[200] Accountancy MCQs for Class 12 with Answers Chapter 1 Accounting for Partnership Firms — Fundamentals

Free PDF Download of CBSE Accountancy Multiple Choice Questions for Class 12 with Answers Chapter 1 Accounting for Partnership Firms — Fundamentals. Accountancy MCQs for Class 12 Chapter Wise with Answers PDF Download was Prepared Based on Latest Exam Pattern. Students can solve NCERT Class 12 Accountancy Accounting for Partnership Firms — Fundamentals MCQs Pdf with Answers to know their preparation level.

Other Important Links

List of All Chapter MCQs as Per CUET Syllabus of Accountancy

Multiple Choice Questions of Accounting for Partnership firm Basic concepts chapter 1 class 12 Accountancy

If the partnership deed is silent or has not been formulated, then partners are entitled to

a) Salary

b) Commission

c) Interest on the loan

d) Profit share in capital ratio

Ans:- c)

In the absense of the partnership deed. Partners are only entitled to receive the interst on partner’s loan @ 6% p.a. No Salary, commission are allowed. Profit is distributed equally.

In partnership business, partner’s liability is:-

a) in proportion to profit/loss

b) in proportion to capital

c) limited

d) unlimited

Ans:- d)

In partnership business, partner’s liability is unlimited. In caee of loss partner’s net private assets can also be sold to meet the partnership business liability.

If a partner individually carries on any business of the same nature as competing with that to the firm, he shall account for

a) retire from partnership

b) all profits made by him

c) dissolve the firm

d) None of the above

Ans:- b)

In the absense of the partnership deed. Partners are only entitled to receive the interst on partner’s loan @ 6% p.a. No Salary, commission are allowed. Profit is distributed equally.

In a partnership, the manager’s commission is shown in

a) profit and loss account

b) Profit and loss appropriation account

c) Balance Sheet

d) None of the above

Ans:- a)

In a partnership firm, the manager’s commission is considered as charge against profit and is debited to profit & Loss A/c.

In a partnership, interest on partner’s capital is:-

a) debited to profit and loss appropriation account

b) credited to profit and loss appropriation account

c) debited to profit and loss account

d) credited to profit and loss account

Ans:- a)

In the absense of any additional information, Interest on Partner’s capital is considered as appropriation. Thus it is debited to profit & Loss Account as an expenses of the firm.

Read Here:- Assertion Reason MCQs of Fundamentals of Partnership of Accountancy class 12

Read Here:- Matching Type MCQs of Fundamentals of Partnership of Accountancy class 12

The partnership is an association of _ or more person.

a) two

b) seven

c) ten

d) twenty

Ans:- a)

To form a partnership firm atleast two persons are required.

The relationship between persons who have agreed to share profits of a business carried on by all or any of them acting for all is known as

a) Partnership

b) Joint Venture

c) Association of persons

d) Body of Individual

Ans:- a)

The partnership is the relation of the persons who have agreed to share profits of a business carried on by all or any one acting for all. at least two or maximum 50 persons are required to form a partnership firm.

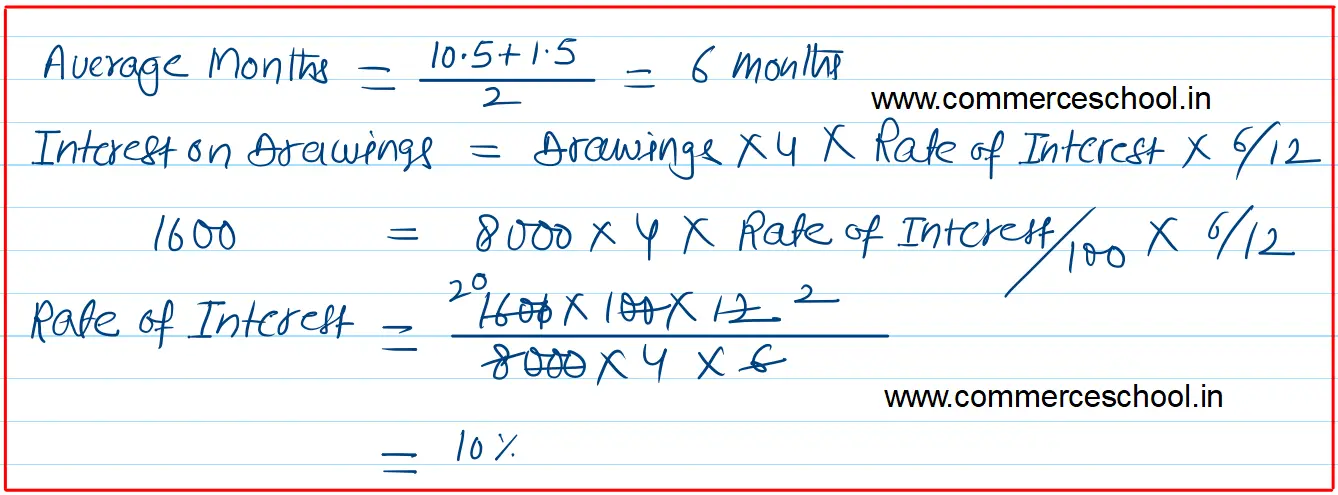

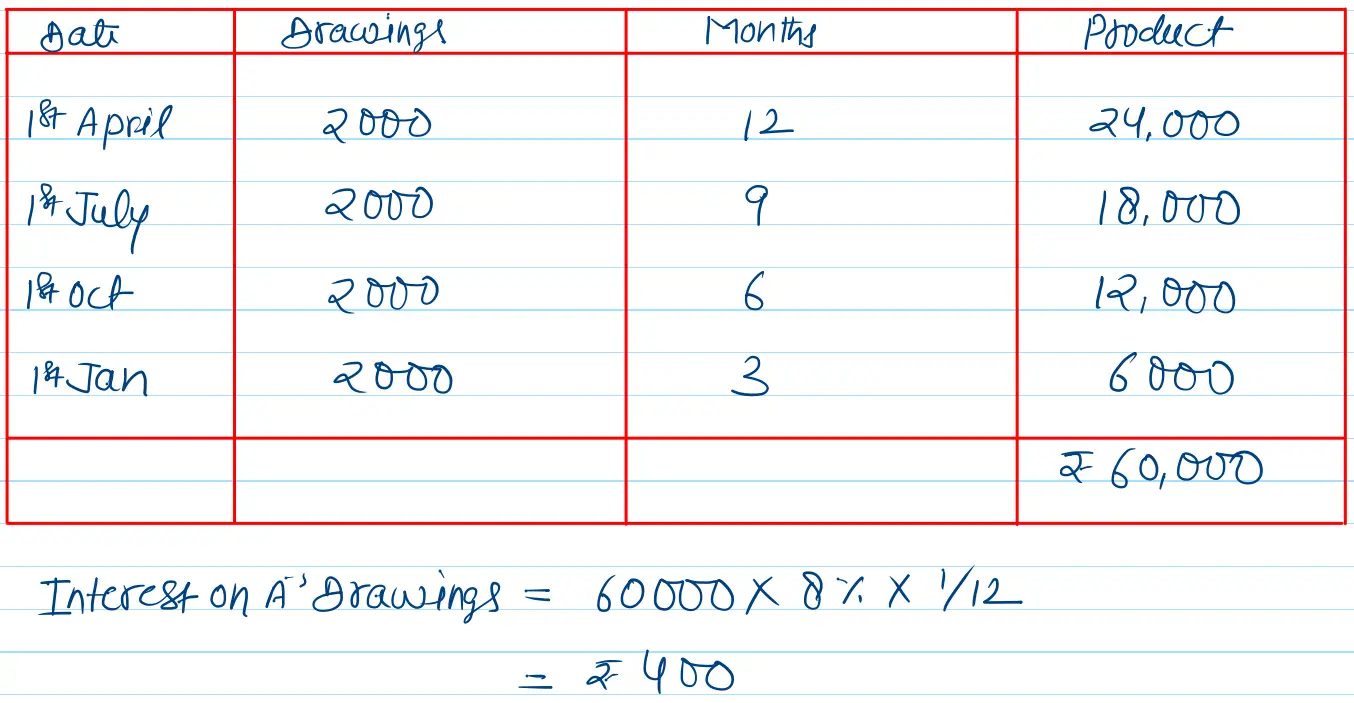

If a partner draws a fixed amount on the first day of every month, then for what period the interest on total drawings is calculated?

a) 5.5 months

b) 6.5 months

c) 6 month

d) None of these

Ans:- b)

Ans:- b)

AS per the short cut method, average of time period of 1st installment and last installment is the total time period in this case.

12 + 1 = 13/2 = 6.5 months

A and B were partners is a firm. They share their profits in the ratio of 2:1. A withdraws an amount of ₹2000 on 1st July 2017. Journalize it.

a) Profit and Loss Appropriation A/c Dr 2000

To A’s capital A/c 2000

b) A’s Capital A/c Dr 2000 Dr 2000

To Profit and Loss A/c 2000

c) A’s Drawings A/c Dr 2000

To Cash/Bank A/c 2000

d) A’s Capital A/c Dr 2000

To A’s Drawings A/c 2000

Ans:- c)

Ans:- c)

Gupta and Bansal are partners in a firm. Gupta withdrew ₹800 per month at the beginning of every month for 6 months ending on 30th September 2017. Bansal withdraw ₹800 per month at the end of every month for 6 months ending on 30th September 2017. Calculate interest on drawings @15% per annum on 30th September 2017.

a) Gupta = ₹320, Bansal = ₹280

b) Gupta = ₹180, Bansal = ₹220

c) Gupta = ₹720, Bansal = ₹720

d) Gupta = ₹210, Bansal = ₹150

Ans:- d)

Calculation of Gupta’s Interest on Drawings

Average Months 6 + 1 = 7/2 = 6.5 months

800 x 6 X 15% X 3.5/12 = ₹ 210

Calculation of Bansal’s Interest on Drawings

Average Months 5 + 0 = 5/2 = 2.5 Months

800 X 6 X 15% X 2.5/12 = ₹ 150

Read Here:- Important MCQs of Goodwill Accountancy class 12

Read Here:- Assertion Reason MCQs of Goodwill Accountancy class 12

Read Here:- Matching Type MCQs of Goodwill Accountancy class 12

Feature of Partnership firm is

a) Two or more persons carrying common business under an agreement.

b) Profits and losses are shared in agreed ratio or as provided in the Partnership Act, 1932

c) Business is carried on by all or any of them acting for all

d) All of the above

Ans:- d)

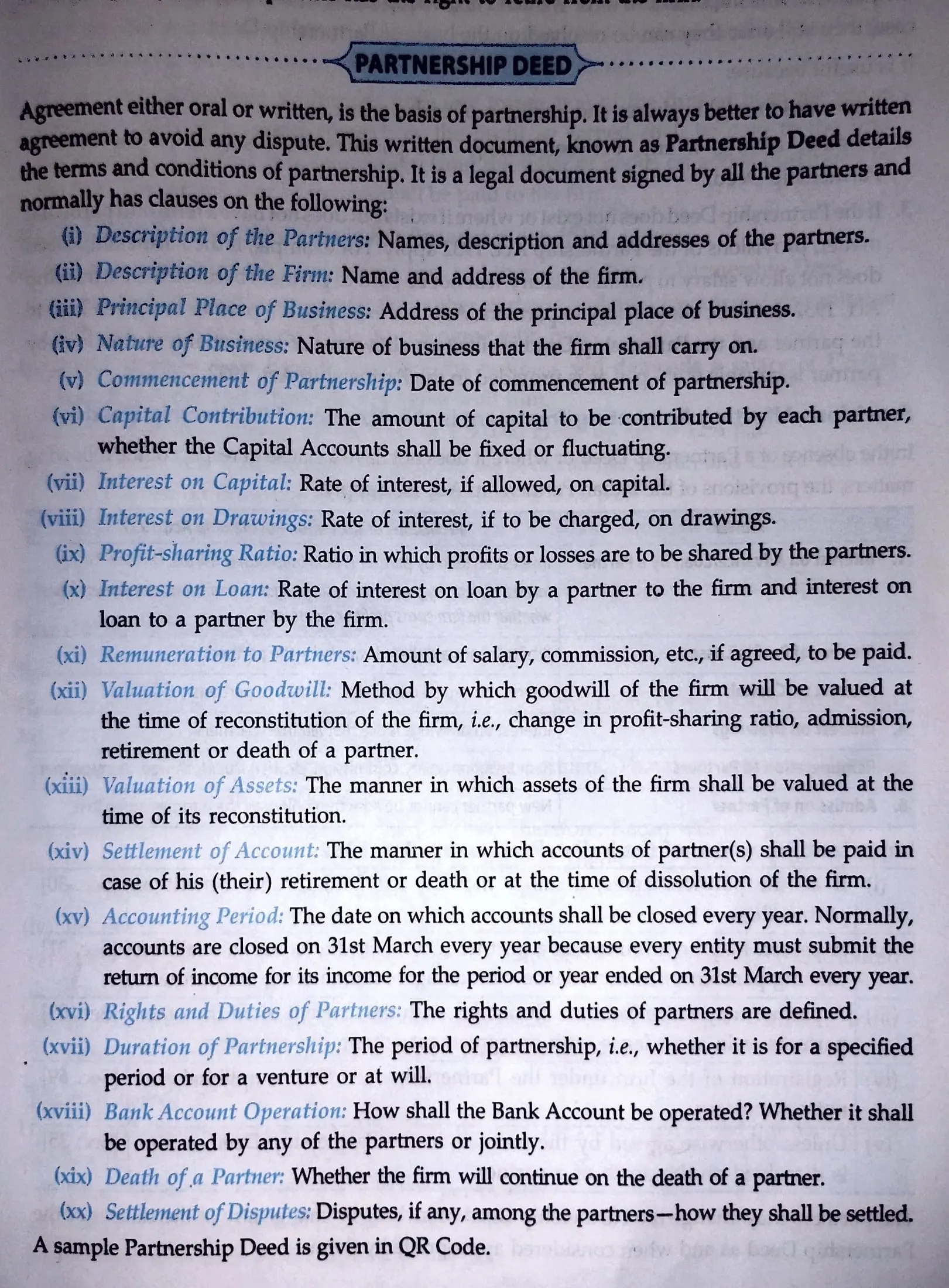

The written agreement among the partners is called

a) Partnership deed

b) Partnership bye-laws

c) Partnership Constitution

d) a Contract

Ans:- a)

The written agreement among the partners is called Partnership Deed. It is also called Articles of Partership, Constitution of Partnership and Partnership Aggreement.

