason (R) is true.

Ans – c)

Explanation:-Yes, partners are principal and agent as well. No any partner can take part in affair of the business.

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Partners are principals but not the agents of other partners.

Reason (R): As per the definition of partnership, a business can be carried on by all or any of them acting for all. Thus, they are the principals and also the agents.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Only Assertion (A) is correct

d) Assertion (A) is false but the Reason (R) is true.

Ans – d)

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Partnership comes into existence as a result of an agreement among the partners.

Reason (R): The Partnership Act lays that the agreement must be in writing.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is false

d) Assertion (A) is not correct but the Reason (R) is correct.

Ans – c)

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Parul, Prerna, and Nimrat are partners sharing profits in the ratio of 3:2:1. Prerna is guaranteed a minimum profit share of ₹75,000 p.a. after appropriations. Profit for the year after all appropriations were ₹1,80,000. The profit share of Parul and Nimrat will be ₹90,000 and ₹30,000.

Reason (R): The profit share of Parul is ₹75,000 since her actual share is ₹60,000 (₹1,80,000 * 2/6). Balance profit ₹1,05,000 will be distributed between Parul and Nimrat in the ratio of 3:1. Thus, Parul will get ₹78,750 and Nimrat will get ₹26,250.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but Reason (R) is false

d) Assertion (A) is false but the Reason (R) is true.

Ans – d)

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): A partnership deed can have clauses that are different from the provisions of the Partnership Act, 1932 and in such situations, clauses in Partnership Deed prevail over the provisions of the Partnership Act, 1932.

Reason (R): The provisions of the Partnership Act, 1932 apply when the partners have not agreed on a matter (say, profits sharing ratio).

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but the Reason (R) is false

d) Assertion (A) is not correct but the Reason (R) is correct.

Ans – a)

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): The firm’s profits and losses are to be shared equally by all the partners.

Reason (R): The partners must share the profits and losses of the Business.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but the Reason (R) is false

d) Assertion (A) is false but the Reason (R) is true.

Ans – d)

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): It is a necessary condition that all the partners should contribute capital in the firm.

Reason (R): The essential condition is that a written agreement exists to share profits of the business and the business may be carried on by all or any of them acting for all.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but the Reason (R) is false

d) Both Assertion (A) and Reason (R) are false.

Ans – d)

Explanation:- No, it is not necessary that all partners contribute capital to the firm. In certain cases partner does not contribute capital rather provide its name that works as a goodwill to the firm. Thus Assertion is false. It is not necessary to have a written agreement. Aggreement can also be in oral form. Thus Reason is also false.

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Only Capital Account is maintained for each partner under Fluctuating Capital Accounts Method.

Reason (R): Interest on Capital, remuneration (Salary/Commission), and profit share are transferred to the credit of Partner’s Capital Accounts while interest on Drawings and share of losses are transferred to the debit.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but the Reason (R) is false

d) Assertion (A) is false but the Reason (R) is true.

Ans – a)

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): In a specified situation, interest on the Partner’s Capital is shown in the Profit and Loss Account.

Reason (R): Interest on capital is transferred to the debit of the Profit and Loss Account If it is specified to be a charge.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but the Reason (R) is false

d) Assertion (A) is false but the Reason (R) is true.

Ans – a)

Explanation:- Interest on partner’s capital is considered as charge against profit it mentioned in partnership deed and debited to profit and loss account.

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): If drawings by a partner are on different dates and/or amounts of drawings is not the same, interest on drawings is calculated using the Product method.

Reason (R): Interest on Drawings is charged for the period it is drawn by a partner. In case, the amount of drawings and/or period for which it is drawn is not uniform, average methods can not be applied to determine interest on capital.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but the Reason (R) is false

d) Assertion (A) is false but the Reason (R) is true.

Ans – a)

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Partners, distribute profits and losses in their profits sharing ratio and not in the ratio of their capitals.

Reason (R): The amount of appropriations, as per partnership Deed are more than the amount of profit available for distribution, profit is distributed in the ratio of appropriations.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but the Reason (R) is false

d) Assertion (A) is false but the Reason (R) is true.

Ans – b)

Profit is distributed in profit sharing ratio not in the ratio of their capitals. If amount of appropriation is more than tha available profit. Profit is distributed in the ratio of appropriation.

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Rent to a partner is transferred to the debit of Profit and Loss Account but is not transferred to the debit of Profit and Loss Appropriation Account.

Reason (R): Rent to a Partner is an expense that is a charge against profits and not an appropriation of profit. Hence, it is transferred to the debit of the Profit and Loss Account.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but the Reason (R) is false

d) Assertion (A) is false but the Reason (R) is true.

Ans – a)

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Interest on Loan to partner is charged @6% p.a. If partnership Deed does not provide for the charging of interest.

Reason (R): In the absence of Partnership Deed, provisions of the Partnership Act 1932 apply. Thus Interest on Loan to Partner should be charged @6% p.a. Otherwise, interest is allowed at the agreed rate of interest.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but the Reason (R) is false

d) Both Assertion (A) and Reason (R) are false.

Ans – a)

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Interest on Loan by Partner is allowed at the agreed rate of interest and in the absence of agreement, it is allowed @8%.

Reason (R): In the absence of Partnership Deed, interest on Loan by a partner is not allowed.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but the Reason (R) is false

d) Both Assertion (A) and Reason (R) are false.

Ans – d)

Explanation:- Interest on partner’s loan is provided @ 6% p.a.

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Avinash, a partner in the firm gave a loan of ₹5,00,000 to the firm without an agreement to rate of interest. Interest on Loan by Avinash is to be allowed @ 6% p.a.

Reason (R): In the absence of Partnership Deed, provisions of the partnership Act, 1932 apply. Thus, Interest on Loan to Partner should be charged @ 6% p.a.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but the Reason (R) is false

d) Assertion (A) is false but the Reason (R) is correct.

Ans – a)

Explanation:- In the absence of partnership deed. Interest on partners loan is provided @ 6% p.a.

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Amit, Bharat, and Charu are partners in the firm. The partnership deed provided for salary to Amit of ₹ 60,000 p.a. Bharat and Charu also asks for salaries of ₹ 60,000 each. Salaries to Bharat and Charu is to be allowed.

Reason (R): In the absence of Partnership Deed, provisions of the Partnership Act, 1932 apply. Thus, salaries are not to be allowed to them.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but the Reason (R) is false

d) Assertion (A) is false but the Reason (R) is correct.

Ans – a)

Explanation:- In the absence of partnership deed, No salary would be provided.

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Jiten, Karan, and Lalit are partners with capitals of ₹ 2,00,000, ₹ 6,00,000, and ₹ 8,00,000 respectively sharing profits in the ratio 3 : 2 : 1. The partnership deed allowed a salary of ₹ 60,000 p.a. to Jiten and interest on capitals @ 5% p.a. Net Profit for the year is ₹ 1,20,000. Profit will be distributed among partners in their profit-sharing ratio, i.e., 3 : 2 : 1.

Reason (R): distributable profit for the year is not adequate to allow all appropriations. Therefore, divisible profit will be distributed in the ratio of appropriations, i.e., 7 : 3 : 4.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but the Reason (R) is false

d) Assertion (A) is false but the Reason (R) is correct.

Ans – a)Explanation:- Jiten will receive 60,000 as salary + 10,000 as interest on capital, Karan will receive 30,000 as interest on capital, Lalit will receive 40,000 as interest on capital. Total appropriation is 1,40,000 that is greater than available profit 1,20,000. Thus available profit 1,20,000 would be disctributed in ratio of appropriation that is 70000:30000:40000 i.e., 7:3:4

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Mohan, Naman, and Onkar are partners with fixed capitals of ₹ 8,00,000 each. The partnership deed allowed a salary of ₹ 1,00,000 p.a. to Onkar and interest on capitals @ 5% p.a. Net Profit for the year is ₹ 5,00,000. Balance profit will be distributed among them equally.

Reason (R): Distributable profit for the year is adequate to allow all appropriations. Divisible profit will be distributed among the partners equally as is provided in the Partnership Act, 1932.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but the Reason (R) is false

d) Assertion (A) is false but the Reason (R) is correct.