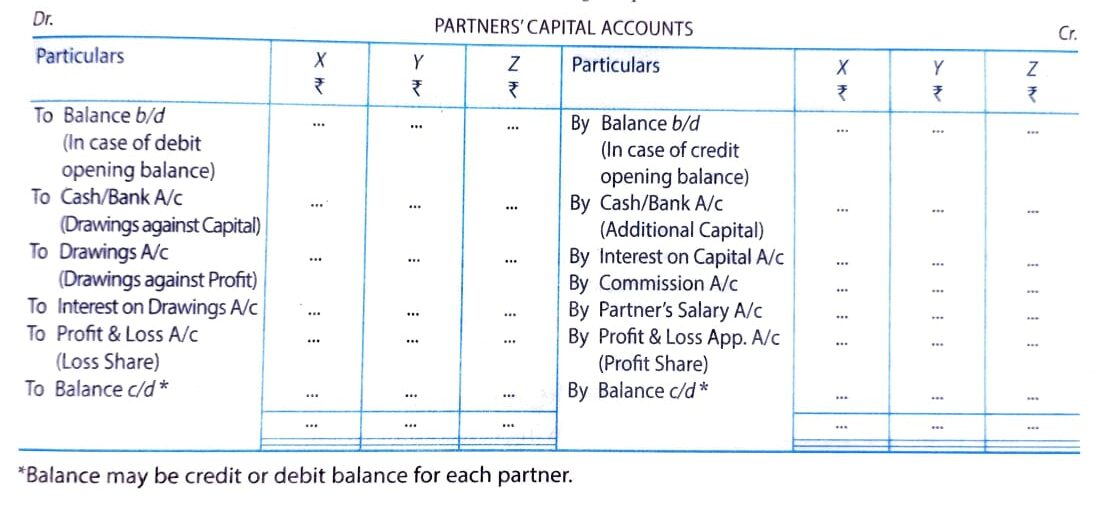

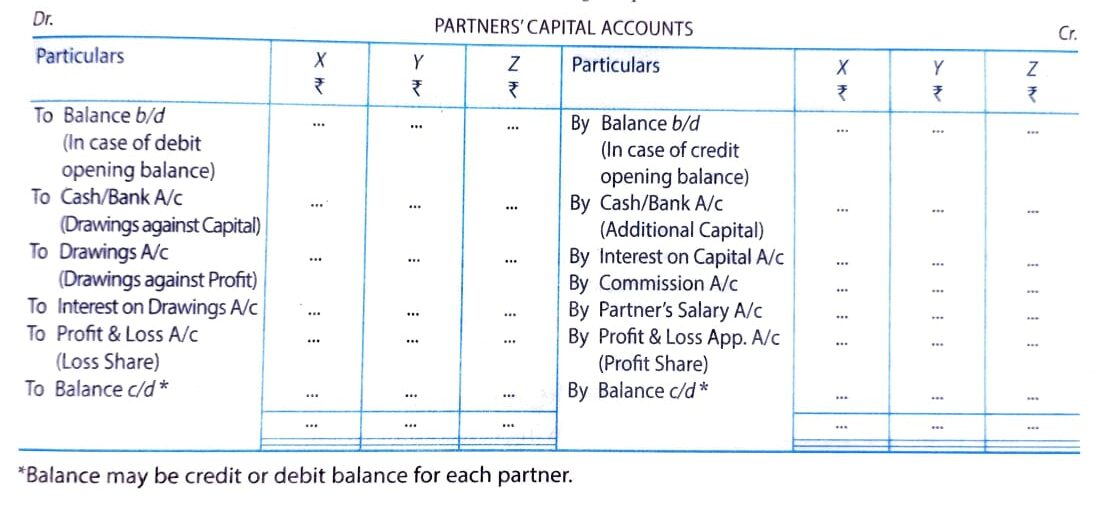

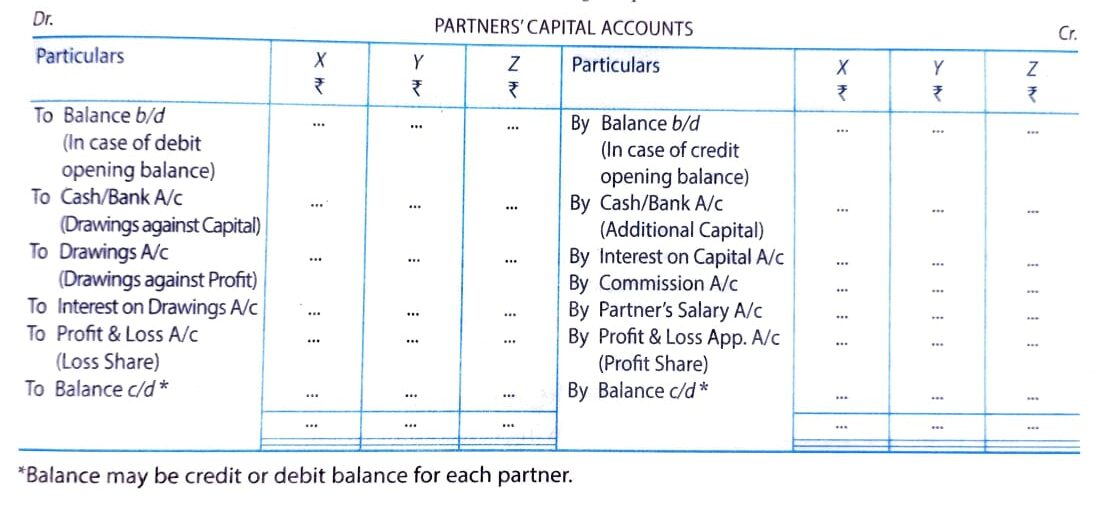

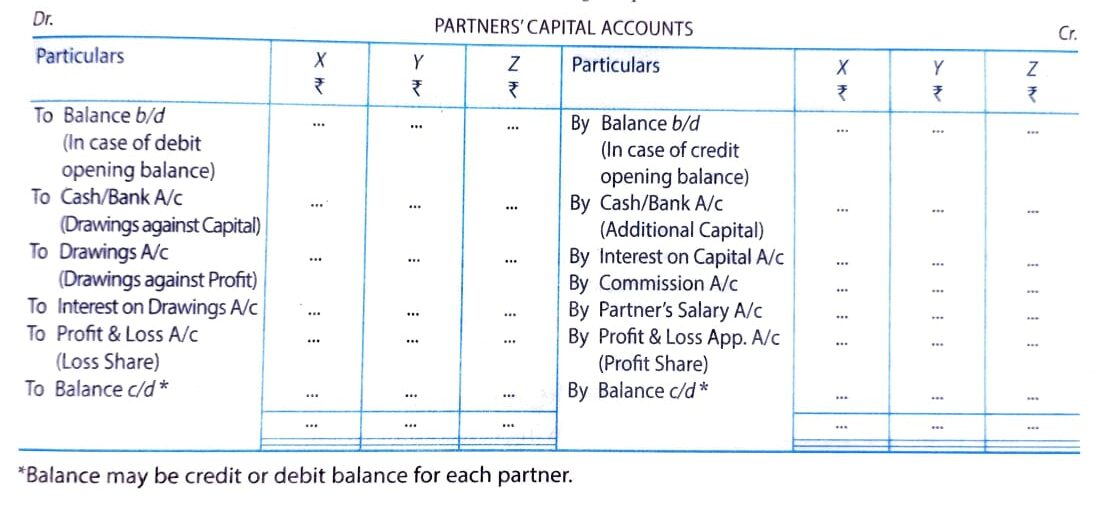

When fluctuating capital method is used, which of the following items are shown on the debit side of the partner’s capital account?

a) Opening debit balance of the capital account

b) Drawings

c) Interest on drawings

d) All of the above

Ans:- d)

A and B were partners in a firm. They share profits in the ratio of 2:3. Their capital account balance as on 1st April 2017 was ₹10,00,000 and ₹20,00,000. Additional capital introduced by them, A = ₹3,00,000, B = ₹2,00,000. Journalize it.

a) Bank A/c Dr. 5,00,000

To A’s Capital A/c 3,00,000

To B’s Capital A/c 2,00,000

b) A’s Capital A/c Dr. 3,00,000

B’s Capital A/c 2,00,000

C’s Capital A/c 5,00,000

c) A’s Capital A/c Dr. 3,00,000

To Bank A/c 3,00,000

d) B’s Capital A/c Dr. 2,00,000

To Bank A/c 2,00,000

Ans:- a)

The liability of the partners in a partnership firm under Indian Partnership Act, 1932 is

a) Limited

b) unlimited

c) No liability

d) Depending on the situation

Ans – b)

Ans:- b)

Because at the time of windup, partners net private assets can also be used to settle external liabilities

Features of a partnership firm are:

a) Two or more persons are carrying common business under and agreement

b) They are sharing profits and losses in the fixed ratio

c) Business is carried by all or any of them acting for all as an agent.

d) All of the above

Ans:- d)

Following are essential elements of a parternship firm except:

a) Altleast two persons

b) There is an agreement between all partners

c) Equal share of profits and losses

d) Partnership agreement is for some business.

Ans:- c)

Read Here:- Important MCQs of Change in Profit Sharing Ratio Accountancy class 12

Read Here:- Assertion Reason MCQs of Change in Profit Sharing Ratio Accountancy class 12

Read Here:- Matching Type MCQ of Change in Profit Sharing Ratio Accountancy class 12

Interest on Capital is allowed on

a) the opening capital

b) the capital at the year-end

c) average capital of the year

d) the capital for the period capital remains invested in the business

Ans:- d)

In the absence of Partnership Deed, the interest is allowed on partner’s capital:

a) @5% p.a.

b) @6% p.a.

c) @12% p.a.

d) No interest is allowed

Ans:- d)

In the absence of the partnership deed, the rule of Indian Partnership Act 1932 apply and no interest on capital is allowed.

In case of partnership the act of any partner is:

a) Binding on all partners

b) Binding on that partner only

c) Binding on all partners except that particular partner

d) None of the above

Ans:- a)

Which of the following statement is true?

a) a minor can not be admitted as a partner

b) a minor can be admitted as a partner, only into the benefits of the partnership.

c) a minor can be admitted as a partner but his rights and liabilities are same of

adult partner

d) None of the above

Ans:- b)

Oustensible partners are those who

a) do not contribute any capital but get some share of profit for lending their name

to the business.

b) contribute very less capital but get equal profit

c) do not contribute any capital and without having any interest in the business, lend their name to the business

d) contribute maximum capital of the business.

Ans:- c)

Sleeping partners are those who

a) take active part in the consudct of the business but provide no capital. However,

salary is paid to them.

b) do not take any part in the conduct of the business but provide capital and share

profits and losses in the agreed ratio.

c) take active part in the conduct of the business but provide no capital. However,

share profits and losses in the agreed ratio.

d) do not take any part in the conduct of the business and contribute no capital.

however, share profits and losses in the agreed ratio.

Ans:- b)

In the absence of a partnership deed, the allowable rate of interest on the partner’s loan account will be:

a) 6% Simple Interest

b) 6% p.a. simple Interest

c) 12% Simple Interest

d) 12% Compounded Annually

Ans:- b)

In the absence of the partnership deed, the rule of Indian Partnership Act 1932 apply and interest on partner’s loan is allowd @ 6% p.a..

A and B are partners in a partnership firm without any agreement. A has given a loan of ₹50,000 to the firm. At the end of the year, the loss was incurred in the business. Following interest may be paid to A by the firm.

a) @5% Per Annum

b) @6% per Annum

c) @6% per Annum

d) As there is a loss in the business, interest can’t be paid

Ans:- b)

In the absence of the partnership deed, the rule of Indian Partnership Act 1932 apply and interest on partner’s loan is allowd @ 6% p.a..

In the absence of the partnership Deed, interest on Capital

a) is allowed @ 6% per annum

b) is allowed @ 10% per annum

c) is allowed at the borrowing rate

d) is not allowed

Ans:- d)

In the absence of the partnership deed, the rule of Indian Partnership Act 1932 apply and no interest on capital is allowed.

Read Here:- Important MCQs of Admission of Partner Accountancy class 12

Read Here:- Assertion Reason MCQs of Admission of Partner Accountancy class 12

Read Here:- Matching Type MCQ of Admission of Partner Accountancy class 12

The relation of partner with the firm is that of:

a) An owner

b) An agent

c) An owner and an agent

d) Manager

Ans:- c)

What should be the minimum number of persons to form a partnership:

a) 2

b) 7

c) 10

d) 20

Ans:- a)

Number of partners in a partnership firm may be:

a) Maximum Two

b) Maximum Ten

c) Maximum One Hundred

d) Maximum Fifty

Ans:- d)

Liability of partner is:

a) Limited

b) Unlimited

c) Determined by Court

d) Determined by Partnership Act

Ans:- b)

Which one of the following is not an essential feature of a partnershp?

a) There must be an agreement

b) There must be a business

c) The business must be carried on for profits

d) The business must be carried on by all partners

Ans:- d)

Every partner is bound to attend diligently to his __ in the conduct of

the business.

a) Rights

b) Meetings

c) Capital

d) Duties

Ans:- d)

In the absence of a Partnership Agreement, Interest on Drawings of a partner is charged

a) @ 8% per annum

b) @ 9% per annum

c) @ 12% per annum

d) No interest is charged

Ans:- d)

In the absence of the partnership deed, the rule of Indian Partnership Act 1932 apply and no interest on drawings is charged.

A and B are partners in a partnership firm without any agreement. A has withdrawn ₹50,000 out of his Capital as drawings. Interest on drawings may be charged from A by the firm:

a) @ 5% Per Annum

b) @ 6% Per Annum

c) @ 6% Per Month

d) No interest can be charged

Ans:- d)

In the absence of the partnership deed, the rule of Indian Partnership Act 1932 apply and no interest on drawings is charged.

A and B are partners in a partnership firm without any agreement. A devotes more time to the firm as compared to B. A will get the following commission in addition to profit in the firm’s profit:

a) 6% of profit

b) 4% of profit

c) 5% of profit

d) None of the above

Ans:- d)

In the absence of the partnership deed, the rule of Indian Partnership Act 1932 apply and no commission to the partners wil be allowed.

Partnership Deed is also called _

a) prospectus

b) Articles of Association

c) Principles of Partnership

d) Articles of Partnership

Ans:- d)

When is the Provision of the Partnership Act enforced?

a) when there is no partnership deed.

b) Where there is a partnership deed but there are differences of opinion between

the partners

c) When capital contribution by the partners varies

d) When the partner’s salary and interest on capital are not incorporated in the

partnership deed.

Ans:- a)

In the absence of Partnership Deed, the interest is allowed on partner’s capital:

a) @ 5% p.a.

b) @ 6% p.a.

c) @ 12% p.a.

d) No interest is allowed

Ans:- d)

In the absence of a partnership deed, the allowable rate of interest on partners loan account will be:

a) 6% Simple Interest

b) 6% p.a. Simple Interest

c) 12% Simple Interest

d) 12% Compounded Annually

Ans:- b)

A and B are partners in partnership firm without any agreement. A has given a loan of ₹ 50,000 to the firm. At the end of year loss was incurred in the business. following interest may be paid to A by the firm:

a) @ 5% per annum

b) @ 6% per annum

c) @ 6% per annum

d) as there is a loss in the business, interest can not be paid

Ans:- b)

In the absence of Partnership deed, the following rule will apply:

a) No interest on capital

b) Profit sharing in capital ratio

c) Profit based salary to working partner

d) 9% p.a. interest on drawings

Ans:- a)

In the absence of the partnership deed, the rule of Indian Partnership Act 1932 apply and no interest on capital, drawings is allowed. no interest is charged on drawings, no salary and commission is allowed to partners. profits distributed equally and interest on partner’s loan is allowed @ 6% p.a.

Read Here:- Important MCQs of Financial Statement of Company Accountancy class 12

Read Here:- Assertion Reason MCQs of Financial Statement of Company Accountancy class 12

Read Here:- Matching Type MCQs of Financial Statement of Company Accountancy class 12

In the absence of Partnership Deed, the profit of a firm is distributed among the partners

a) in the ratio of capital

b) Equally

c) in the ratio of time devoted to the firm’s business

d) according to the managerial abilities of the partners

Ans:- b)

In the absence of the partnership deed, the rule of Indian Partnership Act 1932 apply and profit is distributed equally.

In the absence of agreement, partners are not entitled to:

a) Salary

b) Commission

c) Equal share in profit

d) Both a) and b)

Ans:- d)

In the absence of the partnership deed, the rule of Indian Partnership Act 1932 apply and no interest on capital, drawings is allowed. no interest is charged on drawings, no salary and commission is allowed to partners. profits distributed equally and interest on partner’s loan is allowed @ 6% p.a.

Interest on capital will be paid to the partners if provided for in the partnership deed but only out of:

a) Profit

b) Reserves

c) Accumulated Profits

d) Goodwill

Ans:- a)

If partnership deep provided, interest on capital is provided to the partners only out of profits. as it is the appropriation out of profit. In the case of loss interest on capital is not provided if no extra information is given. sometimes question ask to consider the interest on capital as charge against profit, in this case, interest on capital is provided irrestpective of profit or loss.

In the absence of agreement, partners are entitled to

a) Salary

b) Commission

c) Interest on Loans and Advances

d) Profit Share in Capital Ratio

Ans:- c)

In the absence of agreement (partnership deed), the rules of Indian Partnership Act 1932 apply.Thus No interest on capital and drawing is provided, no commission and salary to partners are provided. profit is distributed equally. interest on partner’s loans and advances are provided @ 6% p.a.

A and B are partners in a partnership firm without any agreement. A has withdrawn ₹ 50,000 out of his drawings. Interest on drawings may be charged from A by the firm:

a) @ 5% Per Annum

b) @ 6% Per Annum

c) @ 6% Per Month

d) No interest can be charged

Ans:- d)

A and B are partners in a partnership firm without any agreement. A devotes more time for the firm as compare to B. A will get the following commission in addition to profit in the firms profit:

a) 6% of profit

b) 4% of profit

c) 5% of profit

d) None of the above

Ans:- d)

In the absence of partnership deed, the following rule will apply:

a) No Interest on capital

b) Profit sharing in capital ratio

c) Profit based salary to working partner

d) 9% p.a. interest on drawings

Ans:- a)

In the absence of agreement, partners are not entitiled to:

a) Salary

b) Commission

c) Equal share in profit

d) Both a) and b)

Ans:- d)

Interest on capital will be paid to the partners if provided for in the partnership deed but only out of:

a) Profits

b) Reserves

c) Accumulated Profitd

d) Goodwill

Ans:- a)

As per Indian Partnership Act, 1932, If a partnership Deed does not exist partners get

a) Salary

b) Interest on Capital

c) Equal Profit Share

d) Commission

Ans:- c)

In the absence of agreement (partnership deed), the rules of Indian Partnership Act 1932 apply.Thus No interest on capital and drawing is provided, no commission and salary to partners are provided. profit is distributed equally. interest on partner’s loans and advances are provided @ 6% p.a.

Read Here:- Important MCQs of Financial Statement Analysis Accountancy class 12

Read Here:- Assertion Reason MCQs of Financial Statement Analysis Accountancy class 12

Read Here:- Matching Type MCQs of Financial Statement Analysis Accountancy class 12

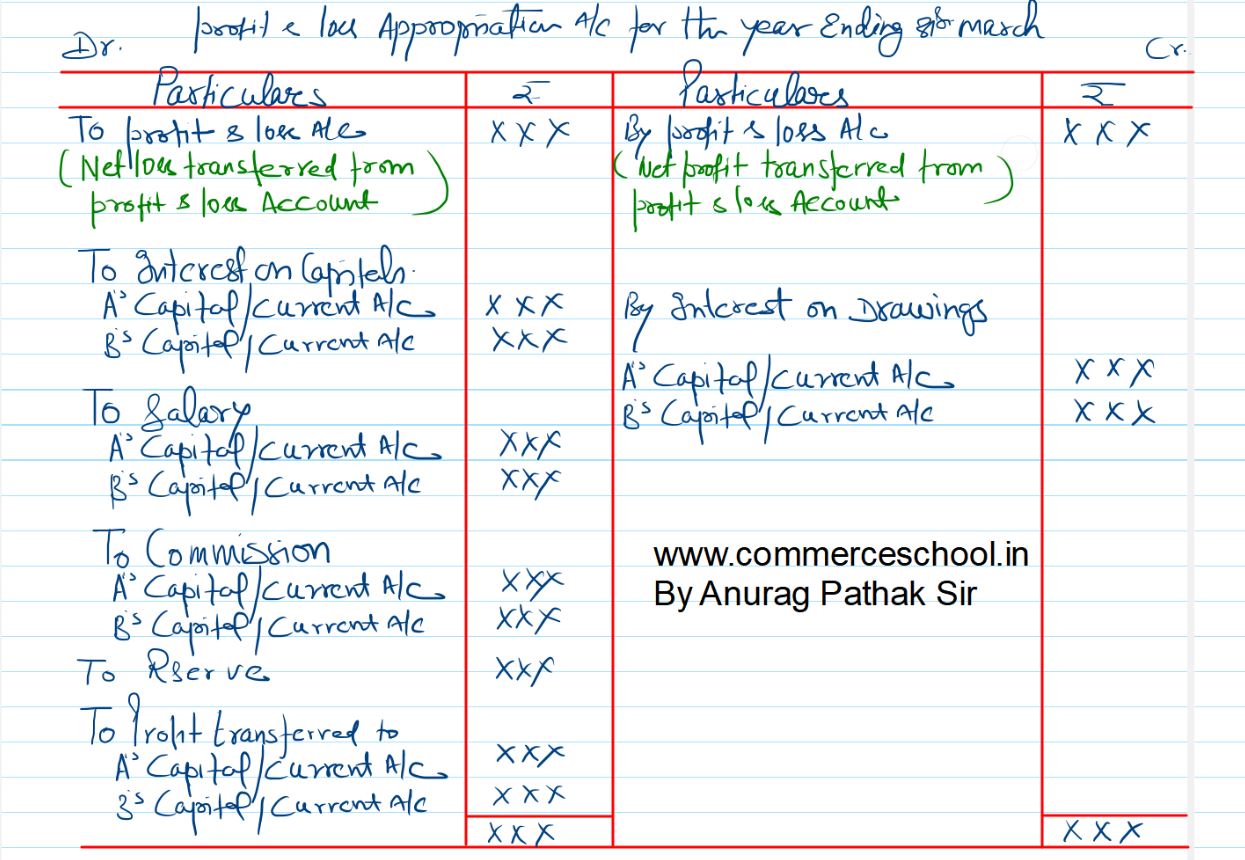

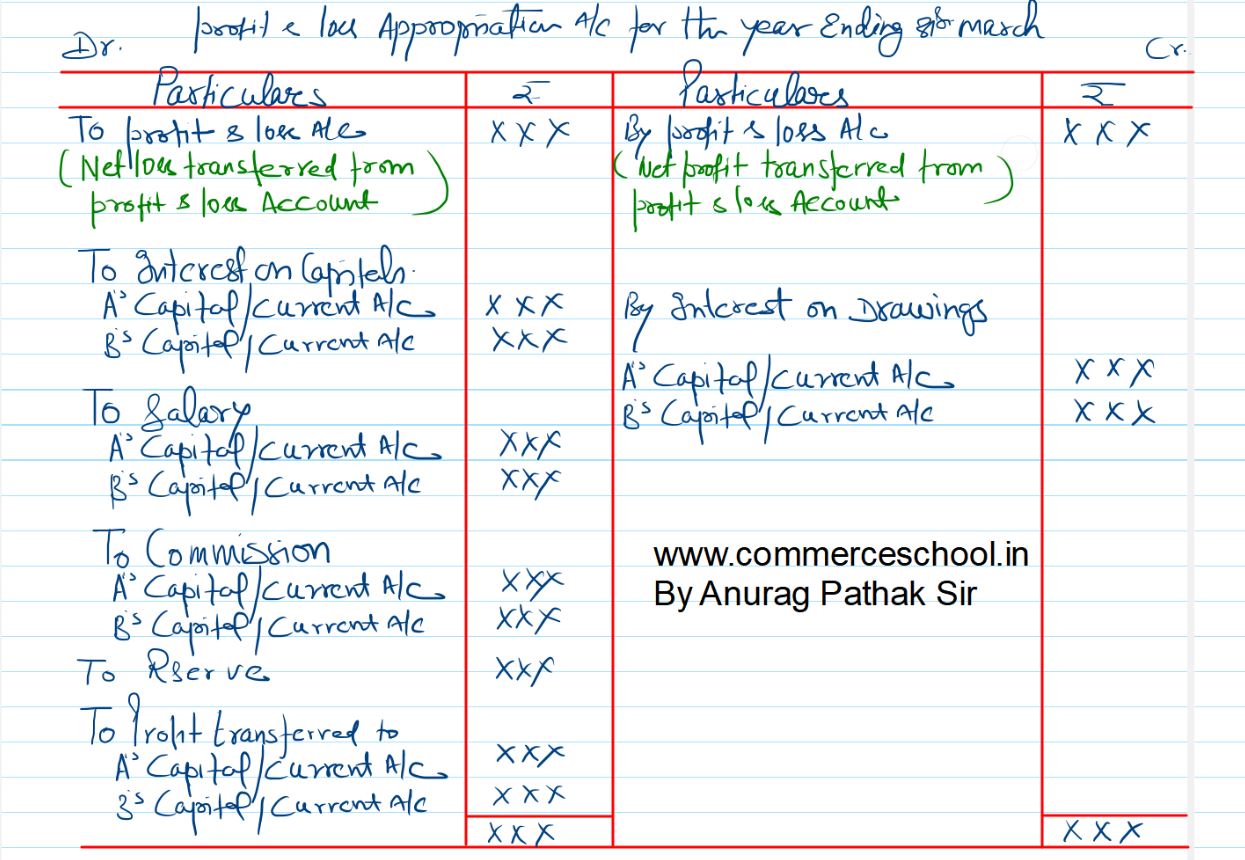

Which one of the following items can not be recorded in the profit and loss appropriation account?

a) Interest on capital

b) Interest on drawings

c) Rent paid to partners

d) Partners salary

Ans:- c)

If any loan or advance is provided by partner, balance of such loans account should be transferred to:

a) B/S Assets side

b) B/S Liability side

c) Partner’s capital A/c

d) Partner’s Current A/c

Ans:- b)

In the absence of partnership deed, partners share profits or losses:

a) In the ration of their capitals

b) In the ratio decided by the court

c) Equally

d) In the ratio of time devoted

Ans:- c)

In the absence of partnership deed:

a) Interest will not be charged on partner’s drawings

b) Interest will be charged @ 5% p.a. on partners drawings

c) Interest will be charged @ 5% p.a. on partner’s drawings

d) Interset will be charged @ 12% p.a. on partner’s drawings

Ans:- a)

In the absence of express agreement, interest @6% p.a. is provided:

a) On opening balance of partner’s capital accounts

b) On closing balance of partner’s capital accounts

c) on loan given by partners to the firm

d) On opening balance of partner’s current accounts

Ans:- c)

Which of the following items is not dealt through profit an loss appropriation account?

a) Interest on Partner’s Loan

b) Partner’s Salary

c) Interest on Partner’s Capital

d) Partner’s Commission

Ans:- a)

Is rent paid to a partner appropriation of profits?

a) It is appropriations of profit

b) It is not appropriations of profit

c) If partner’s contribution as capital is maximum

d) If partner is a working partner

Ans:- b)

Which one of the following items can not be recorded in the profit and loss appropriation account?

a) Interest on capital

b) Interest on drawings

c) Rent paid to partners

d) Partner’s salary

Ans:- c)

Rent paid to partners is a charge against profit. Thus it is recorded at the debit side of profit & Loss A/c as expenses

If any loan or advance is provided by the partner then, the balance of such loan account should be transferred to:

a) B/S Assets side

b) B/S Liability Side

c) Partner’s Capital A/c

d) Partner’s Current A/c

Ans:- b)

Loan and advances provided by the partners to the firm is a liability. Thus it is shown as the liabilities side of the firm Balance Sheet.