Ans – a)

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Param, Qasim, and Ramesh are partners with fixed capitals of ₹ 8,00,000 each. The partnership deed allowed a salary of ₹ 1,00,000 p.a. to Onkar and interest on capitals @ 5% p.a. Net Profit for the year is ₹ 5,00,000. Amounts of appropriations will be credited to their respective capital accounts.

Reason (R): When Capital Accounts are fixed, all appropriations are credited/debited in the Partner’s Current Accounts.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but the Reason (R) is false

d) Assertion (A) is false but the Reason (R) is true

Ans – d)

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Shyam, Tarun, and Umesh are partners. The Partnership deed provided to charge interest on drawings @ 6% p.a. Each partner withdrew ₹ 5,000 per month at the beginning of the month. The firm incurred a loss of ₹ 1,00,000. Therefore, interest will not be charged on drawings.

Reason (R): Interest on Drawings will be charged @ 6% p.a. on ₹ 60,000 for 6.5 months from each partner. It is a withdrawal against anticipated profit.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but the Reason (R) is false

d) Assertion (A) is false but the Reason (R) is true

Ans – d)

Explanation:- Interest on drawings is the income to the firm. Thus it would be charged even if firm incur losses.

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Varun, Waryam, and Yogesh are partners. The partnership deed provided to charge interest on drawings @ 6% p.a. Varun withdrew ₹ 5,000 per month. In the beginning of the month, Waryam in the middle of the month while Yogesh withdrew at the end of the month. Interest will be charged on drawings of ₹ 60,000 from Varun for 6.5 months, Waryam for 6 months and Yogesh for 5.5 months.

Reason (R): Interest on Drawings is charged at the agreed rate of interest, i.e, @ 6% p.a. on ₹ 60,000 for the period amount is withdrawn by a partner, Varun has drawn in the beginning of the month and therefore, interest will be charged for 6.5 months from him and on the same basis form Waryam and Yogesh for 6 months and 5.5. months respectively.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but the Reason (R) is false

d) Assertion (A) is false but the Reason (R) is true

Ans – a)

Read the following statements: Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Pawan, Raman, and Sharman are partners sharing profits in the ratio of 5 : 3 : 2. Raman is guaranteed a minimum profit share of ₹ 1,00,000 p.a. after appropriations to be borne by Pawan. Net profit for the year ended was ₹ 5,00,000 and after appropriations, it was ₹ 3,00,000. Pawan’s capital account will be debited ₹ 10,000 as a shortfall in Guaranteed profit to Raman.

Reason (R): Profit Share of Raman will be ₹ 90,000 (₹ 3,00,000 * 3/10). Therefore, Pawan’s Capital Account will be debited by ₹ 10,000 to meet the shortfall.

Alternatives:

a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation

of Assertion (A).

b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation

of Assertion (A).

c) Assertion (A) is true but the Reason (R) is false

d) Assertion (A) is false but the Reason (R) is true

Ans – a)

… [Trackback]

[…] Read More Info here on that Topic: commerceschool.in/assertion-reason-mcqs-of-accounting-for-partnership-firm-fundamentals/ […]

… [Trackback]

[…] Find More on on that Topic: commerceschool.in/assertion-reason-mcqs-of-accounting-for-partnership-firm-fundamentals/ […]

… [Trackback]

[…] Info to that Topic: commerceschool.in/assertion-reason-mcqs-of-accounting-for-partnership-firm-fundamentals/ […]

… [Trackback]

[…] Information to that Topic: commerceschool.in/assertion-reason-mcqs-of-accounting-for-partnership-firm-fundamentals/ […]

… [Trackback]

[…] Find More on that Topic: commerceschool.in/assertion-reason-mcqs-of-accounting-for-partnership-firm-fundamentals/ […]

… [Trackback]

[…] Read More Info here to that Topic: commerceschool.in/assertion-reason-mcqs-of-accounting-for-partnership-firm-fundamentals/ […]

… [Trackback]

[…] Information on that Topic: commerceschool.in/assertion-reason-mcqs-of-accounting-for-partnership-firm-fundamentals/ […]

… [Trackback]

[…] Find More on on that Topic: commerceschool.in/assertion-reason-mcqs-of-accounting-for-partnership-firm-fundamentals/ […]