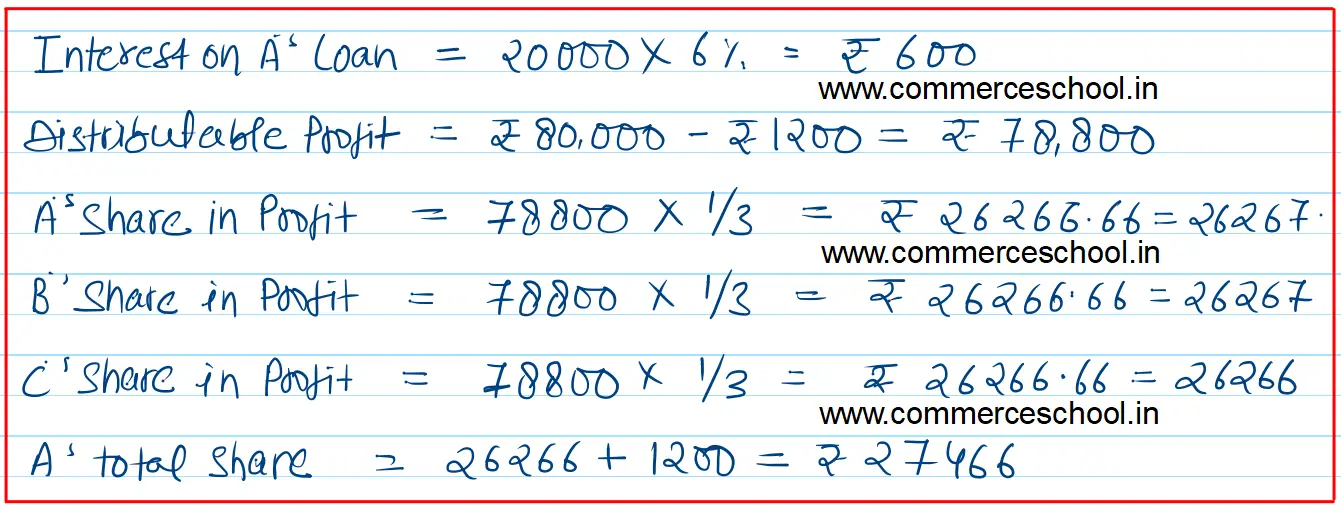

A, B and C were partners with a capital of ₹50,000; ₹40,000, and ₹30,000 respectively carrying on business in partnership. The firm’s reported profit for the year was ₹80,000. As per the provision of the Indian Partnership Act, 1932, find out the share of each partner in the above amount after taking into account that no interest has been provided on an advance by A of ₹20,000 in addition to his capital contribution on 1st April.

a) ₹26,267 for Partner B and C and ₹27,466 for Partner A

b) ₹26,667 each partner

c) ₹33,333 for A ₹26,667 and ₹20,000 for C

d) ₹30,000 for each partner

Ans:- a)

In the absence of agreement (partnership deed), the rules of Indian Partnership Act 1932 apply.Intereset on A’s loan is provided @6% p.a. Profit is distributed equally.

Read Here:- Important MCQs of Accounting Ratios Accountancy class 12

Read Here:- Assertion Reason MCQs of Accounting Ratios Accountancy class 12

Read Here:- Matching Type MCQs of Accounting Ratios Accountancy class 12

The relationship between the partners is of

a) Close relatives

b) Agent and Principal

c) Junior-Senior Relationship

d) Senior subordinate Relationship

Ans – b)

Ans:- b)

Every partner is both an agent and a principal. He is an agent of other partners as he represents them and thereby binds them through his acts. He is principal as he too can be bound by the acts of other partners. The above lines depict which of the following features.

In the absence of a specific provision in the Partnership deed, as to salary and remuneration, the amount payable to him as salary and remuneration will be

a) ₹ 15,000 p.m.

b) ₹ 20,000 p.m.

c) ₹ 10,000 p.m.

d) Nil

Ans:- d)

In the absense of partnership deed, rules of Indian Partnership Act 1932 Apply. No salary and remuneration is provided to the partners.

Read Here:- Important MCQs of Money and Banking Macroeconomics Class 12

Read Here:- Assertion Reason MCQs of Money and Banking Macroeconomics Class 12

Read Here:- Matching Type MCQs of Money and Banking Macroeconomics Class 12

Read Here:- Case/source Based MCQs of Money and Banking Macroeconomics class 12

Profit and Loss Appropriation Account is prepared by

a) Sole trader firm

b) Partnership firm

c) Both a) and b)

d) None of these

Ans:- b)

Profit & Loss Appropriation account is the extension of the Profit & Loss A/c It is prepared in the partnership firm to appropriate the profit among the partners.

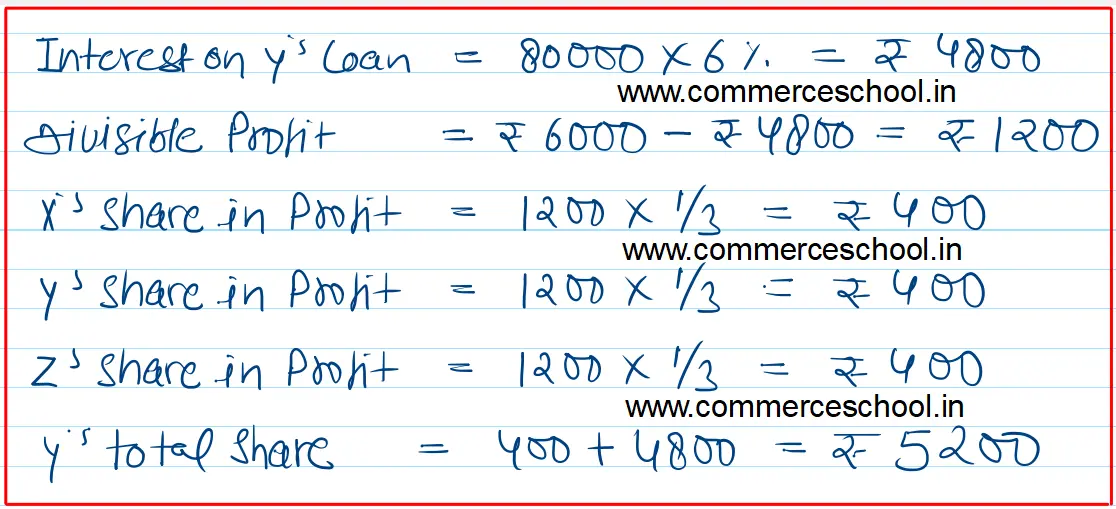

X, Y, and Z are partners in a firm. At the time of the division of profit for the year, there was a dispute between the partners. Profit before interest on partner’s capital was ₹6,000 and Y determined interest @24% p.a. on his loan of ₹80,000. There was no agreement on this point. Calculate the amount payable to X, Y, and Z respectively.

a) ₹2,000 to each partner

b) Loss of ₹4,400 for X and Z; Y will take ₹14,800

c) ₹400 for X, ₹5,200 for Y, and ₹400 for Z

d) None of the above

Ans:- c)

In the absence of agreement (partnership deed), the rules of Indian Partnership Act 1932 apply.Intereset on A’s loan is provided @6% p.a. Profit is distributed equally.

X Y and Z are partners in a firm. At the time of the division of profit for the year, there was a dispute between the partners. Profit before interest on partner’s capital was ₹6,00,000 and Z demanded a minimum profit of ₹5,00,000 as his financial position was not good. However, there was no written agreement on this point.

a) Other partners will pay Z the minimum profit and will share the loss equally.

b) Other partners will pay Z the minimum profit and will share the loss in the capital ratio

c) X and Y will take ₹50,000 each and Z will take ₹5,00,000

d) ₹2,00,000 to each of the partners

Ans:- d)

In the absence of the prtnership deed, provisions of indian partnership act 1932 apply. no interest on capital is allowed to the partners. the profit is distributed equally.

X, Y and Z will share profit of ₹ 6,00,000 in 1 : 1 : 1 i.e., 2,00,000 each.

In the absence of partnership deed or the partnership being silent, the Partnership Act, 1932 provides for no interest on

a) Drawings

b) Capital

c) Both a) and b)

d) Partner’s Loan

Ans – c)

Ans:- c)

In the absence of the prtnership deed, provisions of indian partnership act 1932 apply. no interest on capital and drawings is allowed and charged to the partners. the profit is distributed equally.Interest on partner’s loan is provided @ 6% p.a.

In the absence of agreement, _______ % interest is charged on the partner’s loan.

a) 6%

b) 6% p.a.

c) 12%

d) 12% p.a.

Ans:- b)

In the absence of the prtnership deed, provisions of indian partnership act 1932 apply. Interest on partner’s loan is provided @ 6% p.a.

Read Here:- Important MCQs of Government Budget Macroeconomics Class 12

Read Here:- Assertion Reason MCQs of Government Budget Macroeconomics class 12

Read Here:- Matching Type MCQs of Government Budget Macroeconomics class 12

In the absence of partnership deed, _________ partner gets more share of profit.

a) Sleeping

b) Active

c) Actual

d) No one

Ans:- d)

In the absence of the prtnership deed, provisions of indian partnership act 1932 apply. Profit is distributed equally among partners.

In the absence of an agreement to the contrary, the partners are

a) entitled to interest @ 6% p.a. on their capitals, only if there are profits

b) entitled to interest @ 9% p.a. on their capitals, only if there are profits

c) entitled to interest on their capitals at the bank rate, only if there are profits

d) not entitled to interest on their capitals

Ans:- d)

In the absence of the prtnership deed, provisions of indian partnership act 1932 apply. Interest on partner’s capital is not allowed.

Profit and Loss Appropriation Account is prepared to

a) Distribute the profit and loss for the year among the partners

b) Settle the dispute among the partners

c) Determine the profit remaining for distribution for the year after appropriation

d) Distribute the profit for the year among the partners

Ans:- a)

Profit & Loss Account appropriation account is the extention of profit & Loss A/c and is prepared to distribute the profit and loss among the partners for the year.

Which of the following items is not dealt through the Profit and Loss Appropriation Account?

a) Interest on Partner’s Loan

b) Partner’s Salary

c) Interest on Partner’s Capital

d) Partner’s Commission

Ans:- a)

Explanation:- Interest on partner’s loan is considered as charge against profit and is debited to profity and loss account.

When drawings of an equal amount are made during a year, at the beginning of every month, the average period is ______ months.

a) 5.5

b) 6

c) 6.5

d) 7

Ans:- c)

Explanation:- Average period = average of months of first installment and last instalment i.e., 12 + 1 = 13/2 = 6.5 months.

Read Here:- Important MCQs of Foreign Exchange Rate Macroeconomics class 12

Read Here:- Assertion Reason MCQs of Foreign Exchange Rate Macroeconomics class 12

Read Here:- Matching Type MCQs of Foreign Exchange Rate Macroeconomics class 12

Salary to a partner is _______ with respect to profit.

a) Charge

b) appropriation

c) Both a) and b)

d) None of these

Ans:- b)

Explanation:- salary to a partner is considered as appropriation and is debited to profity & Loss Appropriation account as it is provided when there is profit. in case of lose salary to a pratner is provided.

With context to the debit side of the partner’s current account, pick the odd one out.

a) Drawings

b) Interest on Drawings

c) Salary

d) None of the above

Ans:- c)

Explanation:- salary is credited to the partner’s current A/c.

On 1st June 2018, a partner introduced in the firm additional capital of ₹50,000. In the absence of partnership deed, on 31st March 2019 he will receive interest:

a) ₹3,000

b) Zero

c) ₹2,500

d) ₹1,800

Ans:- b)

Explanation:- In the absense of a partnership deed no interest on capital is allowed to the partners.

On 1st January 2019, a partner advanced a loan of ₹1,00,000 to the firm. In the absence of agreement, interest on loan on 31st March 2019 will be:

a) Nil

b) ₹1,500

b) ₹3,000

d) ₹6,000

Ans:- b)

Explanation:- In the absense of the partnership deed, the interest on partner’s loan is provided @ 6% p.a.

Interest on Partner’s Loan = 1,00,000 X 6% X 3/12 = ₹ 1,500

A partner introduced additional capital of ₹30,000 and advanced a loan of ₹40,000 to the firm at the beginning of the year. Partner will receive year’s interest:

a) ₹42,00

b) ₹2,400

c) ₹Nil

d) ₹1,800

Ans:- b)

Explanation:- As interest on partner’s capital and loan is not given. Thus it is assumed there is no agreement among the parnters about it. Thus in the absense of the paratnership deed, no interest on partner’s capital is allowed, interest on partner’s loan is allowed @ 6% p.a.

Thus total interest received by Partner = 40,0000 X 6% = ₹ 24,00

Read Here:- Important MCQs of Balance of Payments Macroeconomics class 12

Read Here:- Assertion Reason MCQs of Balance of Payments Macroeconomics class 12

Read Here:- Matching Type MCQs of Balance of Payments Macroeconomics class 12

A partnership deed should provide _________.

a) Place of business

b) nature of business

c) name of partners

d) All of these

Ans:- d)

Explanation:-

In a partnership, commission to partners will be given from

a) Current year’s profit

b) reserves

c) goodwill

d) All of these

Ans:- a)

Explanation:- Commission to partner is an appropriation of profits. Thus it is given out of profits of the current year. In case of loss no commission to the partner is provided. >

Which of these is not a feature of partnership?

a) At least two persons

b) Conduct of business for profit

c) Written agreement between all partners

d) Partners are agents and principles to business

Ans:- c)

Explanation:- Agreement between the partners can be oral or written. It is not mandatory to have a written agreement. >

The item that will not be shown in the debit of the Profit and Loss Appropriation Account is

a) Interest on capital

b) Commission to a partner

c) Interest on Drawings

d) Salary to partners

Ans:- c)

Explanation:- Interest on Drawings is shown at the credit side of the Profit & Loss Appropriation A/c as income to the firm.

Pick the odd one out of the following

a) Rent to Partner

b) Manager’s Commission

c) Interest on Partner’s Loan

d) Interest on partner’s Capital

Ans:- d)

Explanation:- Rent to partner, Manager’s Commission, interest on Partner’s loan are charge against profit and are shown at the debit side of Profit & Loss A/c. Whereas, Interest on partner’s capital is an appropriation and is shown at the debit side of Profit & Loss A/c

Read Here:- Important MCQs of Nature and Significance of Management BST class 12

Read Here:- Assertion Reason MCQs of Nature and Significance of Management BST class 12

Read Here:- Matching Type MCQs of Nature and Significance of Management BST class 12

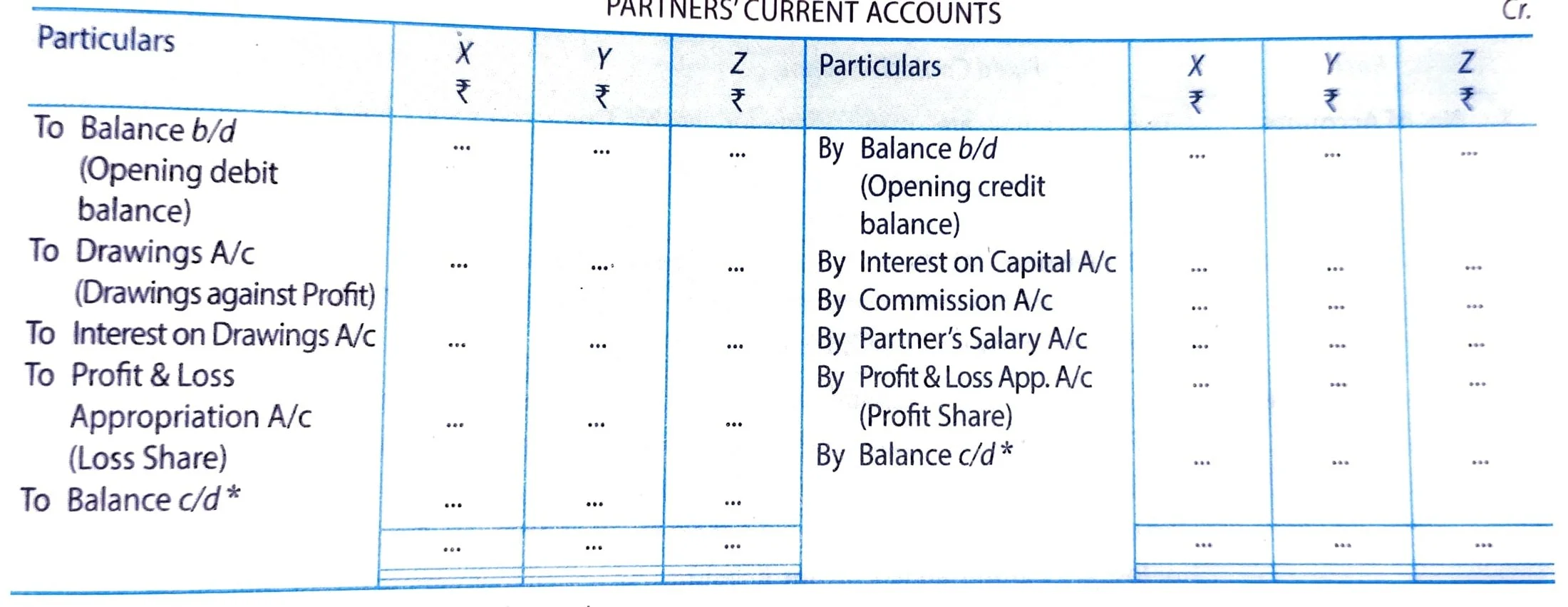

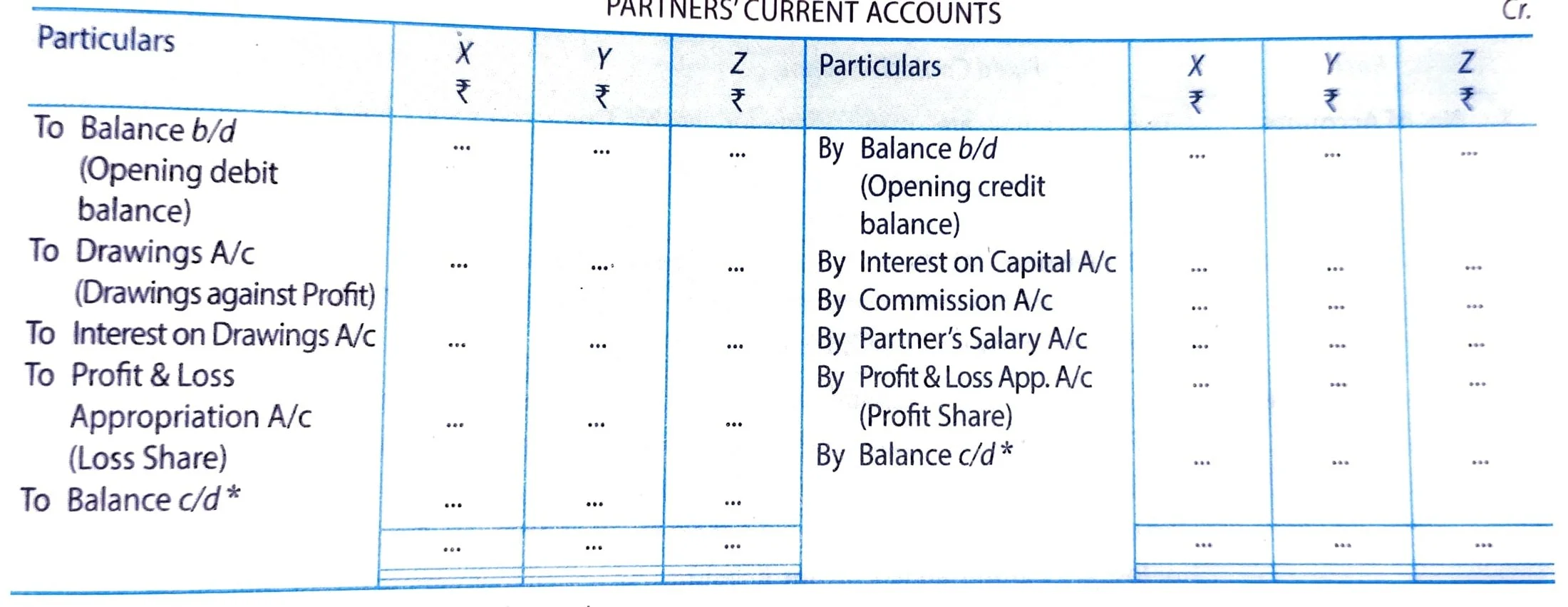

Current Accounts of Partners are maintained if

a) Capitals are fixed

b) Capitals are fluctuating

c) Capitals are fixed or fluctuating

d) it is decided by the Partners

Ans:- a)

Explanation:- In case of fixed capital Method. Current Accounts of partners are maintained.

Articles of Partnership are also known as ________.

a) Partnership Prospectus

b) Partnership Deed

c) Principles of Partnership

d) None of the above

Ans:- b)

Explanation:- A partnership deed is also called partnership agreement or constitution of partnership or articles of partnership

What is the average period in case the partner withdraws consistently at the end of each quarter for a year?

a) 4.5

b) 5.5

c) 6.5

d) 7.5

Ans:- a)

Explanation:- Average period is the average of time period of 1st withdrawls and last withdrawls

Average Period = 9 + 0 = 9/2 = 4.5 Months

On 1st October 2020, Zayn extended a loan to his partnership firm (without any agreement) of ₹10,000. His interest for the year ending 31st December,

2020 is

a) ₹600

b) ₹300

c) ₹150

d) ₹Nil

Ans:- c)

Explanation:- In the absence of the partnership deed interest on partners loan is provided @ 6% p.a.

Interest on Zayn’s Loan = 10,000 X 6% X 3/12 = ₹ 150

In the absence of partnership deed, partners share profits or losses:

a) In the ratio of their capitals

b) In the ratio decided by the court

c) Equally

d) In the ratio of time devoted

Ans:- c)

Explanation:- In the absence of the partnership deed , the provision of Indian Paratnership Act 1932 apply and profit is shared by partners equally.

Read Here:- Important MCQs of Principles of Management BST class 12

Read Here:- Assertion Reason MCQs of Principles of Management BST class 12

Read Here:- Matching Type MCQs of Principles of Management BST class 12

In the absence of Partnership Deed:

a) Interest will not be charged on partner’s drawings

b) Interest will be charged @ 5% p.a. on partner’s drawings

c) Interest will be charged @ 6% p.a. on partner’s drawings

d) Interest will be charged @ 12% p.a. on partner’s drawings

Ans:- a)

Explanation:- In the absence of the partnership deed , the provision of Indian Paratnership Act 1932 apply and No interest is charged on partner’s drawings.

In the absence of an agreement, interest @ 6% p.a. is provided

a) On the opening balance of partner’s capital accounts

b) On the closing balance of partner’s capital accounts

c) On loan given by partners to the firm

d) On the opening balance of partner’s current accounts

Ans:- c)

Explanation:- In the absence of the partnership deed , the provision of Indian Paratnership Act 1932 apply and Interest on Partner’s loan is provided @ 6% p.a. Interest on partners capital and current account is not allowed.

Aman is a partner of Jivan firm with a fixed capital of ₹ 9,00,000. He withdrew ₹ 60,000 during the financial year 2018-19. What will be the journal entry?

a) Drawing A/c Dr. 60,000

To Aman’s Current A/c 60,000

b) Drawings A/c Dr. 60,000

To Aman’s Capital A/c 60,000

c) Aman’s Current A/c Dr. 60,000

To Drawings A/c 60,000

d) Aman’s Capital A/c Dr. 60,000

To Drawings A/c 60,000

Ans:- c)

Explanation:- In the fixed capital method, Partner’s drawings is debited to the partner’s current account as it is transaction of recurring nature..

E, F, and G are partners sharing profits in the ratio of 3:3:2. As per the partnership agreement, G is to get a minimum amount of ₹ 80,000 as his share of profits every year and any deficiency on his account is to be personally borne by E. The net profit for the year ended 31st March,

2020 amounted to ₹ 3,12,000. In this case, ____ was the amount of deficiency borne by E.

a) ₹ 1,000

b) ₹ 4,000

c) ₹ 8,000

d) ₹ 2,000

Ans:- d)

Explanation:- G’s share in profit = 3,12,000 x 2/8 = ₹ 78,000

Deficnency of G = ₹ 80,000 – ₹ 78,000 = ₹ 2,000

E will bear ₹ 2,000.

Which of the following items is not dealt with through the Profit and Loss Appropriation Account?

a) Interest on Partner’s Loan

b) Partner’s Salary

c) Interest on Partner’s Capital

d) Partner’s Commission

Ans:- a)

Explanation:- Interest on Partner’s loan is considered as a charge against profit and is recorded at the debit side of Profit & Loss Account as an expenses.

Read Here:- Important MCQs of Business Environment BST class 12

Read Here:- Assertion Reason MCQs of Business Environment BST Class 12

Read Here:- Matching Type MCQs of Business Environment BST class 12

In the case of fixed capitals, partners will have

a) Credit balances in their Capital Accounts

b) Debit balances in their Capital Accounts

c) credit or debit balances in their capital accounts

d) credit balance or nil balance in their capital accounts

Ans:- d)

Explanation:- In case of fixed capital method, partner’s capital account can either have credit or nil balance. as partner’s can not withdraw more than the available capital

In the case of fixed capitals, interest on capital

a) is credited to Partner’s Capital Account

b) is credited to Partner’s Current Account

c) may be credited to Partner’s Capital or Current Account

d) is debited to Partner’s Capital Account

Ans:- b)

Explanation:- in the fixed capital method, interest on partner’s capital is creditd to the partner’s current account as all recurring nature transaction concering with partners are recorded in it..

A Partner withdraws ₹ ______ on 30th September 2021. The deed provides interest on drawings @ 10%. The total interest charged was ₹1,000.

a) 1,000

b) 5,000

c) 10,000

d) 20,000

Ans:- d)

Explanation:-

Interest on Drawings = Drawings x 10% x 6/12

1,000 = Drawings X 10/100 X 6/12

Drawings = 1,000 x 100 x 12 divided by 60

Drawings = ₹ 20,000

The firm of Sonu and Monu earned a profit of ₹3,25,000 during the year ending on 31st March 2019. They have decided to donate 10% of this profit to an NGO working for senior citizens. Pass the Journal entry for distribution of the profit among partners.

a) Profit and Loss Appropriations A/c Dr 2,92,500

To Sonu’s Capital A/c 1,46,250

To Monu’s Capital A/c 1,46,250

b) Sonu’s Capital A/c Dr 1,46,250

Monu’s Capital A/c Dr 1,46,250

To Profit and Loss Appropriation A/c 2,92,500

c) Profit and Loss Appropriation A/c Dr. 32,500

To Monu’s Capital A/c 16,250

To Sonu’s Capital A/c 16,250

d) None of these

Ans:- a)

Explanation:-

Divisible Profit = 3,25,000 – 10% of 3,25,000 = ₹ 2,92,500

Monus’s Share = 2,92,500 x 1/2 = ₹ 1,46,250

Sonu’s Share = 2,92,500 x 1/2 = ₹ 1,46,250

Which Capital Accounts with balances always show a credit balance?

a) Fixed

b) Fluctuating

c) Normal

d) Real

Ans:- d)

Explanation:-

In Fixed Capital Method, Partner’s capital account always shows a credit balance as partners can not withdraw more than the available capital.

Read Here:- Important MCQs of Planning chapter BST class 12

Read Here:- Assertion Reason MCQs of Planning chapter BST class 12

Read Here:- Matching Type MCQs of Planning chapter BST class 12

Is rent paid to a partner appropriation of profits?

a) It is the appropriation of profit

b) It is not the appropriation of profit

c) If partner’s contribution as capital is maximum

d) If a partner is a working partner

Ans:- b)

Explanation:-

Rent paid to a partner is charge agaisnt profit and is recorded in Profit & Loss A/c.

According to the Profit and Loss Account, the net profit for the year is ₹1,50,000. The total interest on partner’s capital is ₹18,000 and interest on partner’s drawings is ₹2,000. The net divisible as per the Profit and Loss Appropriation Account will be:

a) ₹1,66,000

b) ₹1,70,000

c) ₹1,30,000

d) ₹1,34,000

Ans:- d)

Explanation:-

Divisible Profit = Net Profit + Interest on partner’s drawings – Interest on partner’s capital

Dividisble Profit = ₹ 1,50,000 + ₹ 2,000 – ₹ 18,000 = ₹ 1,34,0000.

According to the Profit and Loss Account, the net profit for the year is ₹4,20,000. The salary of a partner is ₹5,000 per month and the commission of another partner is ₹1,000. The interest on drawings of partners is ₹4,000. The net profit (divisible profit) as per the Profit and Loss Appropriation Account will be:

a) ₹3,63,000

b) ₹3,46,000

c) ₹4,09,000

d) ₹4,01,000

Ans:- a)

Explanation:-

Divisible Profit = Net Profit + Interest on partner’s drawings – Salary of partner – Commission to the partner

Dividisble Profit = ₹ 4,20,000 + ₹ 4,000 – ₹ 5,000 X 12 – 1,000 = ₹ 3,63,000

Interest on partner’s loan will be _______ to ________ account.

a) Credited, profit, and loss

b) credited, profit and loss appropriation

c) debited, profit and loss

d) debited, profit and loss appropriation

Ans:- c)

Explanation:-

Interest on Partner’s loan is a charge against profit and thus debited to profit & Loss Account..

Interest on drawings of Mr. Sharma @ 10% p.a. is ₹ _______ if he withdrew ₹ 10,000 at the beginning of each quarter

a) 1250

b) 4000

c) 3000

d) 2500

Ans:- d)

Explanation:-

Interest on Drawings = Drawings x 4 x 10% x 7.5/12

Interest on Drawings = 10,000 x 4 x 10% x 7.5/12 = ₹ 2,500

Read Here:- Important MCQs of Organising chapter BST class 12

Read Here:- Assertion Reason MCQs of Organising chapter BST class 12

Read Here:- Matching Type MCQs of Organising chapter BST class 12

The firm earned a profit of ₹20,000 (excluding the transaction of rent paid to partner ₹5,000). Write the entry of transfer of profit to profit and loss appropriation account.

a) Profit and Loss A/c Dr 20,000

To Profit and Loss Appropriation A/c 20,000

b) Profit and Loss A/c Dr 20,000

To Profit and Loss Appropriation A/c 15,000

To Rent A/c 5,000

c) Profit and Loss A/c Dr 15,000

To Profit and Loss Appropriation A/c 15,000

d) Profit and Loss A/c Dr 5,000

To Rent A/c 5,000

Ans:- c)

Explanation:-

Rent paid to a partner is a charge against profit. it is recorded in the profit & loss account. Thus it is deducted out of given profit

The Vidit and Seema were partners in firm sharing profits and losses in the ratio of 3:2. Their capitals were ₹1,20,000 and ₹2,40,000 respectively. They were entitled to interest on capital @ 10%. The firm earned a profit of ₹ 18,000 during the year. The interest on Vidit’s Capital will be

a) ₹ 12,000

b) ₹ 10,800

c) ₹ 7,200

d) ₹ 6,000

Ans:- d)

Explanation:-

Interest on Partner’s capital

Vidit = 1,20,000 x 10% = ₹ 12,000

Seema = 2,40,000 x 10% = ₹ 24,000

Total interest on Partner’s capital = ₹ 36,000

As interest on partner’s capital is more than the available profit, the interest would be allowed not more than available profit in the ratio of interest on partner’s capital i.e., 1 ; 2

Interest on Vidit’s Capital = 18,000 x 1/3 = ₹ 6,000

Which of the following is not an essential feature of partnership?

a) An agreement, oral or written, should exist among the partners

b) Agreement should be to carry on lawful business

c) All the partners should contribute capital in the firm

d) There should be at least two partners

Ans:- c)

Explanation:-

It is not mandatory to contribute capital in the firm by the partners.

A and B are partners. According to the Profit and Loss Account, the net profit for the year is ₹2,00,000. The total interest on the partner’s drawings is ₹1,000. A’s salary is ₹40,000 per year and B’s salary is ₹3,000 per month. The net profit as per the Profit and Loss Appropriation Account will be:

a) ₹1,23,000

b) ₹1,25,000

c) ₹1,56,000

d) ₹1,58,000

Ans:- b)

Explanation:-

Divisible Profit = Net Profit + Interest on partner’s drawings – A’s salary – B’s salary

Dividisble Profit = ₹ 2,00,000 + ₹ 1,000 – ₹ 40,000 – ₹ 3,000 x 12 = ₹ 1,25,0000.

According to the Profit and Loss Account, the net profit for the year is ₹1,40,000. The total interest on the partner’s capital is ₹8,000 and a partner is to be allowed the commission of ₹5,000. The total interest on the partner’s drawings is ₹1,200. The net profit as per the Profit and Loss Appropriation Account will be:

a) ₹1,28,200

b) ₹1,44,200

c) ₹1,25,800

d) ₹1,41,800

Ans:- a)

Explanation:-

Divisible Profit = Net Profit + Interest on partner’s drawings – Interest on partner’s capital – partner’s commission

Dividisble Profit = ₹ 1,40,000 + ₹ 1,200 – ₹ 8,000 – ₹ 5,000 = ₹ 1,28,200.

Read Here:- Important MCQs of Marketing Management BST class 12

Read Here:- Assertion Reason MCQs of Marketing Management BST class 12

Read Here:- Matching Type MCQs of Marketing Management BST class 12

A manager gets a 5% commission on net profit after charging such commission. Gross profit ₹ 5,80,000 and expenses of indirect nature other than manager’s commission are ₹ 1,60,000. The Commission amount will be

a) ₹ 21,000

b) ₹ 20,000

c) ₹ 15,000

d) ₹ 22,000

Ans:- b)

Explanation:-

Net Profit = ₹ 5,80,000 – ₹ 1,60,000 = ₹ 4,20,000

Manager’s Commission = 4,20,000 x 5/105 = ₹ 20,000.

In a firm, 10% of net profit after deducting all adjustments, including reserve is transferred to general reserve. The net profit after all adjustments but before transfer to general reserve is ₹88,000. Calculate the amount which is to be transferred to the reserve.

a) ₹5,000

b) ₹8,000

c) ₹8,800

d) ₹4,400

Ans:- b)

Explanation:-

General Reserve = 88,000 x 10/110 = ₹ 8,000

No interest is to be charged on drawings from the partners in case of _______.

a) No interest clause in deed

b) absence of a deed

c) an oral agreement between partners including an interest clause

d) Both a) and b)

Ans:- d)

A partner is __________ to the firm

a) Principal

b) agent

c) Both a) and b)

d) None of these

Ans:- c)

X and Y are partners sharing profits equally. Z was a manager who received the salary of ₹ 8,000 p.m. In addition to the commission of 5% on net profit after charging such commission. Profit for the year is ₹ 13,56,000 before charging salary. Find the total remuneration of Z.

a) ₹ 1,56,000

b) ₹ 1,76,000

c) ₹ 1,52,000

d) ₹ 1,74,000

Ans:- a)

Explanation:-

Remuneration of Z = Salary + Commission

Remuneration of z = 8,000 x 12 + (13,56,000 – 96,000)5/105

Remuneration of Z = ₹ 96,000 + ₹ 60,000 = ₹ 1,56,000.

Read Here:- Normal MCQs of Indian Economy on the Eve of Independence class 12

Read Here:- Matching Type MCQs of Indian Economy on the Eve of Independence class 12

Read Here:- Assertion Reason MCQs of Indian Economy on the Eve of Independence class 12

Mohit and Rohit were partners in a firm with capitals of ₹80,000 and ₹40,000 respectively. The firm earned a profit of ₹30,000 during the year. Mohit’s share in the profit will be:

a) ₹20,000

b) ₹15,000

c) ₹10,000

d) ₹18,000

Ans:- b)

Explanation:-

Mohit Share’s in profit = 30,000 x 1/2 = ₹ 15,000.

A B and C are partners. A’s capital is ₹3,00,000 and B’s Capital is ₹1,00,000. C has not invested any amount as capital but he alone manages the whole business. C wants ₹30,000 p.a. as salary. The firm earned a profit of ₹1,50,000. How much will be each partner’s share of profit:

a) A ₹60,000; B ₹60,000; C ₹Nil

b) A ₹90,000; B ₹30,000; C ₹Nil

c) A ₹40,000; B ₹40,000; C ₹40,000

d) A ₹50,000; B ₹50,000 and C ₹50,000

Ans:- d)

Explanation:-

In the absense of the partnership deed, the salary to c is not allowed. The profit is distributed equally

Profit of A, B and C = 1,50,000/3 = ₹ 50,000.

The net profit of a firm is ₹49,500. The manager is entitled to a commission of 10% on profits before charging his commission. Manager’s Commission will be:

a) ₹4,950

b) ₹4,500

c) ₹5,500

d) ₹495

Ans:- a)

Explanation:-

Manager’s commission = 49,500 x 10% = ₹ 4,950.

Partners have to pay interest on withdrawals (in cash or kind) only when provided by the

a) Partnership Act

b) Partnership Deed

c) a) and b) above

d) None of these

Ans:- b)

Explanation:-

If partner’s agreed and mentioned it in the partnership deed, the interest on partner’s drawings is charged in cash or kind.

Which of these is a charge against profit?

a) Rent to a partner

b) salary of a partner

c) None of these

d) Both a) and b)

Ans:- a)

Explanation:-

Rent to a partner is charge against profit and is debited to profit & Loss A/c.

Read Here:- Normal MCQs of Indian Economy (1950 – 1990) class12

Read Here:- Matching Type MCQs of Indian Economy (1950 – 1990) class12

Read Here:- Assertion Reason MCQs of Indian Economy (1950 – 1990) class12

The firm earned a profit of ₹1,00,000, out of which 20% or ₹15,000 whichever is lesser will be transferred to general reserve.

a) Profit and Loss A/c Dr 15,000

To General Reserve A/c 15,000

b) Profit and Loss Appropriation A/c Dr 15,000

To General Reserve 15,000

c) Profit and Loss A/c Dr 1,00,000

To General Reserve A/c 15,000

To Profit and Loss Appropriation A/c 85,000

d) Profit and Loss Appropriation A/c Dr. 20,000

To General Reserve A/c 20,000

Ans:- b)

Explanation:-

₹ 15,000 will be transferred to general reserve as it is lesser than the 20% of ₹ 1,00,000. General Reserve is transferred through Profit & Loss Appropriation A/c.

Where is interest on Drawings shown in the Final Accounts of the firm?

a) Debit side of Profit and Loss Appropriation A/c

b) Credit side of Profit and Loss Appropriation A/c

c) Credit side of Profit and Loss A/c

d) Debit side of Capital/Current A/c only

Ans:- b)

The net profit of a firm is ₹79,800. The manager is entitled to a commission of 5% of profits after charging his commission. Manager’s Commission will be:

a) ₹4,200

b) ₹380

c) ₹3,990

d) ₹3,800

Ans:- d)

Explanation:-

Manager’s Commission = 79,800 x 5/105 = ₹ 3,800.

Ram and Shyam are partners in the ratio of 3:2. Before profit distribution, Ram is entitled to a 5% commission of the net profit (after charging such commission). Before charging a commission, the firm’s profit was ₹42,000. Shyam’s share in profit will be:

a) ₹16,000

b) ₹24,000

c) ₹26,000

d) ₹16,400

Ans:- a)

Explanation:-

Ram’s Commission = 42,000 x 5/105 = ₹ 2,000

Divisible Profit = ₹ 42,000 – ₹ 2,000 = ₹ 40,000

Shyam’s share in profit = 40,000 x 2/5 = ₹ 16,000.

A B and C are partners in the ratio of 5:3:2. Before B’s salary of ₹, 17,000 the firm’s profit is ₹97,000. How much in total B will receive from the firm?

a) ₹17,000

b) ₹40,000

c) ₹24,000

d) ₹41,000

Ans:- d)

Explanation:-

Divisible Profit = Net Profit – B’s salary

Divisible Profit = ₹ 97,000 – ₹ 17,0000 = ₹ 80,000

B’s share in profit = 80,000 x 3/10 = ₹ 24,000.

B’s total share in profit = ₹ 24,000 + ₹ 17,000 = ₹ 41,000.

Read Here:- Normal MCQs of Liberalisation, Privatisation, Globalisation chapter class 12

Read Here:- Matching Type MCQs of Liberalisation, Privatisation, Globalisation chapter class 12

Read Here:- Assertion Reason based MCQs of Liberalisation, Privatisation, Globalisation chapter class 12

Which of these is not a duty of partners?

a) Use the property of the firm for official purposes

b) Devote time to the business of the partnership

c) To act outside the authority

d) To indemnify for the loss caused by his/her neglect

Ans:- c)

Under Fixed Capital System, there are ______ accounts.

a) 1

b) 2

c) Either a) or b)

d) None of these

Ans:- b)

Explanation:-

In Fixed Capital Method, the partner’s current a/c and partner’s capital a/c are maintained. All recurring transactions every year are recorded in the partner’s current a/c and non recurring transactions are recorded in partner’s capital a/c concerning with partner’s.

The current account of a partner has _______.

a) Debit Balances

b) Credit Balances

c) Either a) or b)

d) None of these

Ans:- c)

Explanation:-

Current Account of the parnter can have either debit balance and credit balances.

Ram and Mohan are partners. They draw for personal use ₹ 6,000 and ₹ 4,000 respectively. Interest is chargeable @ 6% p.a on drawings. What is the interest on drawings?

a) Ram ₹ 180 and Mohan ₹ 120

b) Ram ₹ 360 and Mohan ₹ 240

c) Ram ₹ 30 and Mohan ₹ 20

d) None of these

Ans:- a)

Explanation:-

Interest on Partner’s Drawings

Ram = 6,000 x 6% x 6/12 = ₹ 180

Mohan = 4,000 x 6% x 6/12 = ₹ 120.

Mohan draws ₹ 10,000 p.m. on the last day of every month for his personal use. If interest is to be charged @ 5% p.a., interest chargeable from him in the accounting year will be

a) ₹ 3250

b) ₹ 2750

c) ₹ 3000

d) ₹ 3500

Ans:- b)

Explanation:-

Interest on Mohan’s Drawings = 10,000 x 12 x 5% x 5.5/12 = ₹ 2,750.

Read Here:- Normal MCQs of Poverty chapter economics class 12

Read Here:- Matching Type MCQs of Poverty chapter economics class 12

Read Here:- Assertion Reason MCQs of Poverty chapter economics class 12

Mohan draws ₹ 5,000 regularly on the 15th of every month, for his personal use. Interest is payable for the year on drawings of ₹ 60,000 (at a given rate of interest) for a total period of

a) 5 Months

b) 6 Months

c) 7 Months

d) 6 and a Half Months

Ans:- b)

Explanation:-

Average Months = 11.5 + .5 = 12/2 = 6 Months.

A B and C are partners in a firm without any agreement. They have contributed ₹50,000, ₹30,000, and ₹20,000 by way of capital in the firm. A was unable to work for six months in a year due to illness. At the end of the year, the firm earned a profit of ₹15,000. A’s share in the profit will be:

a) ₹7,500

b) ₹3,750

c) ₹5,000

d) ₹2,500

Ans:- c)

Explanation:-

In the absence of the partnership deed or any aggreement, the profit is distributed equally among the partners.

A’s share in profit = 15,000 x 1/3 = ₹ 5,000.

In a partnership firm, partner A is entitled a monthly salary of ₹7,500. At the end of the year, the firm earned a profit of ₹75,000 after charging A’s salary. If the manager is entitled to a commission of 10% on the net profit after charging his commission, Manager’s Commission will be:

a) ₹7,500

b) ₹16,500

c) ₹8,250

d) ₹15,000

Ans:- d)

Explanation:-

Net Profit = 75,000 + 7500 x 12 = ₹ 1,65,000

Manager’s Commission = 1,65,000 x 10/110 = ₹ 15,000

Net, a partnership firm bought Ted firm for consideration. The transaction involved some goodwill being purchased of ₹20,000. Net has two partners Silly and Lily sharing the profits/Losses equally. Give the entry to remove goodwill from the firm.

a) Goodwill A/c Dr. 20,000

To Profit and Loss Appropriation A/c 20,000

b) Profit and Loss A/c Dr. 20,000

To Goodwill A/c 20,000

c) Goodwill A/c Dr. 20,000

To Silly’s Capital A/c 10,000

To Lily’s Capital A/c 10,000

d) Sily’s Capital A/c Dr. 20,000

To Lily’s Capital A/c 20,000

To Goodwill A/c 20,000

Ans:- d)

Seeta and Geeta are partners sharing profits and losses in the ratio 4:1. Meeta was the manager who received the salary of ₹4,000 p.m. In addition to a commission of 5% on net profits after charging such commission, Profit for the year is ₹6,78,000 before charging Salary. Find the total remuneration of Meeta.

a) ₹78,000

b) ₹88,000

c) ₹87,000

d) ₹76,000

Ans:- a)Explanation:-

Net profit = ₹ 6,78,000 – ₹ 4,000 x 12 = ₹ 6,30,000

Manager’s Commission = 6,30,000 x 5/105 = ₹ 30,000

Total remuneration of Meeta = ₹ 48,000 + ₹ 30,000 = ₹ 78,000

Read Here:- Normal MCQs of Human Capital Formation chapter of Economics Class 12

Read Here:- Matching Type MCQs of Human Capital Formation chapter of Economics Class 12

Read Here:- Assertion Reason Based MCQs of Human Capital Formation chapter of Economics Class 12

If the equal amount is withdrawn at the beginning of each month for personal use, the period for which interest will be charged will be

a) 7 Months

b) 6 Months

c) 5 Months

d) 6.5 Months

Ans:- d)

Average Months = 12 + 1 = 13/2 = 6.5 Months

Profit for the year for a partnership firm showed ₹7,000. A and B are equal partners. However, A has given a loan of ₹1,00,000 to the firm @ 10%. Write a single journal entry of both the transactions.

a) Profit and Loss A/c Dr. 7,000

To Interest on Loan A/c 7,000

b) Profit and Loss A/c Dr. 17,000

To Interest on Loan A/c 10,000

To A’s Capital A/c 3,500

To B’s Capital A/c 3,500

c) Profit and Loss A/c Dr. 7,000

A’s Capital A/c 1,500

B’s Capital A/c 1,500

To Interest on Loan A/c 10,000

d) Profit and Loss A/c Dr. 7,000

Profit and Loss Appropriation A/c 3,000

To Interest on Loan A/c 10,000

Ans – c)

Ans:- c)

Journal entry of Interst on A’s Loan

Profit & Loss A/c Dr 10,000.

To Interest on A’s Loan A/c 10,000

Journal entry to distribute loss:

A’s Capital A/c Dr 3,000.

B’s Capital A/c Dr. 3,000

To Profit & Loss A/c 3,000

Combined single Jurnal entry

Profit & Loss A/c Dr. 7,000

A’sCapital A/c Dr 1,500.

B’s Capital A/c Dr. 1,500

To Interest on Loan A/c 10,000

Pinky and Chinky are partners in firm. They share their profit in a ratio of 2:3. The accountant of the firm, finalized the Profit and Loss and capital account, and presented the accounts to them. Pinky disagreed with accounts because Pinky’s capital account showed a negative balance. Pinky is in doubt, this can not happen. Give your opinion.

a) Pinky is wrong

b) Pinky is correct

c) Accountant is a defaulter

d) None of these

Ans:- a)

Explanation:-Partner’s capital can result in negative balance if accountant is maintaning final account with fluctuating capital method.

Partner’s Drawing Account is closed

a) by transfer to the credit side of the Capital Account

b) by transfer to credit of Current Account

c) either a) or b)

d) by transfer to the debit side of Capital or Current Account

Ans:- d)

Product Method is used for calculation of

a) Distribution of Profit and Loss

b) Distribution of Revaluation Profit or Loss

c) Interest on Drawings

d) Interest on Capital

Ans:- c)

Read Here:- Normal MCQs of Rural Development chapter of Economics Class 12

Read Here:- Matching Type MCQs of Rural Development Chapter of Economics Class 12

Read Here:- Assertion Reason Based MCQs of Rural Development Chapter of Economics Class 12

Which of the following statements is true:

a) Fixed Capital account will always have a credit balance

b) Current account can have a positive or a negative balance

c) Fluctuating capital account can have a positive or a negative balance

d) All of the above

Ans:- d)

Which accounts are opened when the capitals are fixed?

a) Only Capital Accounts

b) Only Current Accounts

c) Capital Accounts as well as Current Accounts

d) Either Capital Accounts or Current Accounts

Ans:- c)

Ram, Raghav, and Raghu are partners in firm sharing profits in the ratio of 5:3:2. As per the partnership deed, Raghu is to get a minimum amount of ₹10,000 as profit. Net profit for the year is ₹ 40,000. Calculate deficiency (if any) to Raghu.

a) ₹750

b) ₹2,000

c) ₹1,500

d) None of these

Ans:- b)

Explanation:-

Raghu’s share in profit = 40,000 x 2/10 = ₹ 8,000.

Deficiency of Raghu = ₹ 10,000 – ₹ 8,000 = ₹ 2,000.

A B and C are partners sharing profits equally. A drew regularly ₹4,000 at the beginning of every month for the six months ended 30th September, 2020. Calculate interest on A’s drawings @ 5% p.a. ended 30th September 2020.

a) ₹200

b) ₹1,200

c) ₹350

d) ₹700

Ans – c)

Ans:- c)

Explanation

Interest on A’s Drawing = 4,000 x 6 x 5% x 3.5/12 = ₹ 350.

If a partner withdraws an equal amount at the end of each quarter, then _________ are to be considered for interest on total drawings.

a) 5.5 months

b) 6 months

c) 4.5 months

d) 7.5 months

Ans:- c)

Explanation

Average Months = 9 = 0 = 9/2 = 4.5 Months.

Which accounts are opened when the capitals are fluctuating?

a) Only Capital Accounts

b) Only Current Accounts

c) Capital Accounts as wells as Current Accounts

d) Either Capital Accounts or Current Accounts

Ans:- a)

Interest on Drawings of the partner is a

a) Loss to the firm

b) Gain (Profit) to the firm

c) Gain (Profit) to partners

d) Loss to bank

Ans:- b)

Interest on Capital of Partner is a

a) Loss to the firm

b) Gain (Profit) to the firm

c) Loss to Partners

d) Loss to tax department

Ans:- a

Mohan, a partner, withdraws ₹ 20,000 on 1st April, 2020 and ₹ 40,000 on 1st October, 2020. Interest on Drawings @ 6% p.a. on 31st March, 2021 will be

a) ₹ 2,400

b) ₹ 3,600

c) ₹ 1,800

d) ₹ 1,200

Ans:- a)

Explanation

Interest on Mohan’s Capital

20,000 x 6% = ₹ 1,200

40,000 x 6% x 6/12 = ₹ 1,200

Total interest on Mohan’s Capital = ₹ 2,400

Salary is given to Shankar ₹10,000 under the fixed capital system. What will be the entry for this transaction?

a) Shankar’s Current A/c Dr. 10,000

To Profit and Loss A/c 10,000

b) Shankar’s Capital A/c Dr. 10,000

To Profit and Loss A/c 10,000

c) Profit and Loss Appropriation A/c Dr. 10,000

To Shankar’s Current A/c 10,000

d) Profit and Loss Appropriation A/c Dr. 10,000

To Shankar’s Capital A/c 10,000

Ans:- c)

Explanation

In case of fixed capital method all recurring transactions concerning to partners are recorded thorugh current account. salary to partner is credited to partner’s current a/c.

Moin and Azam are partners in a firm with capital of ₹20,000 and ₹40,000 respectively. Profit for FY 21 is ₹60,000. Who will get how much share?

a) Moin ₹20,000, Azam ₹30,000

b) Moin ₹20,000, Azam ₹40,000

c) Moin ₹30,000, Azam ₹40,000

d) None of these

Ans:- d)

Explanation

In the absence of mentioning profit sharing ratio, profit is distributed equally. Moin and Azam share in profit = 60,000 x 1/2 = ₹ 30,000.

Balance of Partner’s current accounts are:

a) Debit Balance

b) Credit Balances

c) Debit or Credit Balances

d) Neither Debit nor Credit Balances

Ans:- c)

Closing balance of partner’s current account can be either debit or credit. If partner’s drawings out of profit and loss are more, the partner’s current account closing balance results in debit balance.

Which item is recorded on the credit side of partner’s current accounts:

a) Interest on Partner’s Capitals

b) Salaries of Partners

c) Share of Profits of Partners

d) All of the above

Ans:- d)

Atul, Vipul, and Prafful are partners in a firm without a partnership deed. Praful demands interest on a loan of ₹ 20,000 advanced by him at the market rate of 12%. The amount of interest received by him will be

a) ₹ 2,400

b) ₹ Nil

c) ₹ 1,200

d) ₹ 3,600

Ans:- c)

Explanation:-

Interest on Praful’s Loan = 20,000 x 6% = ₹ 1,200.,

Note:- In the absense of partnership deed. interest is allowed @ 6% p.a.

In the context of the debit side of the profit and loss appropriation account, pick the odd one out.

a) Interest on Capital

b) Partner’s Salaries

c) Interest on Drawings

d) Partner’s Commission

Ans:- c)

Jay and Viru started a partnership with a guarantee given to Jay of ₹30,000 profits per year, The profits for 2020-21 are ₹60,000. Assuming 2:1 as profit sharing ratio, calculate Jay’s share of profit.

a) ₹20,000

b) ₹30,000

c) ₹40,000

d) can’t say

Ans:- c)

Jay’s share in profit = 60,000 x 2/3 = ₹ 40,000.>

If the date of the drawing is not given, interest on Total Drawings is calculated for

a) 4 Months

b) 5 Months

c) 6 Months

d) 1 Year

Ans:- c)

In the absence of time period of drawings. Interest on drawings is calculated taking 6 months as average.

If the Partner’s Capital Accounts are fixed ‘Salary payable to partner’ will be recorded:

a) On the debit side of Partner’s Current Account

b) On the debit side of Partner’s Capital Account

c) On the credit side of Partner’s Current Account

d) None of the above

Ans:- c)

Ajay and Atul started a partnership with a music company with a guarantee given to Ajay of ₹1,00,000 profits per year. The profits for 2020-21 are ₹1,20,000. Assuming 2:1 as profit showing ratio, calculate Atul’s share of profit.

a) ₹20,000

b) ₹40,000

c) ₹60,000

d) ₹80,000

Ans:- a)

the profit of Atul = ₹ 1,20,000 = ₹ 1,00,000 = ₹ 20,000.>

Manager’s Commission of ABC Ltd (Partnership) was ₹33,000. What amount of net profit in manage’s commission was to be charged @10% before charging such commission?

a) ₹3,30,000

b) ₹3,00,000

c) ₹3,000

d) ₹3,300

Ans:- a)

Net Profit = 33,000 x 100/10 = ₹ 3,30,000.

Manish (Manager of XYZ Partnership) was entitled to 20% commission on profits after charging such commission. What was his commission for 2021-22, if firm got ₹60,000?

a) ₹10,000

b) ₹12,000

c) ₹50,000

d) Can’t say

Ans:- a)

Manager’s Commission = 60,000 x 20/120 = ₹ 10,000

If the Partner’s Capital Accounts are fixed, interest on capital will be recorded:

a) On the credit side of Current Account

b) On the credit side of Capital Account

c) On the debit side of the Current Account

d) On the debit side of Capital Account

Ans:- a)

Ram and Shyam are partners sharing profits and losses equally. Financial Statements are prepared for the year ended 31st March 2021, which show a profit of ₹ 1,50,000 before allowing interest on a loan of ₹ 50,000 from Shyam @ 10% p.a. Each partner is entitled to salary as follows:

Ram – ₹ 15,000 per annum

Shyam – ₹ 10,000 per annum

What is Ram’s total appropriation of profit for the year ended 31st March 2021?

a) ₹ 77,500

b) ₹ 70,000

c) ₹ 75,000

d) ₹ 80,000

Ans:- c)

Explanation

Interest on Shyam’s Loan = 50,000 x 10% = ₹ 5000

Net Profit = ₹ 1,50,000 – ₹ 5000 = ₹ 1,45,000

Divisible Profit = ₹ 1,45,000 – ₹ 15,000 – ₹ 10,000 = ₹ 1,20,000

Ram’s Share in divisible profit = 1,20,000 x 1/2 = ₹ 60,000

Ram’s total appropriation = ₹ 60,000 + ₹ 15,000 = ₹ 75,000

A, B, C are partners with ₹10,000, ₹20,000, ₹30,000 capital respectively. Profits are to be divided equally. Interest on capital to be provided @10% p.a. Net profit is ₹12,000. What is C’s share in profit?

a) ₹2,000

b) ₹4,000

c) ₹6,000

d) ₹3,000

Ans:- a)

Explanation

Divisible Profit = ₹ 12,000 – ₹ 10,000 x 10% – ₹ 20,000 x 10% – ₹ 30,000 x 10% = ₹ 6,000

C’s share in Profit = 6,000 x 1/3 = ₹ 2,000

X, Y, Z are partners with ₹1,000, ₹2,000, ₹3,000 capital respectively. Profits are to be divided equally. Interest on capital to be provided @20% p.a. Net profit is ₹1,650. What is X’s share of profit?

a) ₹400

b) ₹300

c) ₹150

d) Can’t say

Ans:- c)

Explanation

Divisible Profit = ₹ 1,650 – ₹ 10,00 x 20% – ₹ 20,00 x 20% – ₹ 30,00 x 20% = ₹ 450

C’s share in Profit = 450 x 1/3 = ₹ 150

P, Q R are partner’s with ₹1,00,000, ₹2,00,000, ₹3,00,000 capital respectively. Profits are to be divided equally. Interest on capital to be provided @10% p.a. Net Loss is ₹6,000. What is P’s share of Interest on capital?

a) ₹3,000

b) ₹2,000

c) ₹1,000

d) Nil

Ans:- d)

Explanation

In case of loss no interest on capital is allowed.

A and B are partners with the capital of ₹ 2,00,000 and ₹ 1,00,000 respectively. Interest payable on capital is 10% p.a. Determine interest on capital for both the partners when the profit earned by the firm is ₹ 24,000.

a) ₹ 20,000 and ₹ 10,000

b) ₹ 15,000 and ₹ 9,000

c) No interest will be paid

d) ₹ 16,000 and ₹ 8,000

Ans:- d)

Explanation

Interest on Partner’s capital

A = 2,00,000 x 10% = ₹ 20,000

B = 1,00,000 x 10% = ₹ 10,000

Total interest on partner’s capital (30,000) > Profit (24,000)

Interest on capital will be provided only upto available profit in ratio of interest on partner’s capital i.e., 2 : 1

A’s interest on capital = 24,000 x 2/3 = ₹ 16,000,

B’s interest on capital = 24,000 x 1/3 = ₹ 8,000

If the Partner’s Capital Accounts are fluctuating, in that case following item/items will be recorded in the credit side of Capital accounts:

a) Interest on Capital

b) Salary of Partners

c) Commission of Partners

d) All of the above

Ans:- d)

Interest on partner’s capitals will be debited to:

a) Profit and Loss Account

b) Profit and Loss Appropriation Account

c) Partner’s Capital Accounts

d) None of the Above

Ans:- b)

Rajan withdraws ₹9,440 at the beginning of every half-year period for personal expenses. Interest on the drawing will be _______ if the rate is

@10% p.a.

a) ₹1,000

b) ₹1,082

c) ₹1,416

d) Nil

Ans:- c)

Explanation

Average time peiod = 12 + 6 = 18/2 = 9 months

Interest on Drawings = 9,440 x 2 x 10% x 9/12 = ₹ 1,416

The partnership agreement can only be written.

a) True

b) False

c) Can’t say

d) Partially true

Ans:- b)

Partnership can be oral or written.

Liam withdraws ₹100 on 31st June 2020 and ₹50 on 31st December 2020. Calculate interest on drawings if interest rate @ 10% p.a.

a) ₹15

b) ₹8.75

c) ₹6.25

d) Nil

Ans:- b)

Interest on Liam Drawings

31st June to 31st March

100 x 10% x 9/12 = ₹ 7.5

31st Dec to 31st March

50 x 10% x 3/12 = ₹ 1.25

Total Interest on Drawings = ₹ 7.5 + ₹ 1.25 = ₹ 8.75

For the firm interest, o drawings are

a) Capital Payment

b) Expenses

c) Capital Receipt

d) Income

Ans:- d)

When a guarantee is given to partner by some of the partners, deficiency on such guarantee is borne by

a) All of the other partners

b) Partnership firm

c) Partners who gave the guarantee

d) None of the partners

Ans:- c)

Munit and Seema came together to provide free food to poor covid patients during the pandemic. They can call this partnership.

a) True

b) False

c) Can’t day

d) Partially true

Ans:- b)

Partnership firm can be formed for a business with profit motive.

Temba withdraws ₹1,00,000 every month for 6 months ending 31st March 2020. If interest on drawings is charged @20% p.a. the amount of interest on drawings will be ______.

a) ₹5,000

b) ₹2,500

c) ₹30,000

d) ₹35,000

Ans:- c)

Average Months = 5.5 + .5 = 6/2 = 3 months

Interest on Temba’s Drawings

1,00,000 x 6 x 20% x 3/12 = ₹ 30,000

25 people can not form a partnership.

a) True

b) False

c) Can’t say

d) Partially true

Ans:- b)

Minimum 2 partners and maximum 50 partners can form partnership firm.

A B and C are partners sharing profits in the ratio of 5:4:1. C is given a guarantee that his share in a year will not be less than ₹ 5,000. Profit for the year ended 31st March 2021 is ₹ 40,000. Deficiency in the guaranteed profit of C is to be borne by B. Deficiency to be borne by B is:

a) Deficiency of C ₹ 1,500 met by B

b) Deficiency of C ₹ 1,000 met by B

c) Deficiency of C ₹ 4,000 met by B

d) None of these

Ans:- b)

C’s share in profit = 40,000 x 1/10 = ₹ 4,000

Deficiency of C = ₹ 5,000 – ₹ 4,000 = ₹ 1,000

When a partner’s capital accounts are floating, which one of the following items will be written on the credit side of the partner’s capital accounts?

a) Interest on drawings

b) Loan advanced by the partner to the firm

b) Partner’s share in the firm’s loss

d) Salary to the active partners

Ans:- d)

When the partner’s capital accounts are fixed, which one of the following items will be written in the partner’s capital account?

a) Partner’s Drawings

b) Additional capital introduced by the partner in the firm

c) Loan, taken by a partner from the firm

d) Loan Advanced by the partner to the firm

Ans:- b)

X, Y, and Z are partners sharing profits in the ratio of 3:2:1. The partnership agreement provides for interest on capital @ 8% per annum and salary for Y of ₹ 8,000 per annum. Net profit for the year 2020-21 was ₹ 84,000 and balances of partner’s Capital Accounts during the year were:

X – ₹ 20,000

Y – ₹ 15,000

Z – ₹ 12,000

i) Z’s share of residual profits for the year 2020-21 will be

a) ₹ 12,040

b) ₹ 12,667

c) ₹ 13,000

d) ₹ 14,000

Ans:- a)

Explanation

Divisible Profit = 84,000 – 20,000 x 8% – 15,000 x 8% – 12,000 x 8% – 8,000 = ₹ 72,240

Z’s share in profit = 72,240 x 1/6 = ₹ 12,040

ii) Total amount of the appropriation credited to Y’s account in the year 2020-21 will be

a) ₹ 24,080

b) ₹ 28,000

c) ₹ 33,280

d) ₹ 33,333

Ans:- c)

Explanation

Divisible Profit = 84,000 – 20,000 x 8% – 15,0000 x 8% – 12,000 x 8% – 8,000 = ₹ 72,240

Ys share in profit = 72,240 x 2/6 = ₹ 24,080

Total Appropriation of Y = 24,080 + 1,200 + 8,000 = ₹ 33,280

Aani, Bani and Chani are partners in 2 : 3 : 2. Aani guaranteed Chani a profit of ₹5,000. The firm earned ₹14,000. Aani’s share will be

a) ₹4,000

b) ₹3,600

c) ₹3,000

d) ₹5,000

Ans:- c)

Explanation:-

Chani Share in profit = 14,000 x 2/7 = ₹ 4,000

Deficiency of chani met by Aani = ₹ 5,000 – ₹ 4,000 = ₹ 1,000

Aani’s share in profit = 14,000 x 2/7 = ₹ 4,000

Aani’s share after chani’s guaranteed = ₹ 4,000 – ₹ 1,000 = ₹ 3,000.

Rishu is a partner in a firm where he draws a fixed amount at the end of every month. Interest on drawings is charged @10% p.a. At the end of the year, interest on Rishu’s drawings was ₹5,500. Drawings of Rishu were

a) ₹1,000

b) ₹12,000

c) ₹6,000

d) ₹10,000

Ans:- d)

Explanation:-

Interest on Rishu’s Drawings = Drawings x 12 x 10% x 5.5/12

5,500 = Drawings x 12 x 10/100 x 5.5/12

Drawings = 5,5000/5.5 = ₹ 10,000

The act of one partner in a partnership is binding on all the partners.

a) True

b) False

c) Can’t say

d) Partially true

Ans:- a)

Explanation:-